- Spot Ethereum ETFs may start trading next Tuesday, heightening anticipation for Ethereum’s market impact and investor interest.

- SEC likely to approve spot Ethereum ETFs, with key players like BlackRock, VanEck, and Franklin Templeton poised for launch.

The SEC is reportedly set to approve several spot Ethereum exchange-traded funds (ETFs), potentially as early as next Tuesday. This development marks a significant moment for Ethereum (ETH), which has recently surged past $3,400, fueling discussions about the broader impact of this regulatory progression.

[mcrypto id=”12523″]Ethereum’s price has caught the eye of many, with the cryptocurrency recovering strongly from a dip below $3,000 last week to trade around $3,445, marking a 12.8% increase over seven days.

Despite this rise, ETH is still trading down 13.2% from its high on March 11th. The anticipation around the possible ETF approvals is contributing to recent price movements and heightened investor interest.

Update: Nate's instincts were right, hearing SEC finally gotten back to issuers today, asking them to return FINAL S-1s on Wed (incl fees) and then request effectiveness on Monday after close for a TUESDAY 7/23 LAUNCH. This is provided no unforeseeable last min issues of course! https://t.co/D21FD9Qf94

— Eric Balchunas (@EricBalchunas) July 15, 2024

The buzz grew after ETF market commentator Nate Geraci confidently anticipated the imminent SEC approval, suggesting that there are no grounds for further delays. His views were supported by Bloomberg’s ETF analyst, Eric Balchunas, who noted that only unforeseen obstacles could delay the scheduled launch.

Welcome to spot eth ETF approval week…

I’m calling it.

Don’t know anything specific, just can’t come up w/ good reason for any further delay at this point.

Issuers ready for launch.

— Nate Geraci (@NateGeraci) July 14, 2024

According to ETHNews sources referenced by Reuters on July 15th, entities such as BlackRock, VanEck, and Franklin Templeton are expected to receive approval to begin trading early next week, pending the submission of final documents by the end of this week.

The launch of spot Ethereum ETFs is poised to open a new chapter for cryptocurrency investments, attracting both retail and institutional investors by offering a regulated way to invest directly in Ethereum, circumventing the complexities associated with direct cryptocurrency ownership.

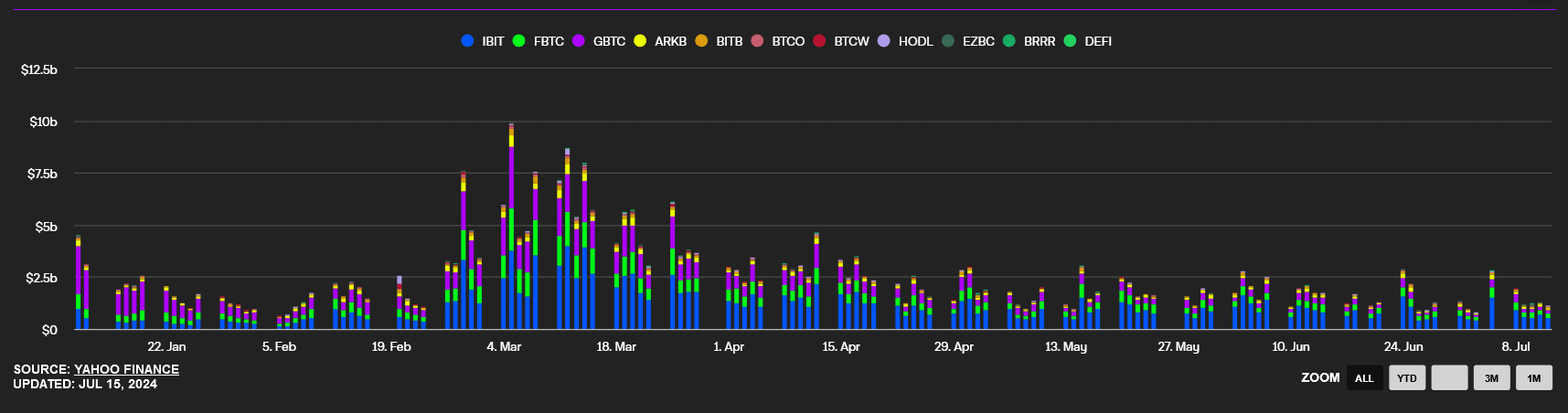

This could replicate the influx observed with the introduction of spot Bitcoin ETFs, which have accumulated $16.12 billion in inflows since their launch earlier this year, as per Farside’s Bitcoin ETF flow table.

The anticipated launch coincides with the 2024 Bitcoin Conference in Nashville, taking place from July 25th to 27th, which will feature prominent figures such as Michael Saylor, Cathie Wood, Robert Kennedy Jr., and Donald Trump.

The timing of the ETF launch could capitalize on the increased exposure and discussions expected at the conference, further boosting interest and investment in Ethereum.