- Bitcoin’s Puell Multiple, a key on-chain indicator, indicates potential bullish price action, according to analysts.

- Miner revenue in Bitcoin, influenced by USD conversion rates, impacts the Puell Multiple’s fluctuations.

A recent analysis by a quant suggests that Bitcoin could be poised for bullish price action, thanks to a well-known on-chain indicator.

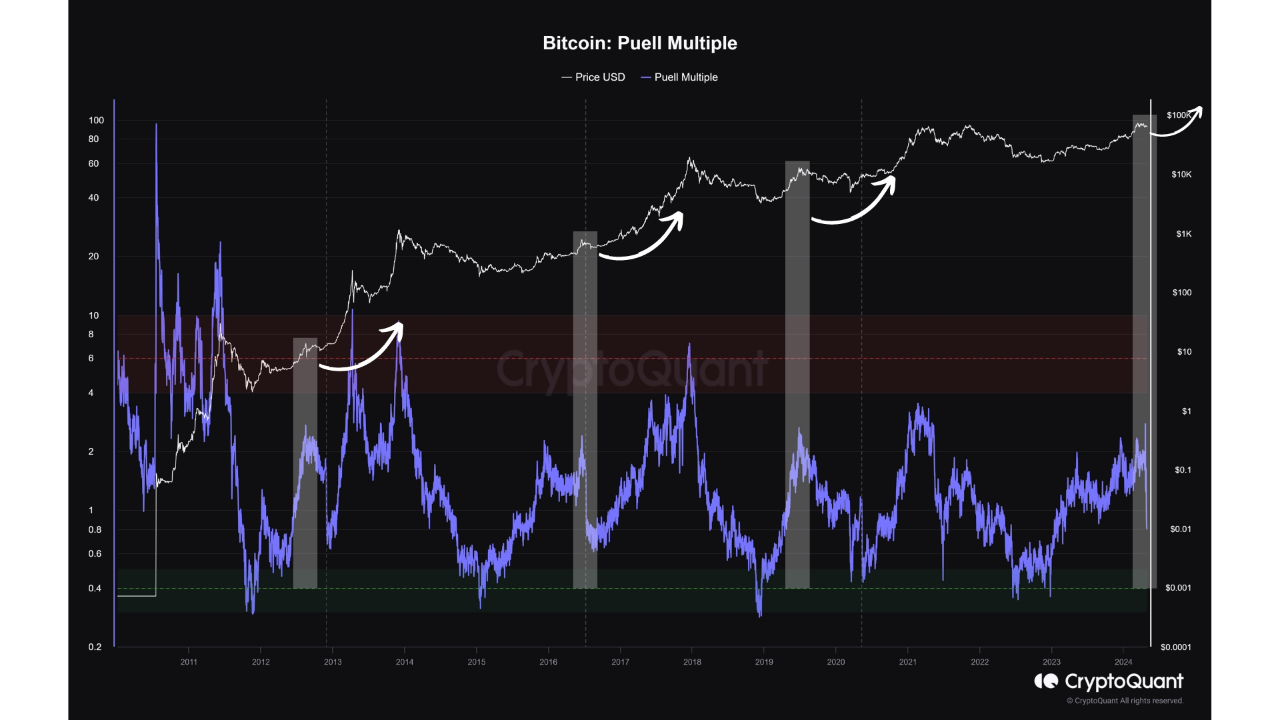

The Bitcoin Puell Multiple, which tracks the ratio between miners’ daily revenue and the 365-day moving average, has entered what analysts are calling the “safe to buy zone.” This metric provides insights into the profitability of Bitcoin mining operations.

Miners earn revenue by validating transactions and adding them to the blockchain. Their earnings, denominated in Bitcoin, fluctuate based on the cryptocurrency’s USD conversion rate. When prices rise, miner revenues increase; when prices fall, revenues decrease.

High Bitcoin prices can incentivize miners to sell their earnings, potentially adding selling pressure to the market. Conversely, low prices may prompt miners to hold onto their Bitcoin until market conditions improve.

Recent data shows that the Bitcoin Puell Multiple had been on an upward trend during Bitcoin’s rally in 2023 and early 2024. However, the indicator has recently experienced a sharp decline, reaching a value of 0.8.

This drop in the Puell Multiple suggests that miners are currently earning less than the yearly average. Despite this, Bitcoin prices have not experienced a similar decline.

The discrepancy between the Puell Multiple and Bitcoin prices can be attributed to the recent Bitcoin Halving event. Halvings occur roughly every four years and result in a halving of mining rewards. The most recent Halving, the fourth in Bitcoin’s history, took place earlier this month.

Historical data indicates that similar drops in the Puell Multiple have preceded bullish price movements in the past. Analysts suggest that this could be indicative of a potential uptrend in Bitcoin prices.

While the Puell Multiple has recently declined, historical patterns and the occurrence of the Halving event suggest that Bitcoin could be primed for bullish action in the near future.