- Litecoin rebounds 2% after weekly 12.75% loss, with whales accumulating $8.24B in holdings amid spot trader neutrality.

- Key resistance at $99.46 could trigger rally to $135 if sustained, signaling reversal of recent declines.

Litecoin (LTC) investors face a critical juncture, with the cryptocurrency’s price rebounding 2% in 24 hours amid shifting market. Despite a 12.75% weekly decline and 36.61% monthly loss, technical indicators suggest potential for further gains if key resistance levels hold.

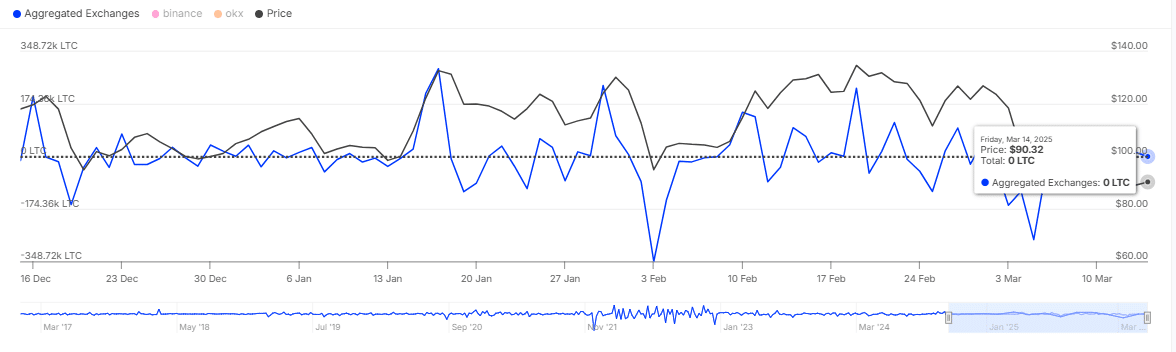

Spot Market Neutrality and Whale Activity

Recent data shows spot traders have halted active buying and selling, with zero LTC traded in the last 24 hours, signaling exhaustion among buyers and sellers. This neutrality contrasts with whale activity, which has surged.

Whales now hold $8.24 billion in LTC, with high trading volumes reflecting both buying and selling. The Bull Bear Indicator, measuring buyer-seller dominance, stands at 28 bulls to 28 bears, indicating equilibrium.

When prices rise during balanced markets, it often signals whale accumulation at lower prices. This trend aligns with LTC’s recent bounce off a $87.71 support level, suggesting strong buyer interest.

Derivatives Reflect Bullish Bias

Derivative markets hint at optimism. The funding rate—a fee paid by long (buy) positions to short (sell) positions—remains positive at 0.0063%, favoring buyers. Open Interest, the total value of open contracts, increased 8.66% to $10.8 million, indicating sustained interest in long positions.

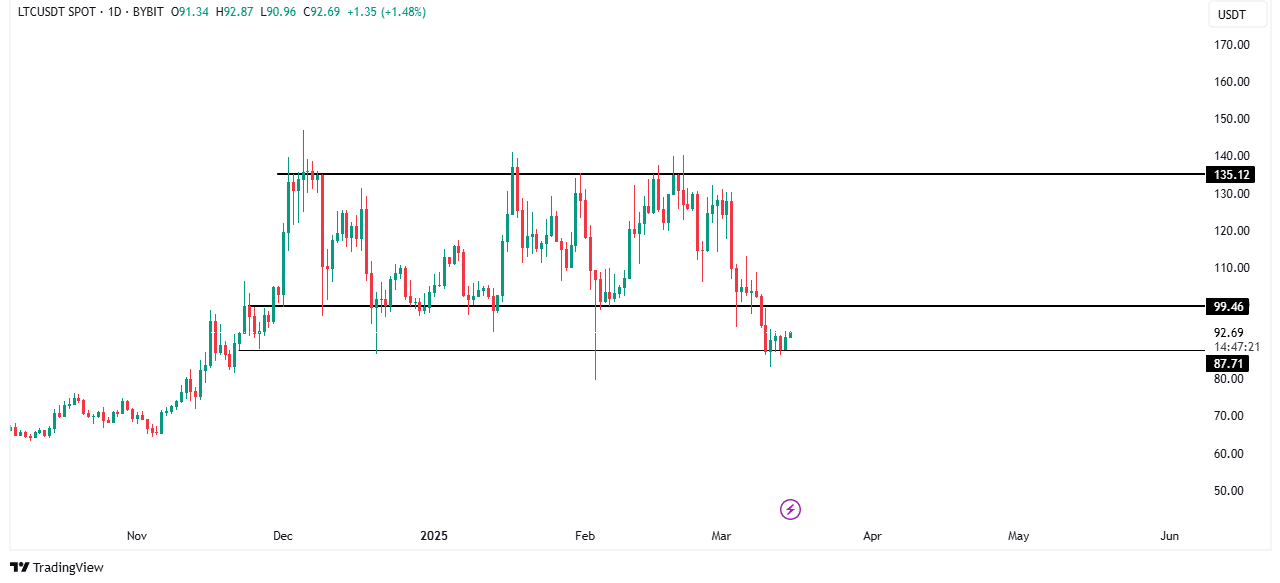

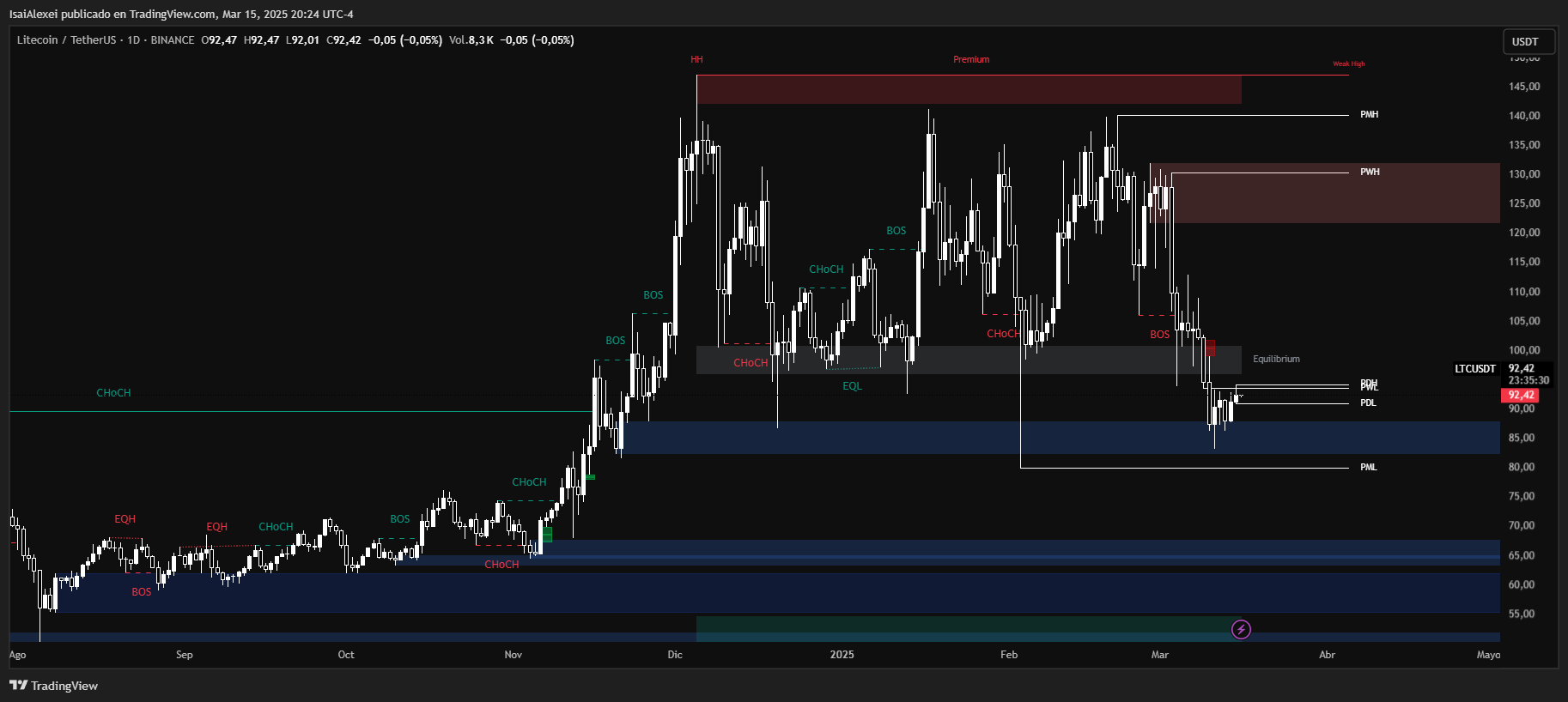

ETHNews technical analysis points to $99.46 as a key hurdle. The level marks the lower boundary of a consolidation channel previously breached during recent declines. If sustained above this threshold, LTC could rally toward the channel’s upper limit of $135.

The $99.46 support level’s recovery would signal that recent dips were temporary, with buyers overpowering sellers. A sustained breakout could reverse LTC’s monthly losses, though momentum must remain strong to avoid a pullback.

While indicators suggest potential upside, volatility remains a risk. Spot traders’ neutrality leaves the market vulnerable to external factors like regulatory shifts or broader crypto market movements. Whales’ activity, however, offers a stabilizing force, with large positions potentially influencing price direction.

Litecoin’s path forward hinges on maintaining gains above $99.46. Success here could catalyze a sustained upward trend, aligning with technical patterns and derivative market signals.

As of today, Litecoin (LTC) is trading at $92.27, reflecting a 0.22% decline in the past 24 hours. Over the past week, LTC has dropped 9.85%, and in the last month, it has fallen 27.14%. Despite this, Litecoin remains 47.31% higher in the past six months, but its year-to-date performance is down by 10.67%.

LTC’s all-time high remains significantly higher, and the coin has been trading within a parallel channel, facing resistance at $99-$100. If the price continues to decline, the next key support level is around $85-$80.

However, ETHNews analysts suggest that a potential 22% recovery could occur if market conditions improve, with a possible upside target of $110-$120.