- After breaking above a descending trendline from October 13, SUI shows potential to reach its peak of $2.3686.

- On-chain data suggests no imminent trend reversal for SUI, with a 17.22% rise in Open Interest indicating bullish sentiment.

SUI token demonstrates a compelling uptick in market performance, showcasing robust gains and strong trader interest that may signal a sustained bullish trend.

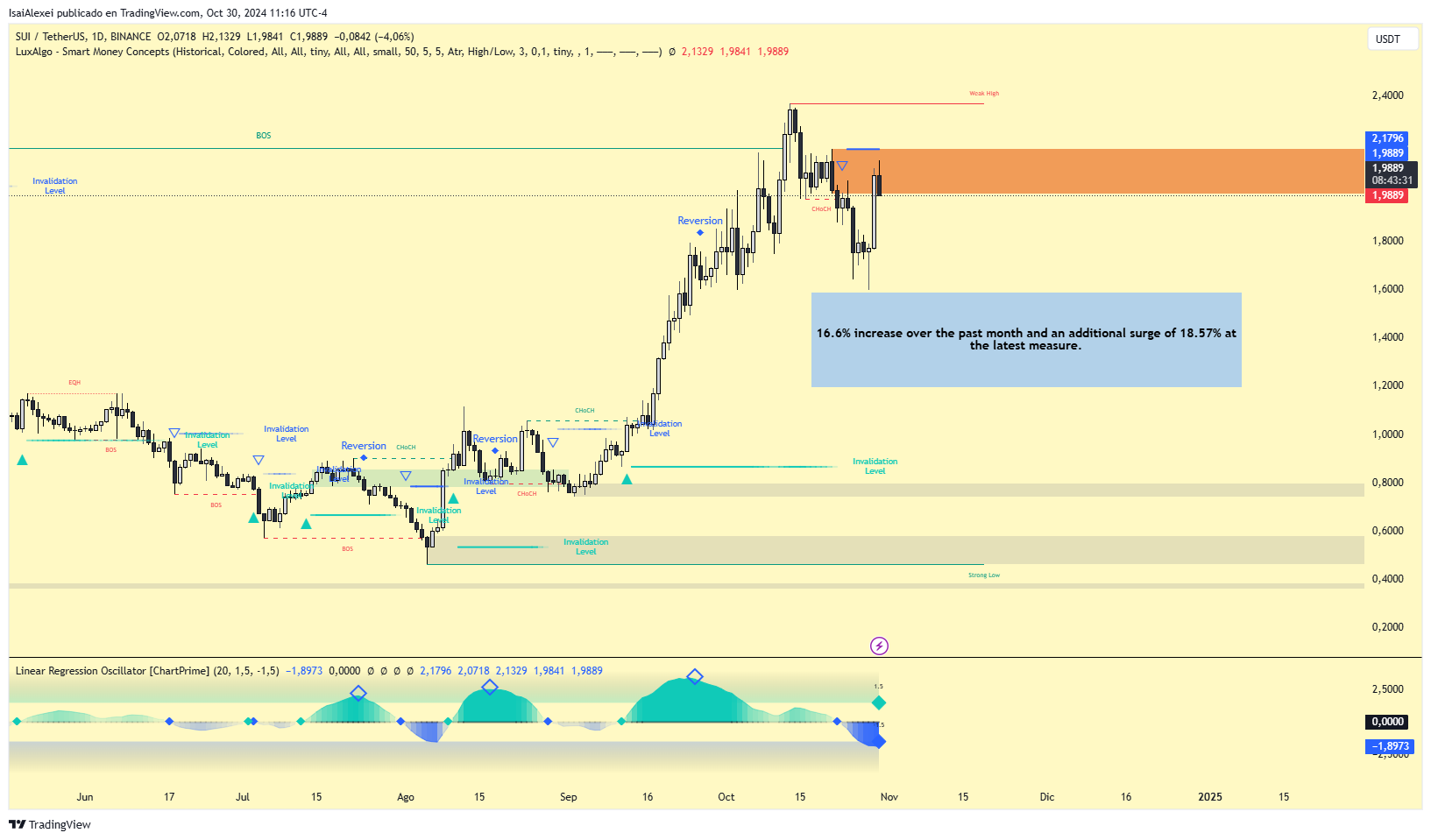

SUI has shown notable market activity recently, with a 16.6% increase over the past month and an additional surge of 18.57% at the latest measure. This rise has significantly boosted its trading volume, which has soared by 93.54% to reach $1.1 billion.

Such robust activity underscores a growing market interest and could be indicative of continued positive momentum.

Technical Indicators

From a technical perspective by ETHNews, SUI’s movement appears optimistic. It recently surpassed a major descending trendline that began forming on October 13, a movement catalyzed by its bounce from the support level at $1.6049.

Should this upward trend persist, SUI might target the $2.3686 mark, which represents its peak in October 2024.

Conversely, should the token experience renewed selling pressure, it might revert to its previous descending trendline, adjusting downward in response.

Trader Activity and On-Chain Analysis

On-chain data and trader analytics provide a deeper insight into SUI’s potential trajectory. According to ETHNews, current on-chain metrics do not forecast an imminent reversal, suggesting that the uptrend may have stability.

Complementing this analysis, data from Coinglass regarding Open Interest and liquidation metrics indicate a prevailing bullish sentiment among traders.

Specifically, Open Interest has escalated by 17.22%, reaching a total of $519.50 million, reflecting an increased demand for long positions in the market.

Concurrently, approximately $4.14 million worth of SUI short positions were liquidated over the past 24 hours, an event that typically strengthens the prevailing market trend.

The liquidity flow, measured by the Chaikin Money Flow (CMF) indicator, further confirms the ongoing accumulation of SUI.

With a CMF reading of 0.13, remaining in the positive territory suggests that liquidity continues to flow into the market, potentially pushing SUI’s price beyond its current annual high.