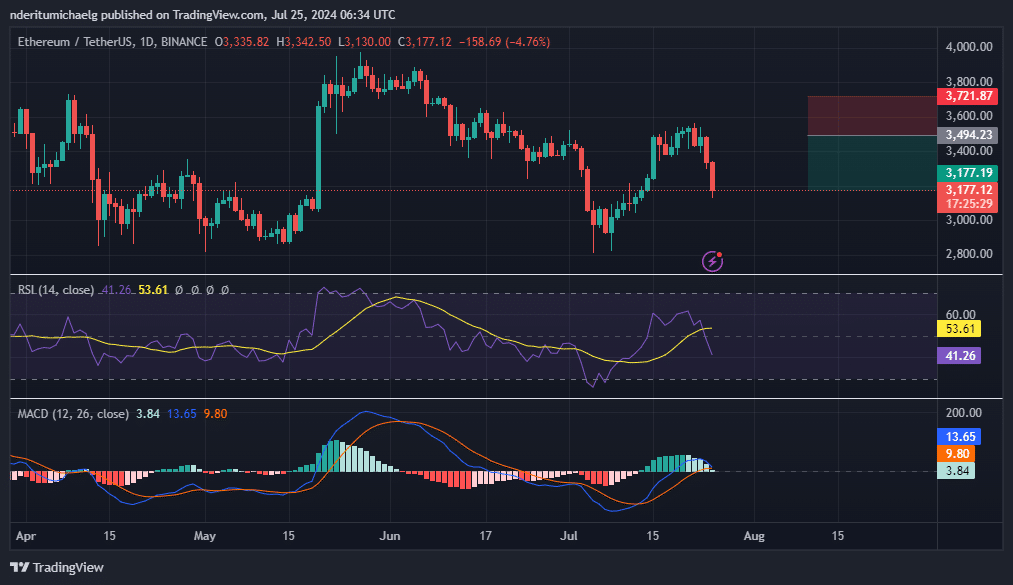

- Technical indicators like MACD and RSI suggest weakening bullish momentum, potential further price declines expected.

- Grayscale transfers 140,044 ETH to Coinbase Prime, indicating significant whale activity post-ETF approval.

The approval of Ethereum ETFs has led to a notable increase in selling pressure in the cryptocurrency market. This response aligns with patterns observed in past financial product launches within the sector.

Following the regulatory approval, Ethereum’s price showed a clear decline, signaling a typical “sell the news” reaction where initial enthusiasm transitions into strategic sell-offs.

[mcrypto id=”12523″]Ethereum was trading at $3,177 shortly after the ETFs were approved, reflecting a decrease of more than 10% since the approval. Before this decline, Ethereum had enjoyed a 21% increase from its July lows, peaking just 15 days before the ETF approvals.

This increase suggests that the market had initially responded positively to the prospect of ETFs.

Market indicators such as the Moving Average Convergence Divergence (MACD) show that the bullish momentum is weakening, with a potential shift to negative territory. The Relative Strength Index (RSI) indicates that further declines could occur, as it has not yet reached oversold conditions.

The next significant support level for Ethereum is projected to be below $2,900

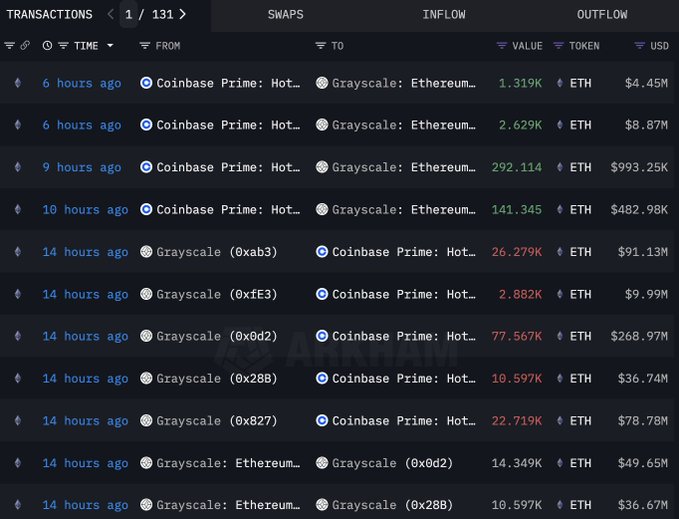

Large-scale investors, often referred to as “whales,” have played a significant role during this period.

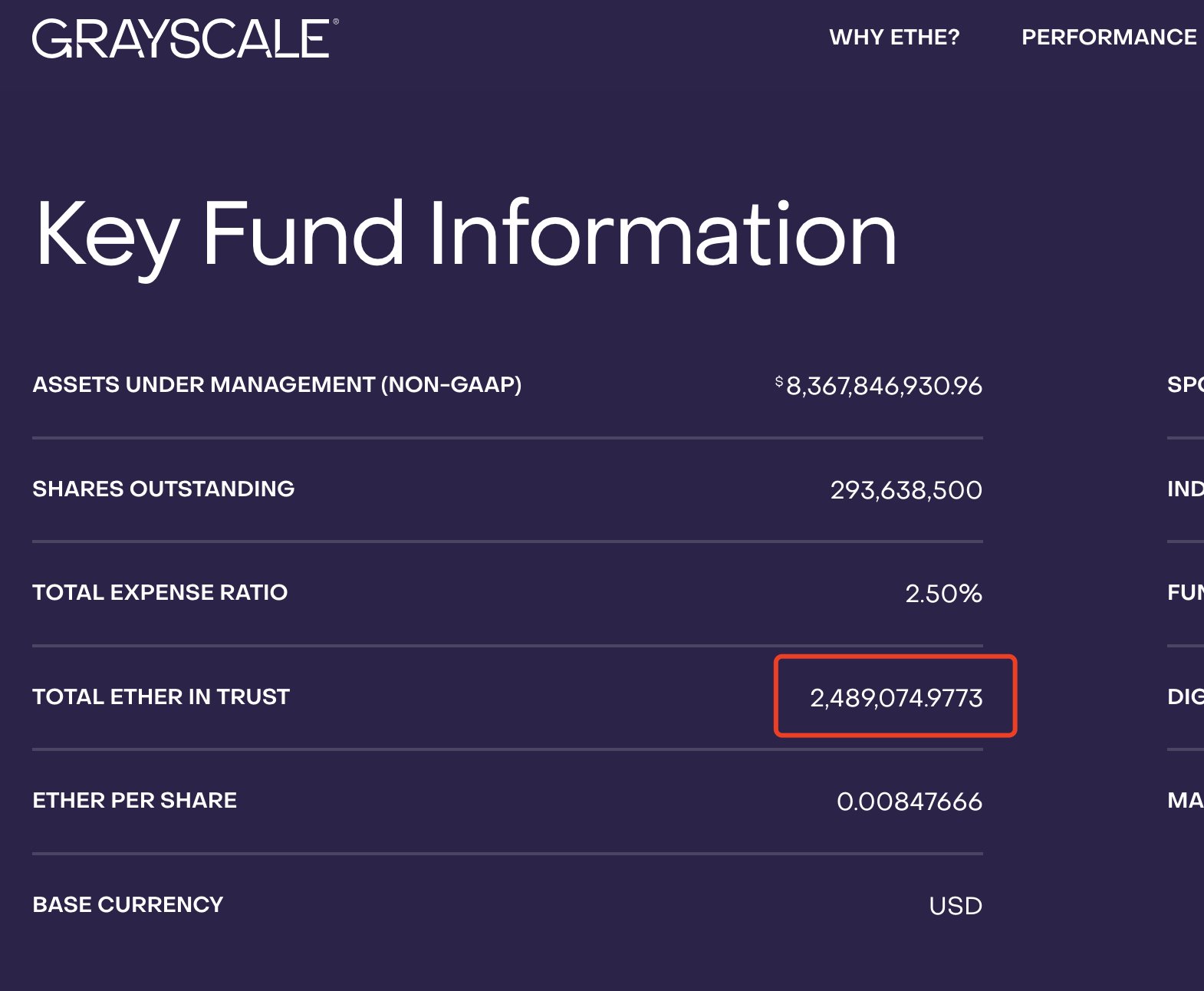

According to #Grayscale’s website, #Grayscale currently holds 2,489,075 $ETH($7.9B). – Source: etfs.grayscale.com/ethe

According to data from Lookonchain, Grayscale moved 140,044 ETH to Coinbase Prime, valued at nearly $500 million. This transfer is indicative of whales using the new ETF liquidity to adjust their holdings, contributing to the selling pressure.

Despite the market downturn, not all activities are geared towards selling. The iShares Ethereum ETF, managed by BlackRock, added about 76,669 ETH, worth approximately $262 million, to its assets, indicating continued buying interest at lower prices.

BlackRock(iShares) Ethereum ETF wallet received 76,669 $ETH($262.4M) from #CoinbasePrime 10 hours ago.

According to #BlackRock's official website, #BlackRock currently holds 79,699 $ETH($277M).https://t.co/sefS6WTlHz pic.twitter.com/pvEGrWxvT9

— Lookonchain (@lookonchain) July 25, 2024

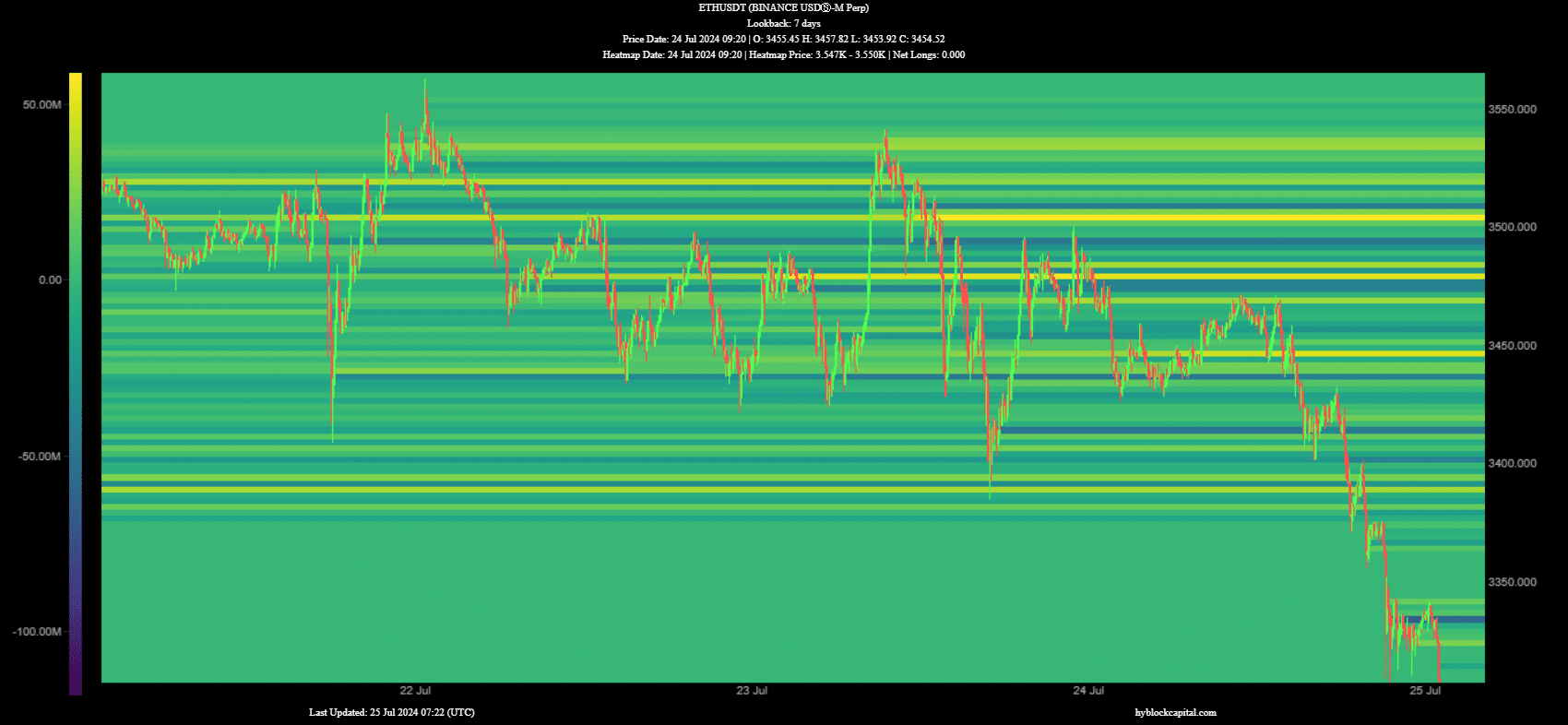

Additionally, the market has seen a spike in liquidations, especially of long positions, as evidenced by trading data from HyblockCapital’s heatmaps.

The data showed a significant increase in liquidations as Ethereum’s price fell below various support levels, particularly dropping below $3,300 in one trading session.

This activity highlights the market’s volatility and the immediate impact of financial developments such as the introduction of an ETF.