- Stellar (XLM) trades at $0.2676 faces $0.28–$0.30 resistance breakout targets $0.36 with cross-border finance events in 2025.

- Monero (XMR) tests $230–$235 resistance stealth addresses maintain demand despite U.S. sanctions on linked wallets.

Stellar (XLM), priced at $0.2676, is attempting to push past resistance between $0.28 and $0.30. Success could lead to a retest of $0.36. Upcoming events, including its 2025 Mainnet Demo Day, aim to highlight its role in cross-border payments.

Monero (XMR), trading at $229.34, faces resistance near $230–$235. A break above this zone might push it toward $250. Its privacy tools, like stealth addresses, continue drawing interest despite regulatory pressure.

Zcash (ZEC), at $33.72, must hold above $33–$35 to challenge higher targets near $42. Its zero-knowledge proofs and planned upgrades remain central to its appeal.

All three crypto face regulatory scrutiny but address distinct markets

XLM in financial infrastructure, XMR and ZEC in private transactions. Supply limits differentiate them—XLM’s 50 billion cap contrasts with ZEC’s 21 million, while Monero’s emission rate prioritizes gradual growth. Traders are watching support levels: $0.25 for XLM, $220 for XMR, and $30 for ZEC.

Recent price gains suggest renewed attention, though technical indicators remain neutral.

Stellar (XLM) is currently trading at $0.2676, posting a modest +0.93% daily gain and a robust +13.30% increase over the past week. However, the asset remains in recovery mode after a -5.77% drop in the past month, and it’s still down 19.67% year-to-date. Over the last 6 months, though, XLM has shown impressive strength, surging +176.07%, and is up 125.54% over the past year, pointing to a solid long-term recovery trajectory.

Technically, XLM is attempting to reclaim higher ground after bouncing from recent support near $0.25. The current short-term resistance lies around $0.28–$0.30, a zone where price previously faced rejection.

A confirmed breakout above this level could open up the path toward $0.33–$0.36, aligning with previous local highs.

On the downside, support remains around $0.24–$0.25, and any failure to hold this zone could invite a pullback to the $0.21–$0.22 range. Indicators suggest a neutral trend, with oscillators gradually leaning bullish as momentum picks up.

Fundamentally, Stellar is preparing for significant ecosystem activity in Q2 2025. It will host its Mainnet Demo Day on April 23, showcasing new projects under the Stellar Community Fund, followed by a global meetup in Dubai on May 1 during the TOKEN2049 event.

These events aim to highlight Stellar’s growing role in cross-border finance and real-world adoption.

With a circulating supply of 30.84 billion XLM and a capped max supply of 50 billion, Stellar offers predictable tokenomics and a strong use case in fiat interoperability.

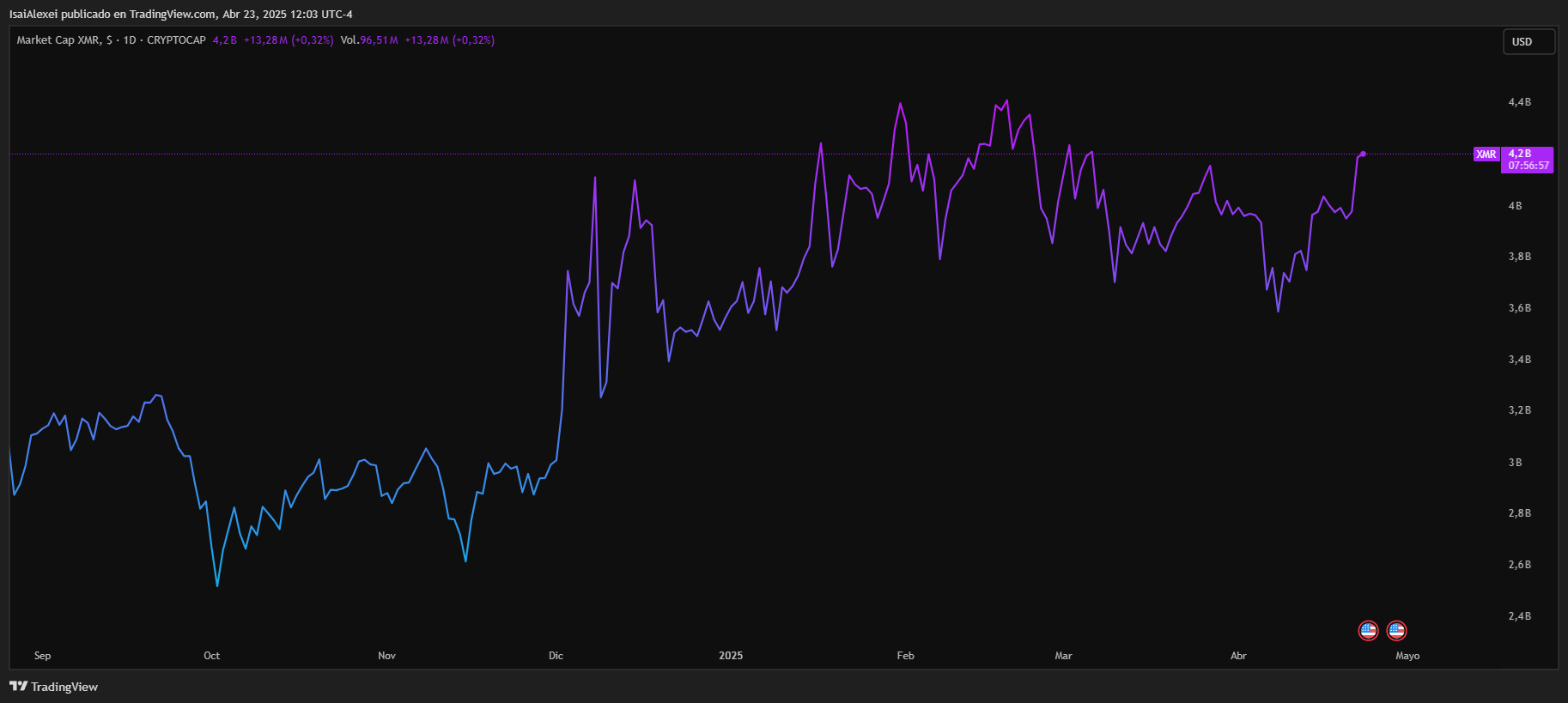

Monero (XMR) is currently trading at $229.34, with a daily gain of +1.04%, and continues its upward trajectory with a 6.35% increase over the past week and 5.78% gain over the past month.

On a broader scale, XMR is up 18.85% year-to-date and an impressive +89.18% over the past 12 months, making it one of the strongest performers among top privacy coins.

Monero’s market capitalization stands at $4.23 billion, with a circulating supply of 18.45 million coins and a relatively low 24h trading volume of $96.6 million, reflecting niche demand and lower liquidity compared to major Layer 1 tokens.

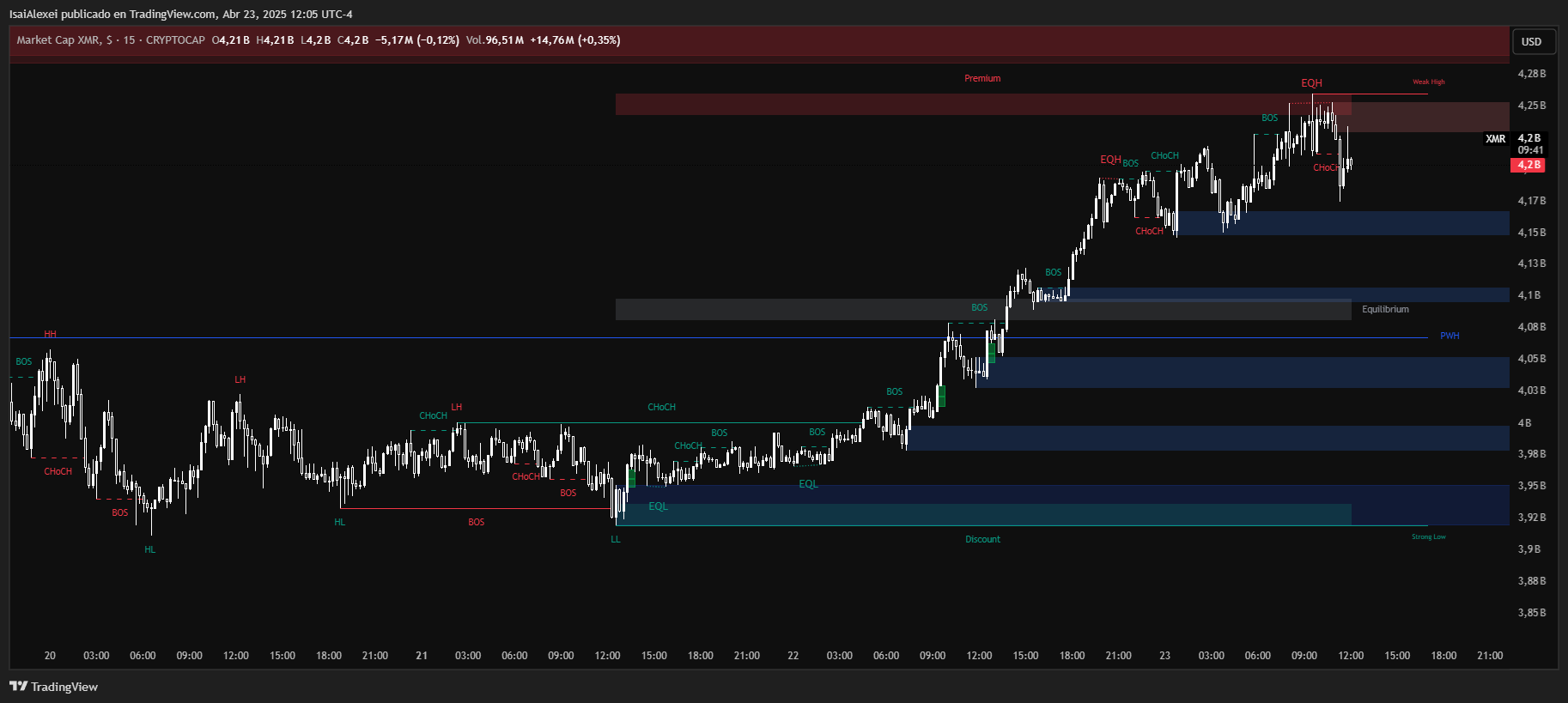

From a technical perspective, XMR is currently holding above key short-term support at $220, and now testing the $230–$235 resistance range. A successful breakout could open the path toward $250–$265, especially if volume increases and broader market sentiment stays bullish.

However, if price rejects at this resistance, the next downside levels to watch are $212 and $198. Indicators suggest a neutral to bullish trend, with momentum building on multiple timeframes but not yet in overbought territory.

Despite regulatory scrutiny—most recently from the U.S. Treasury sanctioning Monero addresses tied to illicit marketplaces—XMR continues to hold relevance as a tool for private, censorship-resistant transactions.

Zcash (ZEC) is currently trading at $33.72, reflecting a +1.84% daily gain and maintaining a 9.76% rise over the past week, with a monthly gain of 8.91%. Despite the recent bullish momentum, ZEC remains down -39.96% year-to-date, and it is still ~91% below its all-time high of $386, placing the token deep in a long-term correction. However, the 1-year return stands at +39.06%, signaling renewed investor interest in privacy-focused projects amid broader crypto adoption.

Technically, ZEC is attempting to hold above the $33–$35 resistance zone, which has been a key level over the last few weeks. A clean breakout above $36.50–$38 could trigger a move toward $42.00–$47.00, which represents a major overhead supply area.

On the downside, the key support to monitor is at $30.00, and any sustained breakdown could open a path to $27.50 or even $25.00. The technical outlook is currently neutral, as oscillators show signs of recovery, but moving averages still lag behind price.

On the fundamental side, Zcash continues to lead in the privacy coin sector with its zero-knowledge proof technology, ensuring fully anonymous transactions. The team remains active in development, with recent community events including a hackathon and a scheduled April 11 community call.

Zcash is also in the midst of exploring a hybrid proof-of-stake upgrade, which may enhance scalability and energy efficiency in the future. Regulatory challenges remain a concern, especially with delistings from centralized exchanges, but ZEC still holds relevance in privacy-conscious regions and user groups.