- Uniswap trades at $5.14, down 0.75%, supported at $5.00, resistance at $5.60–$5.85; consolidation phase indicated by neutral momentum.

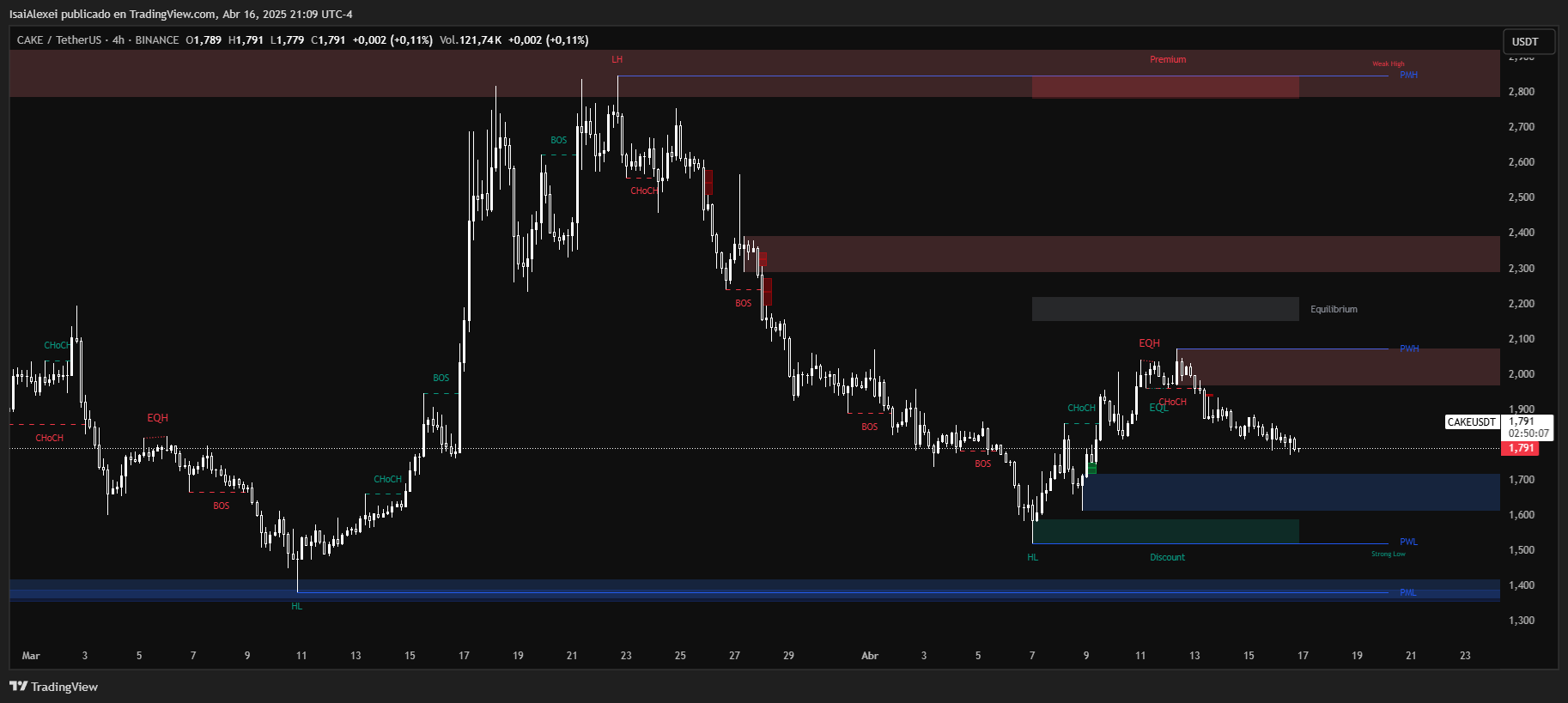

- PancakeSwap’s CAKE token stands at $1.78 with 5.85% weekly gain; resistance $1.88–$1.95, support $1.70–$1.75, neutral momentum signals consolidation.

- AAVE trades at $133.91 today, down 0.21%, recovers 6.93% weekly; holding $130–$132 support and eyeing $140–$148 resistance levels.

Decentralized finance markets display mixed trends following recent corrections, reflecting investor prudence amid shifting conditions. Uniswap trades at $5.14, with support at $5.00 and resistance between $5.60 and $5.85, while PancakeSwap’s CAKE token sits at $1.78, holding support from $1.70 to $1.75 and eyeing a breakout above $1.88.

Aave’s token, AAVE, stands at $133.91, trading within the $130–$132 support band and targeting $140–$148 on a move. Technical indicators such as RSI and MACD remain neutral, indicating a consolidation phase ahead.

Uniswap maintains its current position as a decentralized exchange by volume and has approved a $113 million treasury delegation program. PancakeSwap opened its Tokenomics 3.0 vote on April 15, running through April 18, and continues community events like the BNB Super Meetup. Aave’s governance passed a buyback proposal and advanced its GHO stablecoin and Horizon initiative.

Uniswap trades at $5.14 today, down 0.75% on the session. Over the past week, the token has climbed 7.71%, yet it remains down 61.08% since January and 28.96% over the last twelve months. UNI now sits at bargain levels compared with its all‑time high of $45.02.

From a chart perspective, UNI finds support at $5.00 and meets resistance between $5.60 and $5.85. If price clears that zone, then targets at $6.25 and $7.10 come into view.

However, a drop below $5.00 could push holdings back toward $4.50. Momentum tools such as the RSI and MACD sit near neutral, signaling a period of consolidation ahead.

PancakeSwap’s token, CAKE, stands at $1.78, marking a 1.79% decline today. Over seven days, CAKE has gained 5.85%, but it remains down 28.85% this year and 35.32% over twelve months. The token trades just above its $1.70–$1.75 support band, with resistance at $1.88–$1.95.

A successful break above that ceiling could send CAKE toward $2.20 and $2.40. Conversely, failure to hold support might open the path to $1.55. Momentum indicators are flat but show early improvement, suggesting traders are weighing their options.

Aave’s AAVE token sits at $133.91, down 0.21% on the day but up 6.93% over the past week. Still, AAVE has lost 56.56% since January and 18.68% in the last month. Price holds in the $130–$132 range, while resistance lies at $140–$148. If bulls reclaim that zone, then $160 becomes the next target. If support gives way, the token could revisit $120, where buyers have previously stepped in.

On fundamentals, Uniswap retains its position as the largest decentralized exchange by trading volume, and its governance picked up after approval of a $113 million treasury delegation program.

Meanwhile, PancakeSwap opened its Tokenomics 3.0 vote on April 15, running until April 18, and continues to host events such as the BNB Super Meetup. Aave’s governance body passed a buyback proposal and advances its GHO stablecoin and Horizon initiative aimed at real‑world asset adoption.

If UNI, CAKE or AAVE can hold key supports and clear their near‑term ceilings, then technical rebounds could accelerate. Nevertheless, growing regulatory oversight and KYC integrations in decentralized finance may temper gains if sentiment shifts. Traders will watch these levels closely over the next few days.