- LINK defies market slump, spikes 8.4% amid whale’s $7.1M bet; resistance at $14.50 remains critical.

- Whale’s $7.1M LINK purchase triggers price surge, but unrealized loss signals caution ahead of Fed meeting.

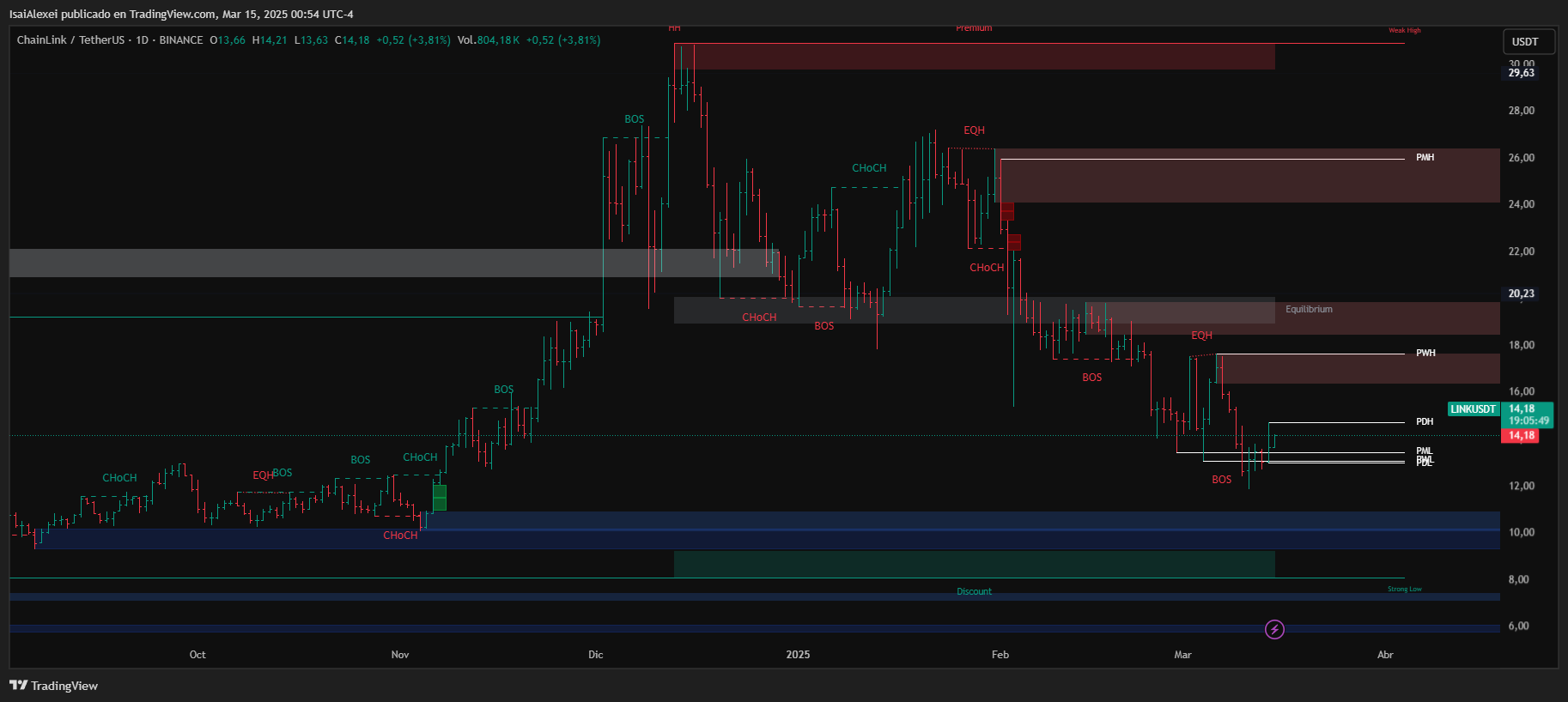

Chainlink’s LINK, rose 9% in early Friday trading, climbing from $12.98 to $14.41. At the time of writing, LINK held at $14.27, marking an 8.39% 24-hour gain. This uptick contrasted with broader market trends, as most digital assets traded lower amid investor reaction to inflation-linked consumer sentiment data and anticipation of the Federal Reserve’s upcoming rate decision.

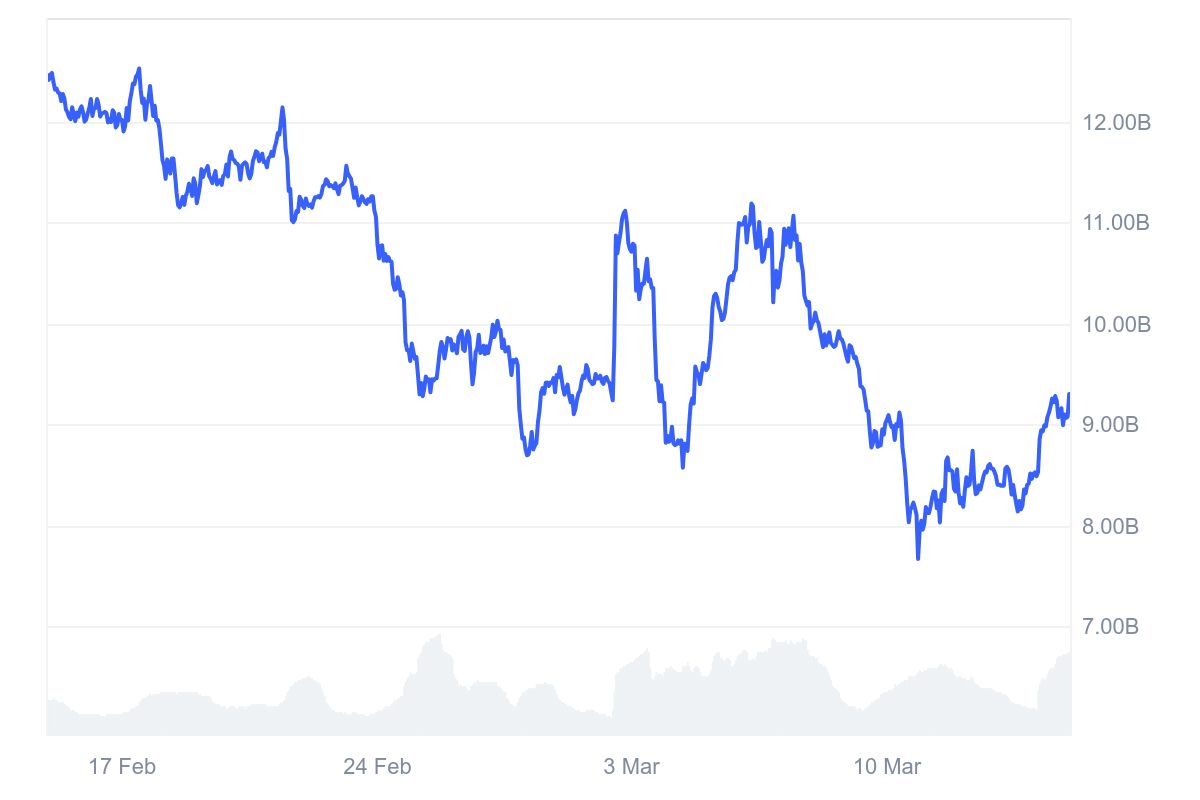

Chainlink now ranks as the 12th-largest cryptocurrency by market capitalization at $9.11 billion, despite an 18% weekly decline. On-chain data revealed a whale transaction involving 506,226 LINK ($7.1 million) purchased at an average price of $14.03.

To fund the purchase, the whale sold 1,108.83 ETH ($2.1 million) and withdrew $5 million in USDC from Spark, a decentralized lending platform. However, the position currently shows an unrealized loss of $194,000, as LINK’s price has yet to surpass the whale’s entry level.

The transaction occurred hours before the price surge, suggesting the whale anticipated a trend reversal. Analysts note that large purchases like this can fuel short-term bullish sentiment, though selling pressure persists.

Meanwhile, mixed macroeconomic signals dominate the broader crypto market. Recent consumer sentiment data highlighted rising inflation expectations, which could influence the Fed’s stance on interest rates during next week’s meeting.

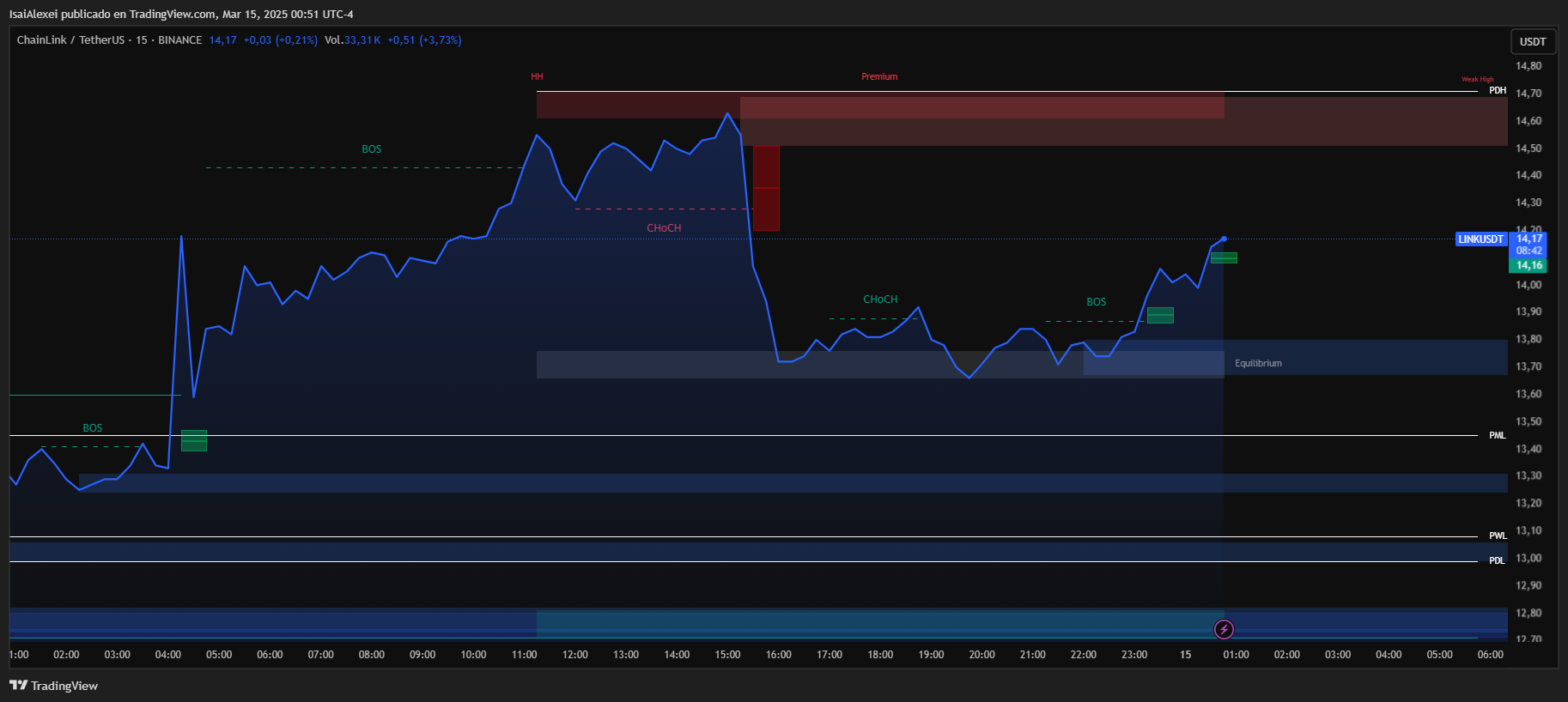

LINK’s price trajectory now hinges on two factors: its ability to sustain levels above $14 and the impact of macroeconomic developments. If the Fed holds rates steady, as markets expect, volatility may ease. However, LINK faces technical resistance near $14.50, a level that has capped gains in recent weeks.

This whale spent 7.1M $USDC to buy 506,226 $LINK at an average price of $14.03 in the past 30 minutes!

It sold 1,108.83 $ETH for 2.1M $USDC and withdrew another 5M $USDC from #Spark for the purchases.

Its $LINK long position currently has an unrealized loss of $194K. https://t.co/jP8gyy49KR pic.twitter.com/CCmCsP4R8u

— Spot On Chain (@spotonchain) March 14, 2025

While whale activity often signals confidence, current conditions warrant caution. Mixed economic data and unrealized losses in large positions contribute to uncertainty. For investors, the coming days will clarify whether Chainlink’s rally marks a sustained shift or a short-lived rebound.

As of today, Chainlink (LINK) is trading at $14.01, reflecting a 6.29% increase in the past 24 hours. Despite this short-term recovery, LINK has dropped 18.76% over the past week and has seen a 25.68% decline over the last month. Over the past year, LINK has also decreased by 32.90%, indicating continued volatility in the market.

Chainlink reached its all-time high of $53.00 on May 10, 2021, and its lowest recorded price was $0.35 on January 28, 2019. Currently, technical indicators suggest a sell signal in both daily and weekly timeframes, highlighting bearish sentiment. If LINK continues its recovery, resistance levels to watch are $15.00-$16.00, while key support remains around $13.00-$12.50.