- Recovery rally faces macro headwinds, token unlocks; charts and sentiment to dictate near-term DEX trajectory

- Governance upgrades (Uniswap DAO), tokenomics revamps (CAKE 3.0), cross-chain growth (1inch) counter L2 rivalry, regulation risks.

The decentralized exchange (DEX) sector is flashing tentative green shoots as blue-chip tokens like Uniswap (UNI), PancakeSwap (CAKE), and 1inch (1INCH) stage bullish reversals from multi-month downtrends.

Despite lingering macro headwinds—year-to-date drawdowns of 14-50% and steep retracements from ATHs—these DeFi stalwarts are showing renewed momentum, with weekly gains of 11-15% and rising buy-side volume.

Technically, all three are carving potential higher lows, battling key resistance zones (UNI: $6.50-$6.70; CAKE: $2.35-$2.55; 1INCH: $0.20-$0.22), while oscillators hint at bullish divergence. Fundamentally, strategic pivots—Uniswap DAO’s governance push, PancakeSwap’s Tokenomics 3.0 overhaul, and 1inch’s cross-chain expansion—signal adaptation amid intensifying L2 competition and regulatory fog.

As DEX volumes rebound, can this trio sustain their recovery rally, or will unlock events and macro pressure trigger another leg down? The charts—and community sentiment—hold the clues.

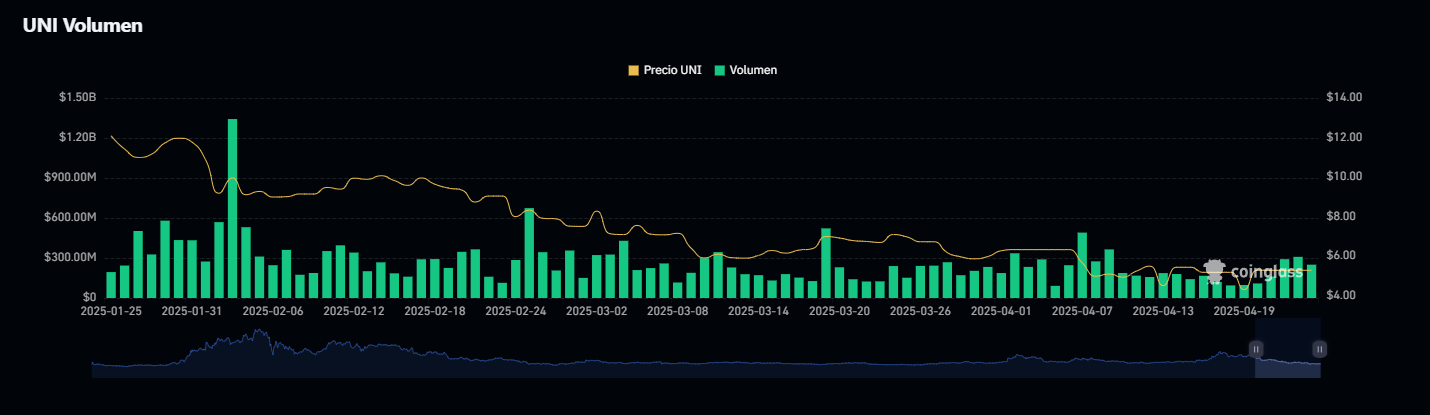

Uniswap (UNI) is currently trading at $5.94, with a +2.17% gain on the day, and a solid +14.53% increase over the past week, suggesting short-term bullish sentiment. Despite the recent recovery, UNI remains in a broader downtrend, with a -14.76% decline over the past month, -19.96% loss over the last 6 months, and a -55.01% year-to-date drop. Compared to its all-time high of $45.02, UNI is down over 86%, although it still shows a +440% gain since inception.

Pssst

LP rewards are live through the Uniswap Web App ⚡️ pic.twitter.com/hAL3g2QshT

— Uniswap Labs 🦄 (@Uniswap) April 25, 2025

From a technical perspective, UNI is attempting to establish a higher low pattern, with resistance near the $6.50–$6.70 zone. A breakout above this range would confirm a bullish reversal, opening the path toward $7.80 and $8.50, while a failure to sustain above $5.50 could lead to another test of $5.10–$4.80 support.

Volume has started to climb, and oscillators are trending toward neutral-bullish territory, suggesting a potential continuation if momentum builds.

Fundamentally, Uniswap remains the largest decentralized exchange (DEX) by cumulative volume, having processed over $1 trillion in trades. Recently, the Uniswap DAO backed a $113 million “Treasury Delegation” program aimed at boosting governance participation.

However, the ecosystem faces increasing competition from Layer 2 DEXs and regulatory uncertainty, including recent headlines linking the protocol to campaign donations in political investigations.

PancakeSwap (CAKE) is currently trading at $2.0904, reflecting a +3.09% daily gain, and a +15.62% increase over the past week, signaling growing bullish sentiment. Despite the recent strength, CAKE remains down -16.50% year-to-date and -28.05% over the past year, and trades over 95% below its all-time high of $44.33. However, a +18.91% gain in the last 6 months and rising volume suggest that investors are starting to reposition around CAKE’s fundamental updates.

♾ What if DeFi had no limits?

🌐 A community-driven protocol where everyone can contribute pic.twitter.com/CJpiyQ6ua5— PancakeSwap (@PancakeSwap) April 25, 2025

Technically, CAKE is recovering from a sharp decline and now trading above the $2 psychological support. If momentum holds, the next resistance lies at $2.35–$2.55, with further upside potential toward $3.12, where the 200-day EMA sits.

On the downside, $1.90–$1.75 serves as support, and a break below this range could reignite bearish pressure. Chart patterns suggest a potential trend reversal, supported by increasing buy volume and bullish divergence on RSI.

Fundamentally, PancakeSwap is actively rebranding its token economy through the Tokenomics 3.0 proposal, aimed at reducing emissions and optimizing supply distribution. The governance vote was held between April 15–18, which contributed to renewed interest in CAKE.

The platform continues to expand across chains, with its utility on the BNB Smart Chain, Ethereum, and zkSync Era, increasing its total value locked (TVL) and user base. Upcoming listings, meetups, and its strong DeFi presence continue to reinforce CAKE’s long-term potential.

1inch (1INCH) is currently trading at $0.1953, with a +2.21% gain on the day, and a strong +11.76% increase over the past week, suggesting a short-term bullish reversal from recent lows.

Despite this uptick, the token is still in deep retracement territory—down -50.00% year-to-date, -56.82% over the last 12 months, and -79.12% from its all-time high of $0.99. The current market cap stands at $263.35 million, with a circulating supply of 1.39 billion tokens and a 24h volume of $23.85 million.

Make the connection pic.twitter.com/rL06dIfF5G

— 1inch (@1inch) April 25, 2025

Technically, 1INCH is attempting a bottom reversal, following weeks of accumulation in the $0.17–$0.19 range. If momentum continues, a breakout above $0.20–$0.22 could send the price toward $0.28 and $0.30, marking a potential 50%+ rally from current levels.

Failure to sustain current momentum, however, may result in a pullback toward $0.17, the recent support base. Technical traders are also noting signs of a megaphone or bullish divergence pattern, aligning with prior bottoming behavior observed in similar DeFi tokens.

Fundamentally, 1INCH continues to expand integrations across wallets and DeFi protocols. Recent news includes upcoming integration with Trezor Swap and continued visibility at major events like the Dubai Fintech Summit (May 12–13, 2025). A 7.72% token unlock is also scheduled for November, which may introduce short-term volatility.

Long-term, 1inch remains one of the most prominent decentralized exchange (DEX) aggregators, offering competitive routing across chains and strong infrastructure support.