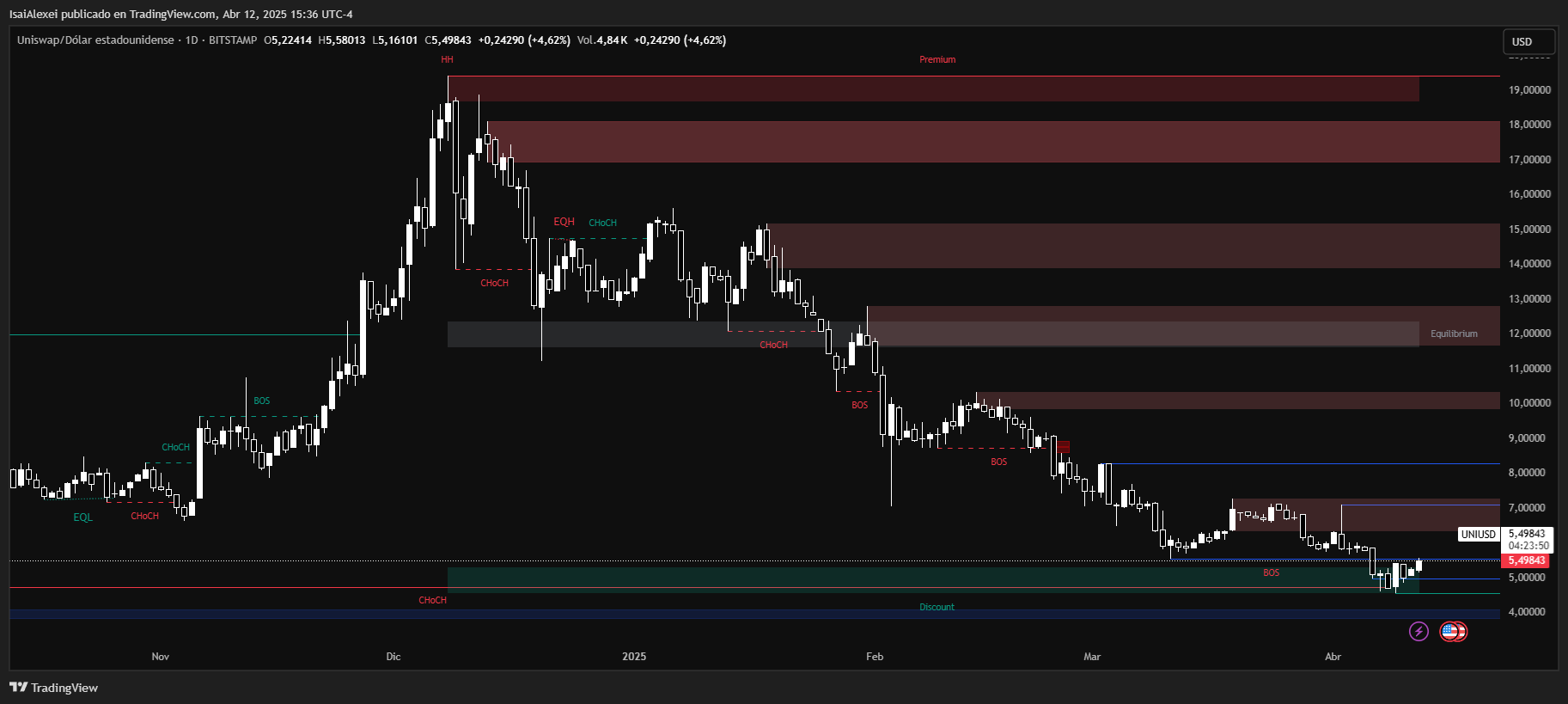

- Uniswap holds support at $5.00 and may rise further if it clears the $5.90 to $6.10 resistance zone.

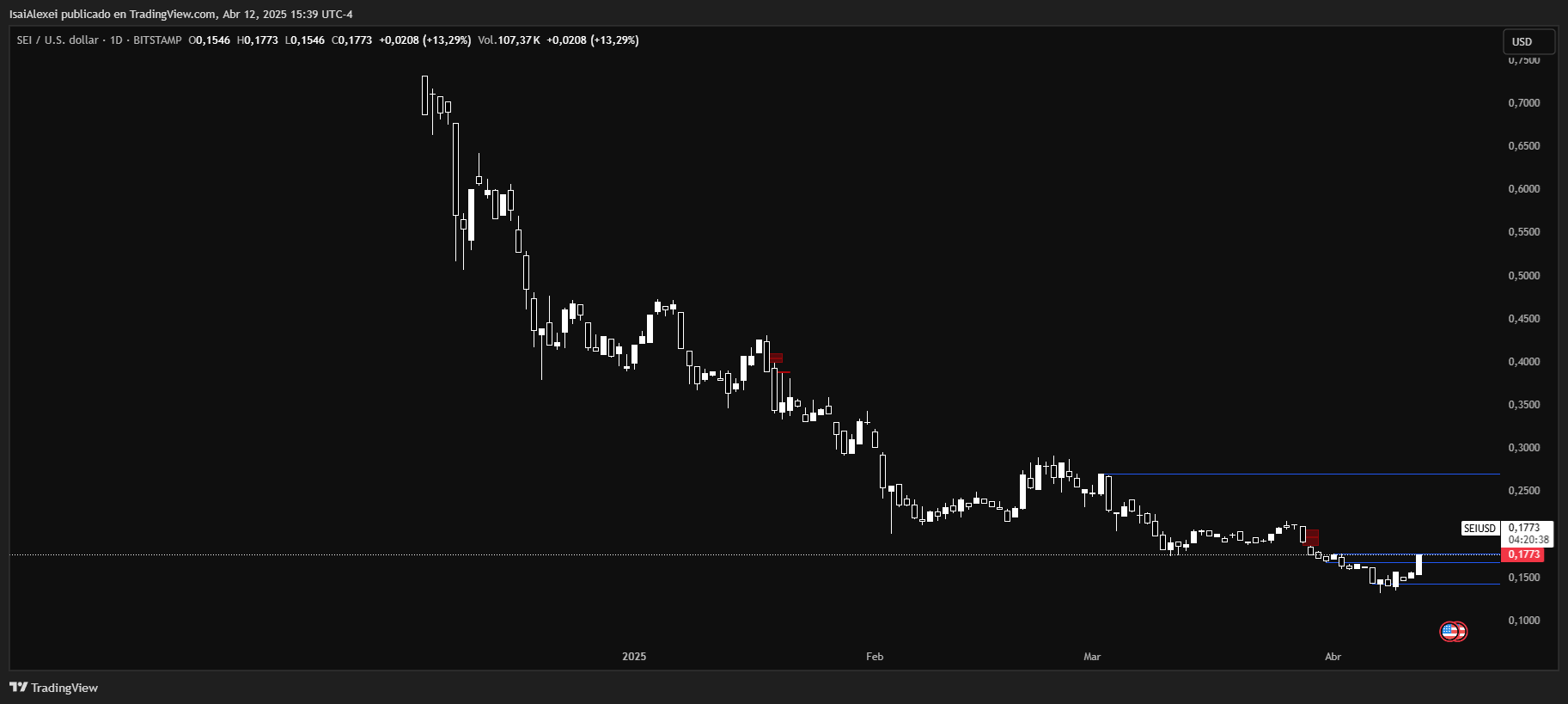

- SEI is testing the $0.18 level again, with increasing volume suggesting short-term buyer activity has returned recently.

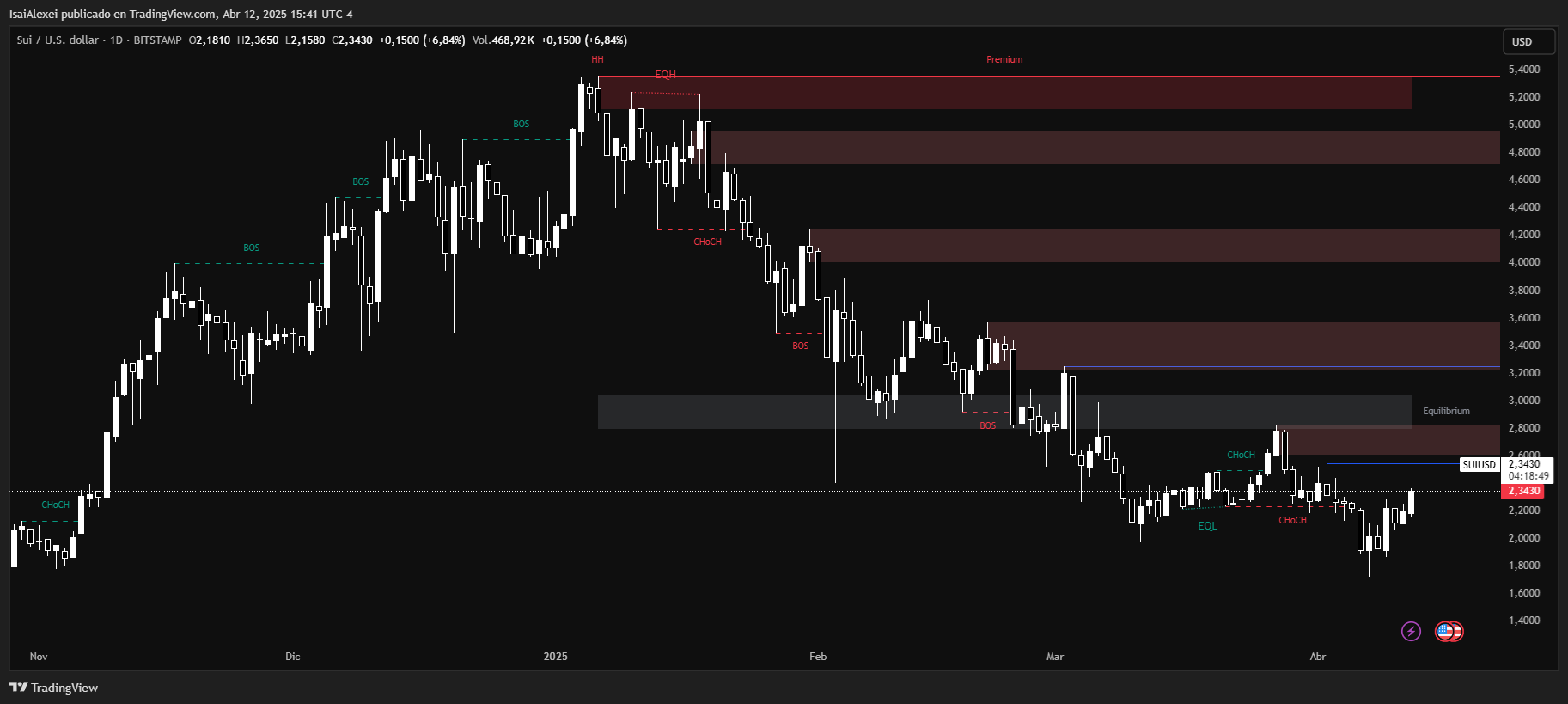

- SUI bounced from $2.28, forming a bullish pattern that may confirm if price breaks $2.40 with strong volume.

The decentralized finance market remains active, with select digital assets showing temporary gains despite broader annual declines. Among those, Uniswap (UNI), Sei (SEI), and SUI are drawing attention due to increased price activity, volume shifts, and proximity to short-term technical thresholds.

Uniswap (UNI): Short-Term Support Holds at $5.00

Uniswap (UNI) is currently priced near $5.57, following a 6.42% rise over the past 24 hours. Despite this move, UNI is still down 57.83% since the beginning of the year and 39.09% over the past twelve months. The token has maintained a support base around $5.00, a level that has now become a short-term reference point for traders.

Recent governance decisions, including the deployment of a $113 million Treasury Delegation initiative, have reinforced Uniswap’s ongoing function within decentralized exchanges. Technically, UNI has exited its most recent intraday range, with price action now approaching a minor resistance band between $5.90 and $6.10.

If that zone is surpassed, market participants may evaluate the potential for a push toward $6.70–$7.00, a range where prior selling activity was concentrated. Meanwhile, the Relative Strength Index (RSI) is climbing from weaker levels, and trading volume has marginally increased, indicating renewed engagement. Maintaining $5.30 as support remains a priority to avoid a retreat to the $4.80 range.

Sei (SEI): Recovery Attempt at $0.18 Mark

Sei (SEI) has posted a 14.51% gain in the last 24 hours, trading at $0.1776. This rebound follows a steep decline of 55.12% year-to-date and a 73% drop over the past year. The current upward shift is drawing attention as SEI retests the $0.18 price level, which is viewed by chart analysts as a barrier to further gains.

The token is now attempting to recover a previous support zone. Trading volume has also risen in tandem with the price, suggesting active participation from buyers. Should SEI close above the $0.18–$0.20 range, the next areas of interest include $0.24 and $0.26. These zones were previously marked by higher distribution, where sellers historically became more active.

Conversely, failure to sustain this recovery could send SEI back toward the $0.15–$0.16 area, which supported its recent low. Technical tools such as RSI and MACD on short-term charts have shown crossover signals that align with current upward movement, though confirmation requires continued strength in the coming sessions.

SUI: Approaching Resistance with Pattern Support

SUI is priced at $2.33 after a 6.45% rise today. The token has decreased by 43.41% since the start of the year but has gained 56.16% over the last 12 months. The current price places SUI just under the $2.35–$2.40 band, which some traders identify as the next key hurdle.

Recent price action includes a rebound from $2.28 and the formation of a technical setup known as an inverse head-and-shoulders pattern on the hourly chart. This pattern, if confirmed, may lead to price levels near $2.52 and $2.82. Volume has increased during the rise, and RSI is approaching overbought territory, though it has not crossed into that range.

A close above $2.40, paired with consistent volume, would indicate potential for further price movement. However, a planned token unlock event on May 1 introduces a risk factor, as new supply may affect upward price traction. If $2.28 remains a floor, and broader market pressure stays limited, projections show a possible rise to $2.56 within the next five trading days.