- LUNC holds key support despite a 66% drop as burn activity intensifies and trading volume surges over 61% in 24 hours.

- Bearish MACD and neutral RSI reflect mixed momentum, with price action likely to remain sideways amid cautious market sentiment.

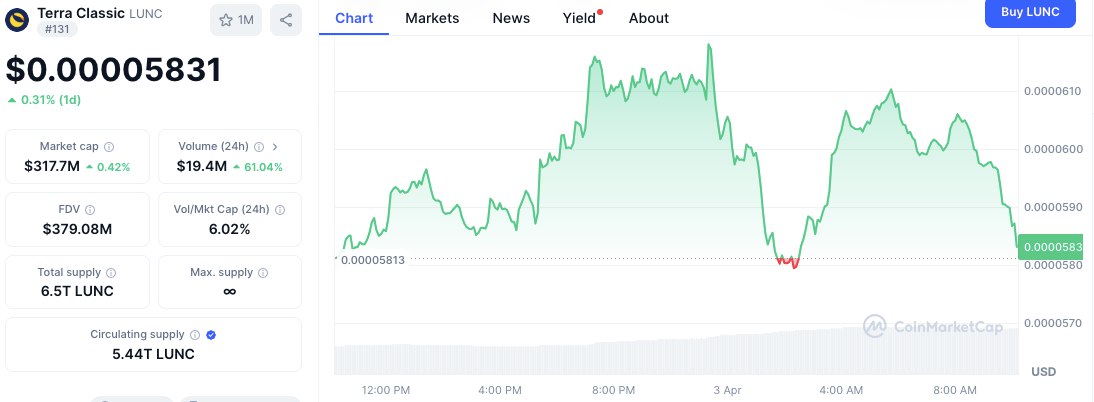

The Terra Luna Classic (LUNC) token is currently locked in a major consolidation phase, hovering near a key support level amid a rise in weekly token burns. The price has remained low despite increased on-chain activity to reduce supply, raising questions about the token’s short-term direction.

However, with traders watching closely, market indicators suggest mixed momentum as the community intensifies its recovery efforts following the ecosystem’s collapse in 2022.

LUNC was trading at $0.000060 at the time of writing, showing little change over the past several days. The price has declined more than 66% from its peak in December 2024, and efforts to create a rebound have so far been unsuccessful. This slowdown comes despite an active burn initiative that saw over 727 million tokens destroyed in the past week alone, according to data from LUNC Metrics.

This week’s biggest contributor was the Luna Foundation Guard, which burned over 211 million LUNC on Wednesday and removed 1.7 billion TerraClassic USD tokens from circulation. Since the effort began, these actions have brought the total number of burned LUNC tokens to over 407 billion.

BREAKING: The @LFG_org wallet has been BURNED! 🔥🤯

211,577,500 $LUNC

1,754,725,793 $USTC are now gone!Are we about to witness the greatest comeback in #Crypto history. Stay tuned! 💎🤲🏻 #LuncBurn #Binance @cz_binance pic.twitter.com/hWADqHtxBa

— Mr. Diamondhandz1💎 (@MrDiamondhandz1) April 2, 2025

Volume and Volatility Offer Conflicting Signals

While the price has remained even, the 24-hour trading volume shows a different view. LUNC’s trading activity surged more than 61% to $19.4 million, pointing to renewed interest from traders. However, the token’s daily gain of just 0.31%, closing at $0.00005831, shows that buyers are not yet taking full control.

This volume increase resulted in a volume-to-market cap ratio of 6.02%, pointing to heightened short-term speculation. LUNC’s circulating supply stands at 5.44 trillion, with a fully diluted valuation of $379 million. Despite the surge in trade activity, the price faced resistance above $0.000061 before retreating, suggesting that sentiment remains cautious.

Technical Indicators Show Mixed Momentum

Technical indicators add another layer of complexity to the outlook. The Moving Average Convergence Divergence (MACD) continues to show bearish pressure. The MACD line at -0.00000151 remains below the signal line at -0.00000133, forming a bearish crossover that favors sellers. Although the histogram bars are declining, indicating a possible weakening in downward pressure, no clear bullish reversal has emerged.

Meanwhile, the Relative Strength Index (RSI) is more neutral. At 44.21, the 14-day RSI is slightly below the midpoint of 50, suggesting that LUNC is neither overbought nor oversold. The lack of divergence or strong upward movement reflects a market still searching for direction.

Adding to the cautious sentiment is the ongoing community discussion, as reported by ETHNews, around a phased rollout of on-chain liquidity for USD Coin. While still in its early stages, the proposal has not meaningfully influenced price movement. Until stronger consensus forms and technical indicators shift, LUNC will likely continue moving sideways near its current range.