- Crucial SEC ruling on VanEck’s Ethereum ETF; listing not guaranteed.

- 75% of analysts believe the SEC will approve the Ethereum ETF.

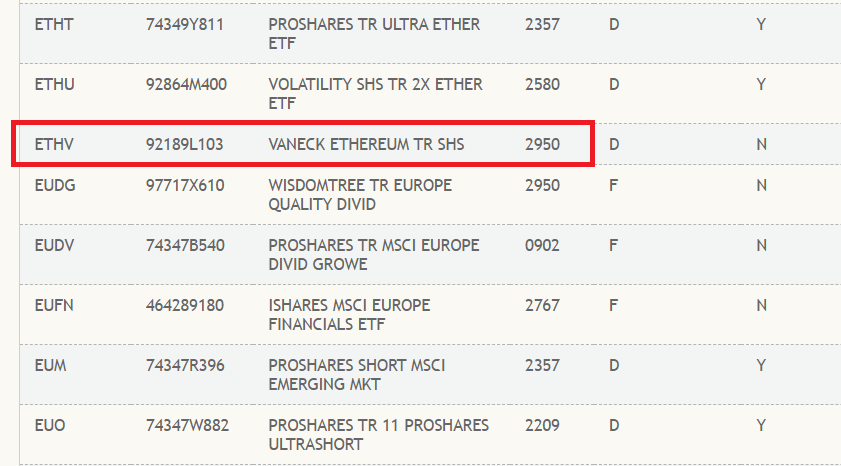

By showing up with the symbol ETHV on the Depository Trust and Clearing Corporation’s (DTCC) new securities list, VanEck’s proposed spot Ethereum ETF has advanced significantly.

This is a major step for the ETF and comes soon after the Chicago Board Options Exchange (CBOE) published revised 19b-4 forms.

SEC-Approved Pending

The DTCC listing does not, however, guarantee US Securities and Exchange Commission (SEC) approval, which is still pending. The decision of the SEC continues to be a significant obstacle for VanEck’s Ethereum ETF.

VanEck’s spot Ethereum ETF application is expected to be the first to hear from the SEC. The financial community is eagerly awaiting news on whether the SEC will approve or reject the product.

September of 2023 saw VanEck file for the spot Ethereum ETF. The action prompted several industry titans to submit comparable applications, indicating the increasing interest and promise in Ethereum-based funds, including BlackRock, ARK Invest, and Fidelity.

Initially Skeptical and Shifting Opinions

The future of funds based on Ethereum was not looking well at first. Lack of participation was one significant barrier that people speaking with the SEC mentioned.

To add yet another level of complication to the regulatory environment, Alex Thorn had previously contended that the SEC might differentiate between ETH and staked ETH in order to approve an Ethereum ETF, as previously reported by ETHNews.

Just days before the anticipated decision on May 23, though, opinion turned around. With the absence of staking and political concerns as major drivers of this confidence, Bloomberg ETF analysts Eric Balchunas and James Seyffart have projected a 75% possibility of SEC approval for a spot Ethereum ETF.

The Upbeat Prognosis of Standard Chartered

Standard Chartered went on to say that it was confident that the Ethereum ETF would receive regulatory approval. The bank believes Ethereum will reach $8,000 before the end of the year. This upbeat prediction fits well with the current changes in the market.

Meanwhile, ETH has risen by 3.0% in the previous 24 hours, and CoinMarketCap data show it is currently valued at $3,792.27. It has increased by 31.12% throughout the last week, indicating a bullish trend.

[mcrypto id=”12523″]