- Toncoin sees 80% surge in large transactions, indicating strong whale activity and potential upward price movement.

- Active addresses increase by 30%, suggesting greater market participation and enhanced liquidity for smoother transaction execution.

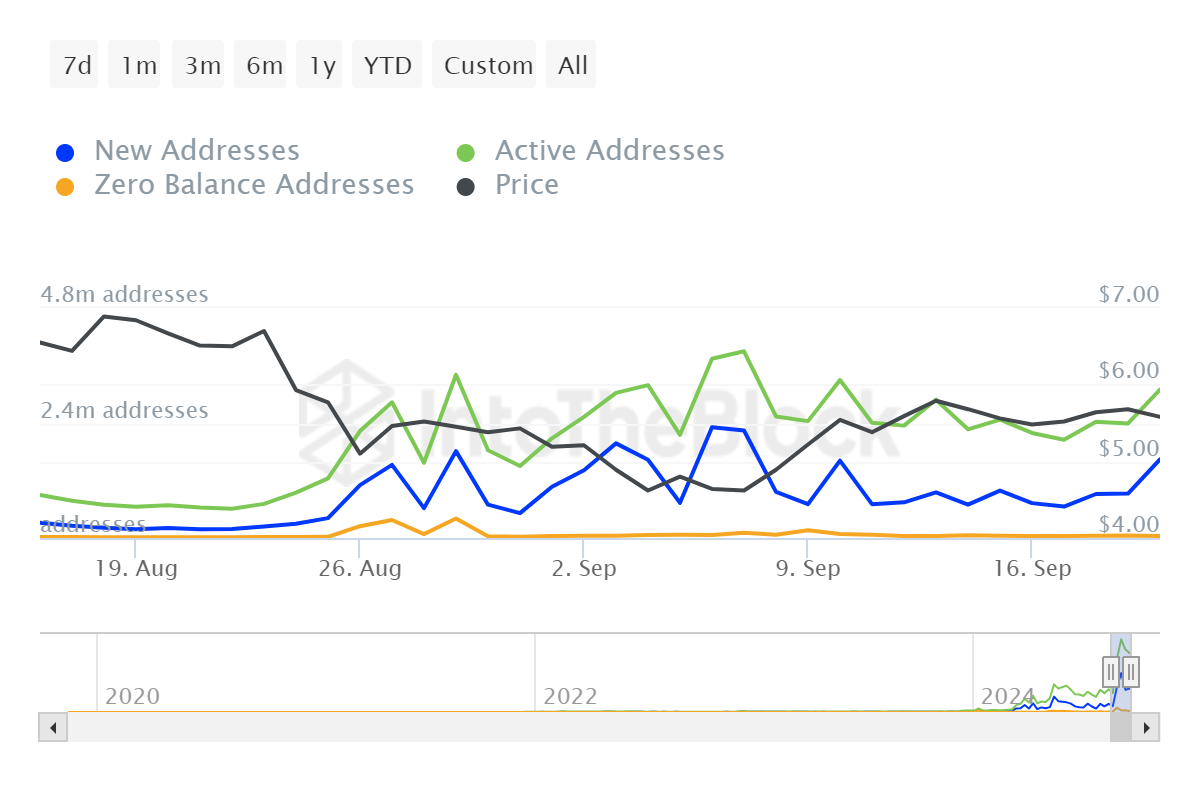

Toncoin has recently demonstrated big activity in its transaction metrics, indicating robust interest from the market. TON has witnessed an 80% increase in large transactions alongside a 30% rise in active addresses, signaling heightened engagement from both major and individual investors.

Strong Uptake in Large Transactions

The substantial increase in large transactions suggests a growing interest among major investors who are engaging with Toncoin. This level of activity typically instills confidence in the broader investor community, potentially setting the stage for upward price movements and increased market liquidity.

The rise in active addresses, which has reached 30% in the last 24 hours, is another indicator of Toncoin’s expanding market presence. More active addresses mean more participants are engaging with Toncoin, enhancing the liquidity of the market.

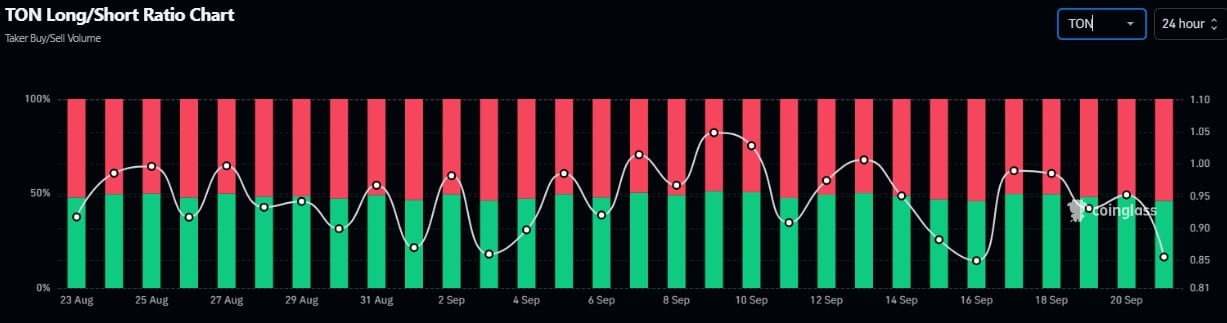

However, the scenario is not without its challenges. The long-short ratio, a critical indicator of market sentiment, has shown a decline, as per recent Coinglass data.

This trend suggests that a smaller proportion of investors are holding long positions in anticipation of a price increase in Toncoin, possibly due to current market conditions influenced by recent economic policies like the Fed’s interest rate cuts.

This decline in the long-short ratio might suggest a cautious stance among traders, reflecting concerns over potential price adjustments in the near future. Such a cautious approach could be a response to broader economic signals or specific developments within the cryptocurrency sector.

Implications for Investors

For investors, the mixed signals in Toncoin’s recent activity highlight the importance of vigilance and strategic planning. While the surge in transactions and active addresses points to a potentially lucrative phase, the shifting long-short ratio calls for careful analysis of market trends and possible risk management strategies.

Objective of the TON and Curve Finance Collaboration

The primary aim of this collaboration is to facilitate more seamless stablecoin transactions, reducing the disparity between buying and selling prices. By integrating Curve’s advanced trading technology, TON seeks to establish a fluid environment for stablecoin exchanges on its blockchain.

🔈 TON Foundation collaborates with @CurveFinance to incubate a new stable swap project on #TON!

This collaboration will simplify stablecoin trading, boost liquidity, and enhance the DeFi experience on TON.

Apply to build the project here ➡️ https://t.co/6o4vNNdrIK pic.twitter.com/KuflHkfjrT

— TON 💎 (@ton_blockchain) September 17, 2024

Components of the Collaboration Several key elements characterize this partnership:

- Stable Swap Project: The initiative will leverage Curve’s Constant Function Market Makers (CFMM) technology, noted for its ability to maintain minimal slippage during transactions. This will provide users with cost-effective and efficient stablecoin trading options.

- Development Team: A dedicated team, chosen jointly by TON and Curve Finance, will lead the development of the stable swap project. This team is tasked with ensuring the project adheres to both technical standards and community expectations.

- Advisory Role: Michael Egorov, the founder of Curve Finance, will serve as an advisor, contributing his deep understanding of protocol mechanics and strategic insights.

- Token Airdrop: To involve the community, the project will distribute a portion of its native tokens to veCRV holders, rewarding them for their early support.

Growing Stablecoin Usage within TON

Since launching USDT on its platform, TON has seen significant uptake, with $720.6 million in net circulation reported within four months. This demonstrates a robust interest in stablecoins within the TON ecosystem.

“In the four months since USDT’s launch, our community has demonstrated a historic level of demand for the token,” said Vlad Degen, DeFi Lead from TON Foundation.

Beyond financial applications, TON’s ecosystem is enriched by various mini-apps, such as Hamster Kombat (HMSTR) and Catizen (CATI), which contribute to the blockchain’s vibrancy.

These apps have attracted substantial user interaction, particularly from regions like Russia and India, underscoring the global appeal of TON’s offerings.

[mcrypto id=”46920″]

The current price of Toncoin (TON) is $5.61, with an increase of 0.75% in the past hours. The day’s range is between $5.61 and $5.76, and the 24-hour trading volume is $4.67 million USD. Over the past year, Toncoin’s price has fluctuated between $0.84 and $6.98.