- Chainlink (LINK) price hits $11.96, reflecting a 5.47% increase, with market capitalization rising to $7.50 billion.

- Trading volume for LINK surges 86.08%, reaching $222.24 million, indicating growing trader confidence and market activity.

Chainlink (LINK), is currently displaying signs of potential growth in the cryptocurrency market. This technology notably enhances security across different blockchain networks, a feature increasingly essential for transactions involving non-fungible tokens (NFTs) and supporting vast financial exchanges.

[mcrypto id=”12709″]As of the latest data by ETHNews, LINK is trading at $11.96, marking a 5.47% increase over the last 24 hours, and bringing its market capitalization to $7.50 billion, up by 5.46%. Additionally, the trading volume has seen a significant jump of 86.08%, amounting to $222.24 million in the same period.

These statistics reflect a rising trader interest and a strengthened market presence that might pave the way for further gains.

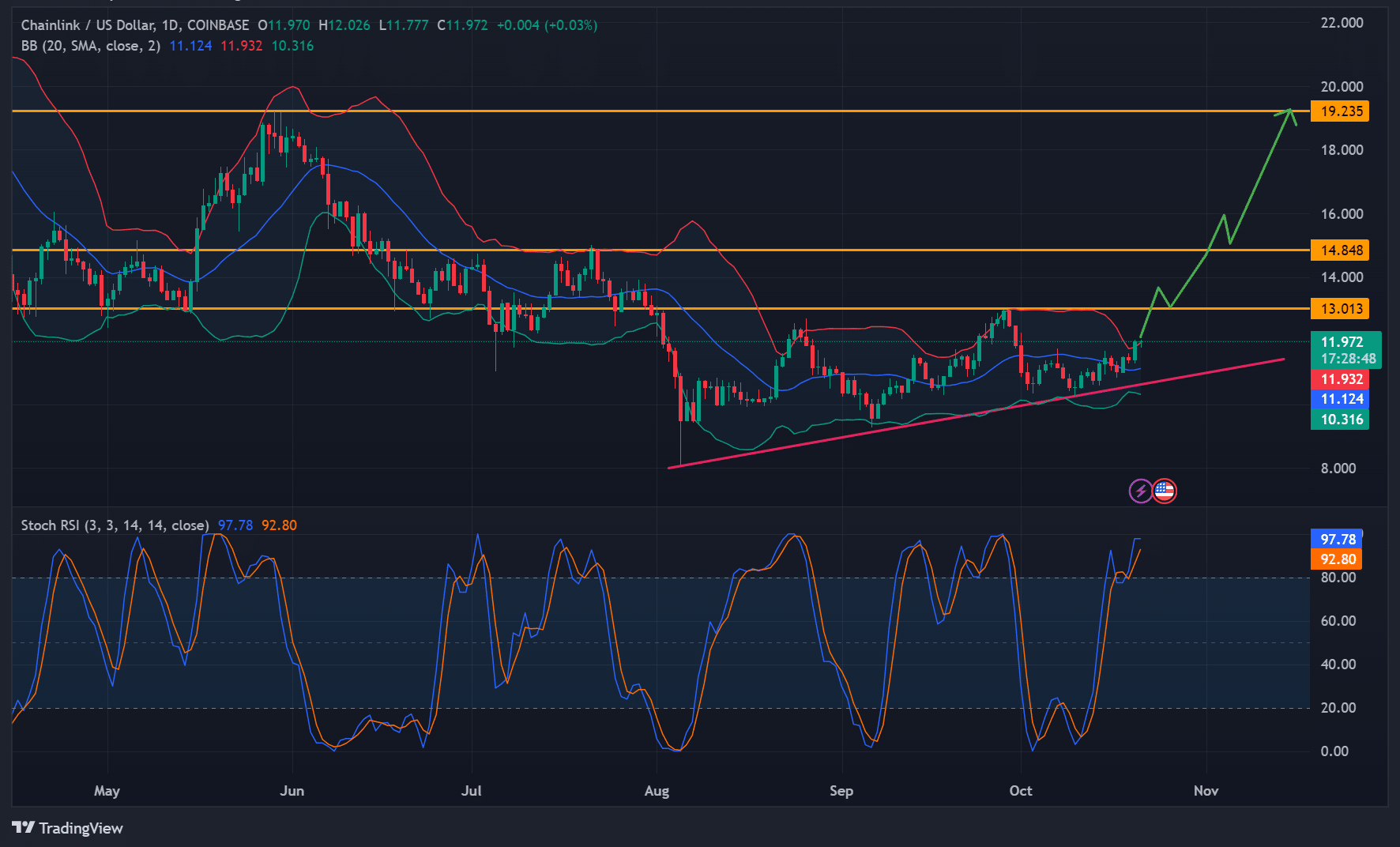

Currently, LINK is through a price range with established support at $10.31 and resistance at $13.01. Technical indicators like the Stochastic RSI suggest overbought conditions, with readings over 97, which could predict a brief price correction before an upward continuation.

Should LINK surpass the $13.01 resistance, the next targets could be $14.85 and potentially $19.23 if the momentum sustains. The Bollinger Bands on LINK’s price charts are also widening, indicating that volatility is high and could lead to significant price movements in the near term.

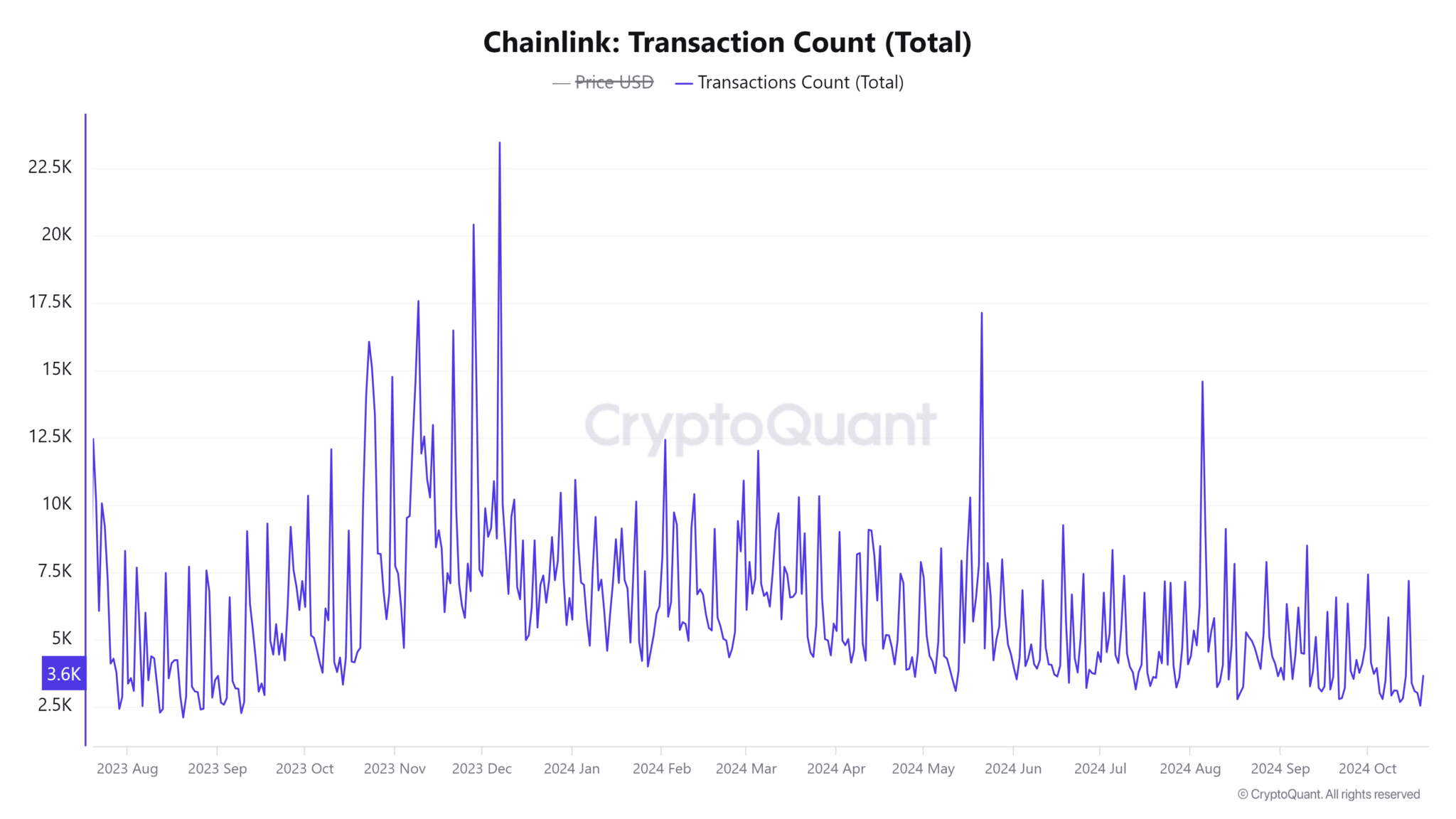

Further underpinning the optimistic outlook is the network’s increasing activity. Data from CryptoQuant shows a 1.34% rise in active addresses and a 1.51% increase in transaction counts in the last day, suggesting heightened user engagement and adoption. This dynamic is often viewed positively as it reflects a robust and active network.

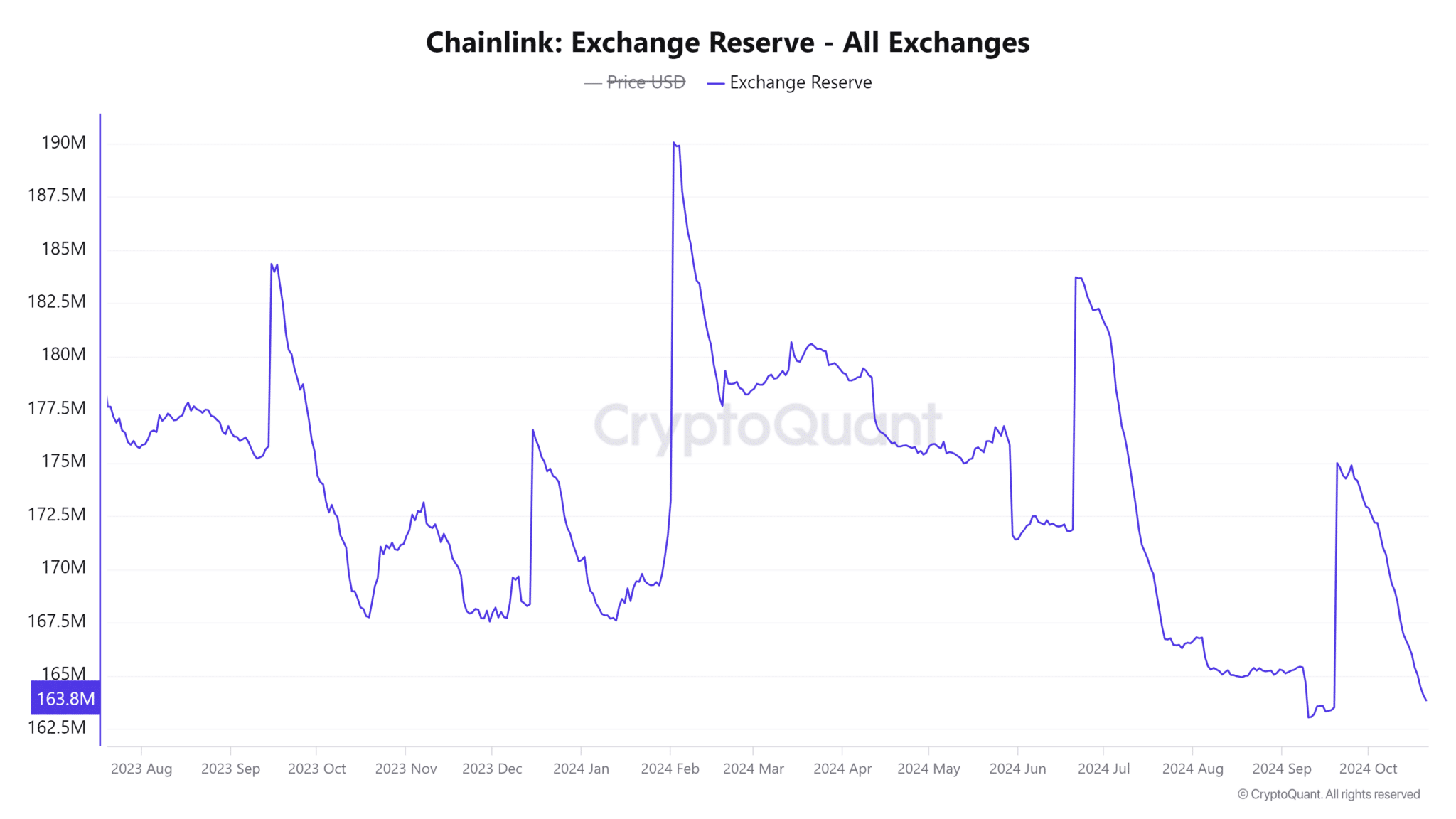

Another critical factor to consider is the decline in LINK tokens held in exchange reserves, which have decreased by 0.19%, now standing at 163.8 million. This trend often indicates that holders are opting to keep their tokens in personal wallets or other forms of storage, anticipating future price increases.

A lower supply of tokens available for trading on exchanges could lead to price spikes as demand may exceed the readily available supply.

LINK exhibits several indicators of a bullish future in the cryptocurrency market. With its technological foundations and current market dynamics, it remains a watched asset among traders and investors, potentially poised for further price exploration.