- IOMAP data reveals strong support at $3,140; resistance at $3,242 might break, setting a target of $3,347.

- Ethereum Fear and Greed Index at 39 suggests neutral market sentiment, offering a strategic buying opportunity amidst ETF anticipation.

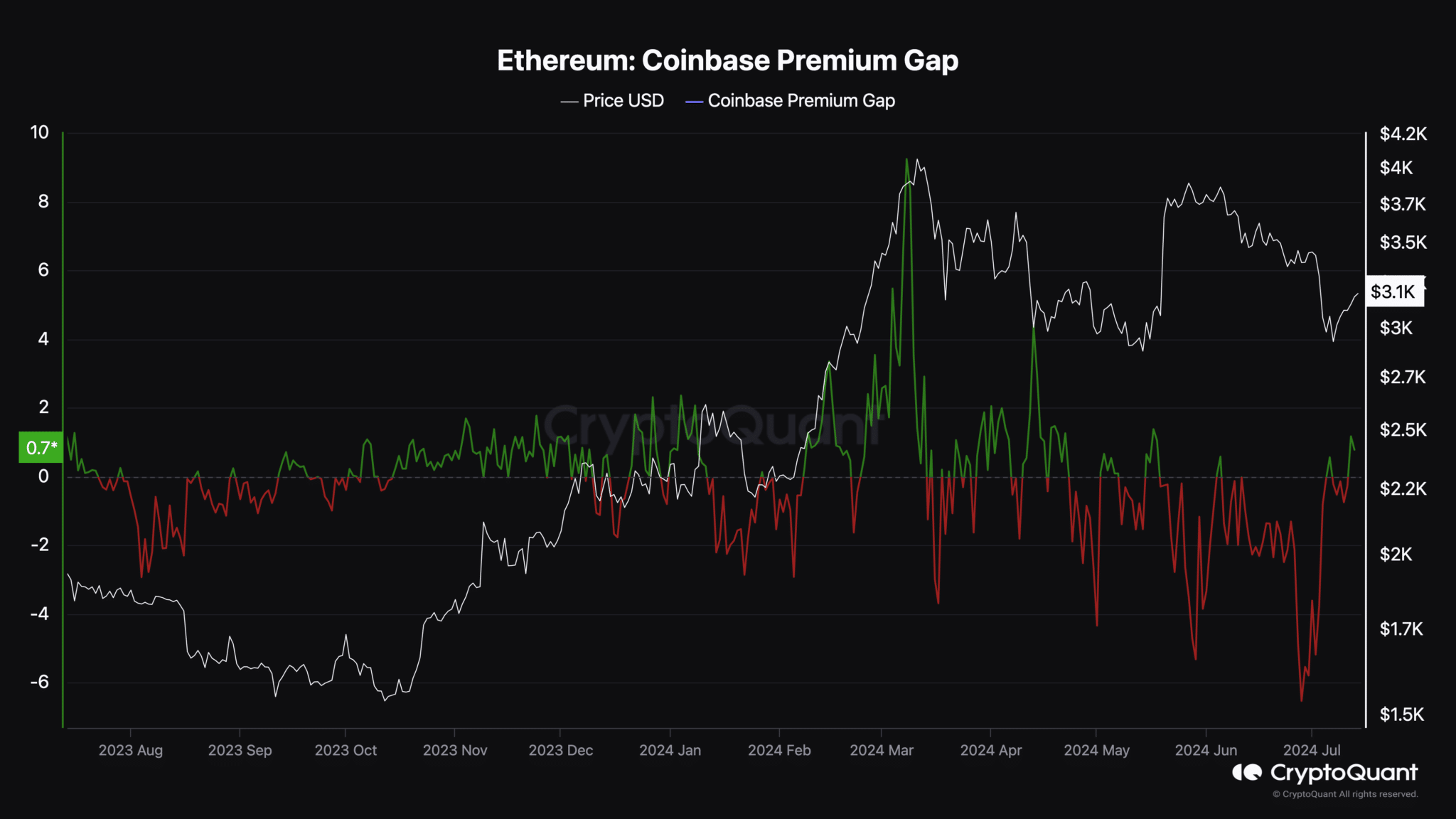

The Ethereum market in the United States is exhibiting signs of increased buying activity, potentially setting the stage for significant price movements reminiscent of earlier peaks. Analysis of the Coinbase Premium Gap, a metric indicating the price difference between Ethereum on Coinbase and Binance, suggests an upswing in American investor interest.

Recently, this gap expanded to 0.78, signifying robust buying pressures likely spurred by anticipation of the upcoming Ethereum ETF.

In March 2023, a contraction in this gap correlated with a drop in Ethereum’s price to below $1,400. Contrastingly, a surge in the gap in March 2024 saw the cryptocurrency’s price escalate to $4,065.

[mcrypto id=”12523″]Currently, Ethereum trades at $3,194, down 34.70% from its peak, yet ongoing U.S. acquisitions could drive a recovery in its market valuation.

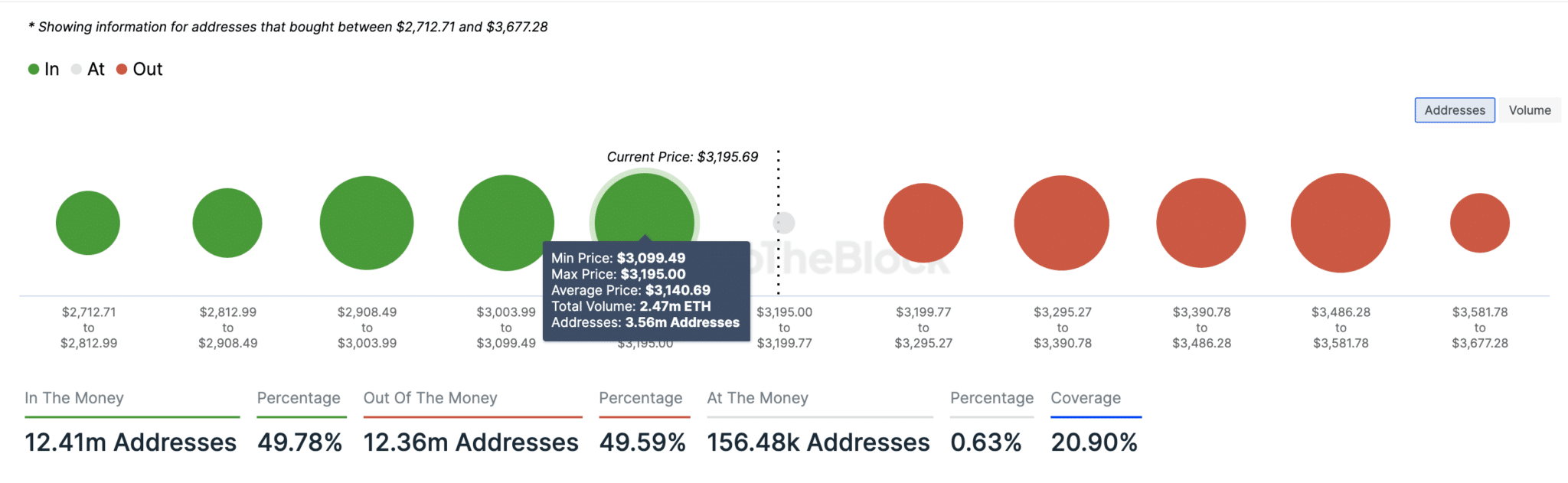

Furthermore, IntoTheBlock’s In/Out of Money Around Price (IOMAP) data provides insights into potential resistance or support levels based on the distribution of investor purchases.

Currently, 3.56 million Ethereum addresses hold the cryptocurrency at an average purchase price of $3,140, suggesting a robust support level.

Above this, around $3,242, 2.02 million addresses are positioned out of the money, which could serve as the next resistance point.

Ethereum Fear and Greed Index is 39 ~ Neutral

Current price: $3,196 pic.twitter.com/tCL9CFlZSu— Ethereum Fear and Greed Index (@EthereumFear) July 14, 2024

Should buying momentum persist, Ethereum may attempt to breach the $3,242 resistance. Success here could pave the way to $3,347. The Ethereum Fear and Greed Index, currently at 39, indicates a balanced market sentiment, neither overly fearful nor greedy. This environment, combined with the potential ETF catalyst, presents a buying opportunity for investors.

A decline in engagement could temper expectations for Ethereum’s price ascent, underlining the importance of staying informed on broader market trends and sentiments to optimize investment strategies effectively.