- Kraken has sees the largest Bitcoin and Ethereum outflows since 2017.

- Significant shift towards self-custody as major players withdraw assets.

One of the leading cryptocurrency exchanges, Kraken, has had its biggest outflows of Ethereum (ETH) and Bitcoin (BTC) since 2017, according to new data from CryptoQuant.

Kraken: Largest $BTC and $ETH Outflows Since 2017!

“Kraken's #Bitcoin reserves have dropped to the same level as in 2018, now holding 122,300 BTC. For #Ethereum, this is the first time Kraken's reserves have fallen below 1 million units, a level not seen since early 2016.” – By… pic.twitter.com/pS4kEajpHF

— CryptoQuant.com (@cryptoquant_com) June 3, 2024

Historic Outflows at Kraken

Data from Dominando Cripto’s Joao Wedson posted on the quick-take platform of CryptoQuant exposes an unexpected pattern at Kraken. 49,100 BTC were taken out of the exchange, or about $3.33 billion.

By financial terms, this enormous withdrawal represents the biggest money transfer from the exchange. Not behind, roughly 572,100 ETH—worth about $2.15 billion—left the platform as well.

At roughly 122,300 BTC, Kraken’s Bitcoin reserves have dropped to levels last seen in 2018. More significantly, for the first time since early 2016, Ethereum reserves have fallen below a million.

Strategic Repositioning or Market Move?

While the news may first appear concerning, Wedson notes that address scans show the asset changes were “synchronized and rapid,” implying that these outflows may have been an institutional scheme or Kraken itself strategically shifting reserves.

These changes are crucially timed to occur right when the market is still processing the effects of the SEC’s recent approval of spot Ethereum exchange traded funds.

This regulatory decision has made ETH less readily available on centralized exchanges, which has given rise to expectations of a potential supply shortage that could raise Ethereum’s price.

Shift Towards Self-Custody

The larger background is a notable move away from exchanges as the main owners of cryptocurrency.

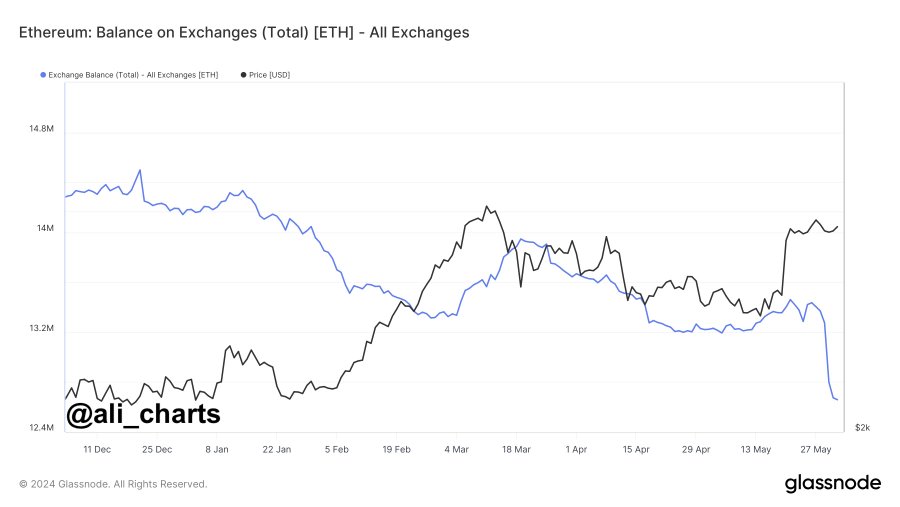

After the ETF clearance, market analyst Ali saw a large drop in Ethereum stored on exchanges—roughly 777,000 ETH—which suggested a changing market dynamic in which big players may be shifting toward more self-custody in the face of growing institutional involvement.

A more thorough analysis of exchange balances reveals a consistent decline and indicates a growing tendency to keep cryptocurrencies off exchange systems, which supports the trend.

Conventionally, these kinds of changes are seen as bullish signals, suggesting less sell pressure and more long-term holding habits among investors.

Meanwhile, CoinMarketCap data shows that the price of BTC at the moment of writing is about $69,209.60, up 1.22% over the last 24 hours. At 2.01%, this also indicates a bullish position over the last 7 days.

[mcrypto id=”12344″]On the other hand, ETHNews previously reported on Kraken’s API, which displayed Mt. Gox payments as “payment in preparation.”