- BNB Chain saw a rise in revenue of more than 70% as well as notable gains in market capitalization and trading volume.

- Network activity remained robust and investor confidence unexpectedly increased despite a decline in revenue and price.

In 2024, the first quarter was notably optimistic, especially for BNB and the blockchain that powers it, BNB Chain. This optimism was not misplaced, as multiple indicators pointed to strong growth and promising future prospects.

Q1 2024: An Indicator of Hope

The cryptocurrency market experienced substantial gains at the start of 2024, with BNB taking the lead. BNB Chain’s income increased over 70% from the final quarter of 2023, according to Coin98 Analytics.

The blockchain reported an astounding $66.8 million in sales for the first quarter of this year, a 70% increase that brought the total revenue to $6.62 million.

Not just the financial measures were enjoying the growth’s warmth. The market capitalization of the coin surged by 65%, hitting $60 billion, a 30% annual growth. Following suit, trading volumes increased by 2.3 times in the current quarter and an even more remarkable 2.8 times in the previous year.

Broadening Perspectives: The Increase of BNB Owners

In Q12024, there were over 113 billion BNB holders—an increase of 80.7% from the year before. This is an unparalleled spike in the number of holders. The holder base’s growth demonstrated BNB’s increasing acceptance and appeal in the cryptocurrency world.

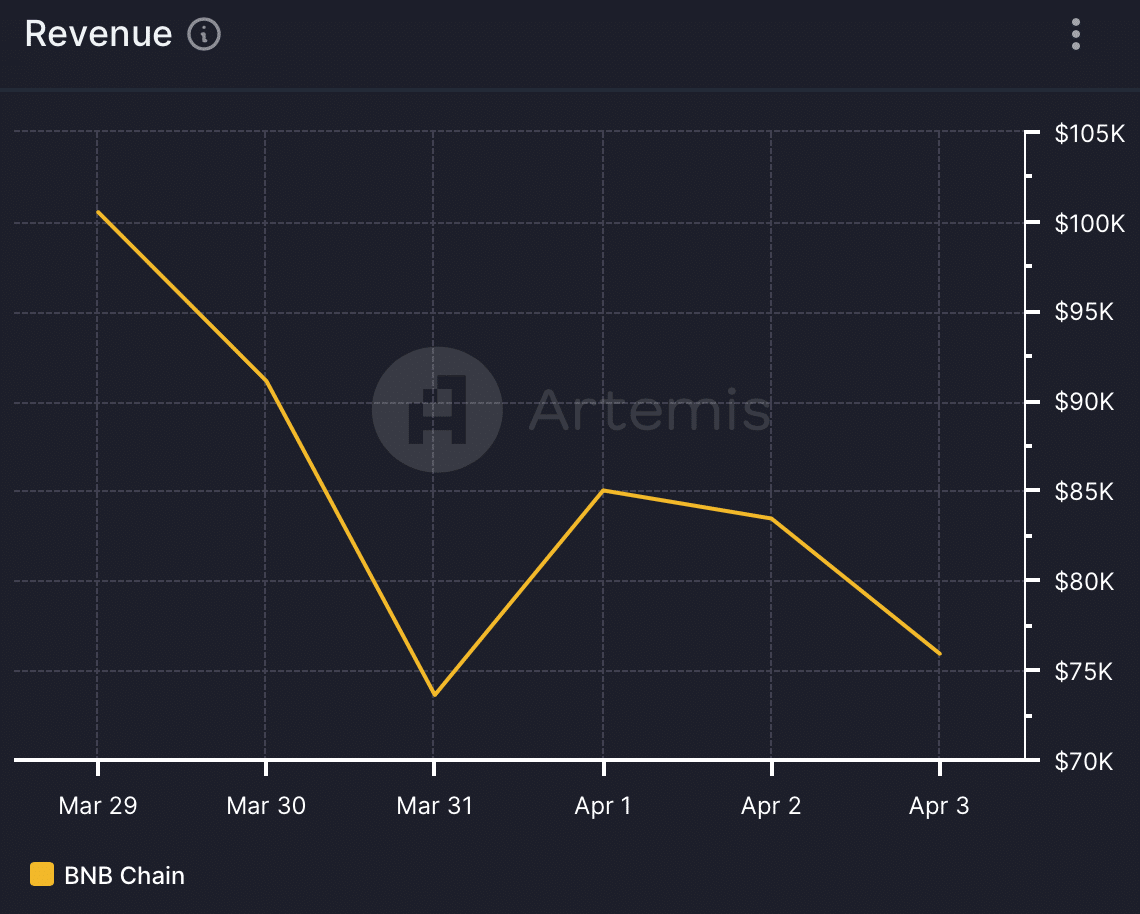

But as the second quarter progressed, it was clear that the chain’s fortunes had drastically changed. Artemis’ data showed a decrease, with revenue and blockchain fees declining in the final seven days of the studied period.

The network activity of BNB Chain was different despite the financial downturn. The chain continued to have a large number of active addresses and transactions each day, indicating that the ecosystem was still dynamic and active.

Meanwhile, as previously reported by ETHNews, BNB Chain’s announcement of a $1 million incentive for developers led to an unexpected increase in memecoin initiatives within its ecosystem.

Pessimistic Market Attitudes and Price Adjustments

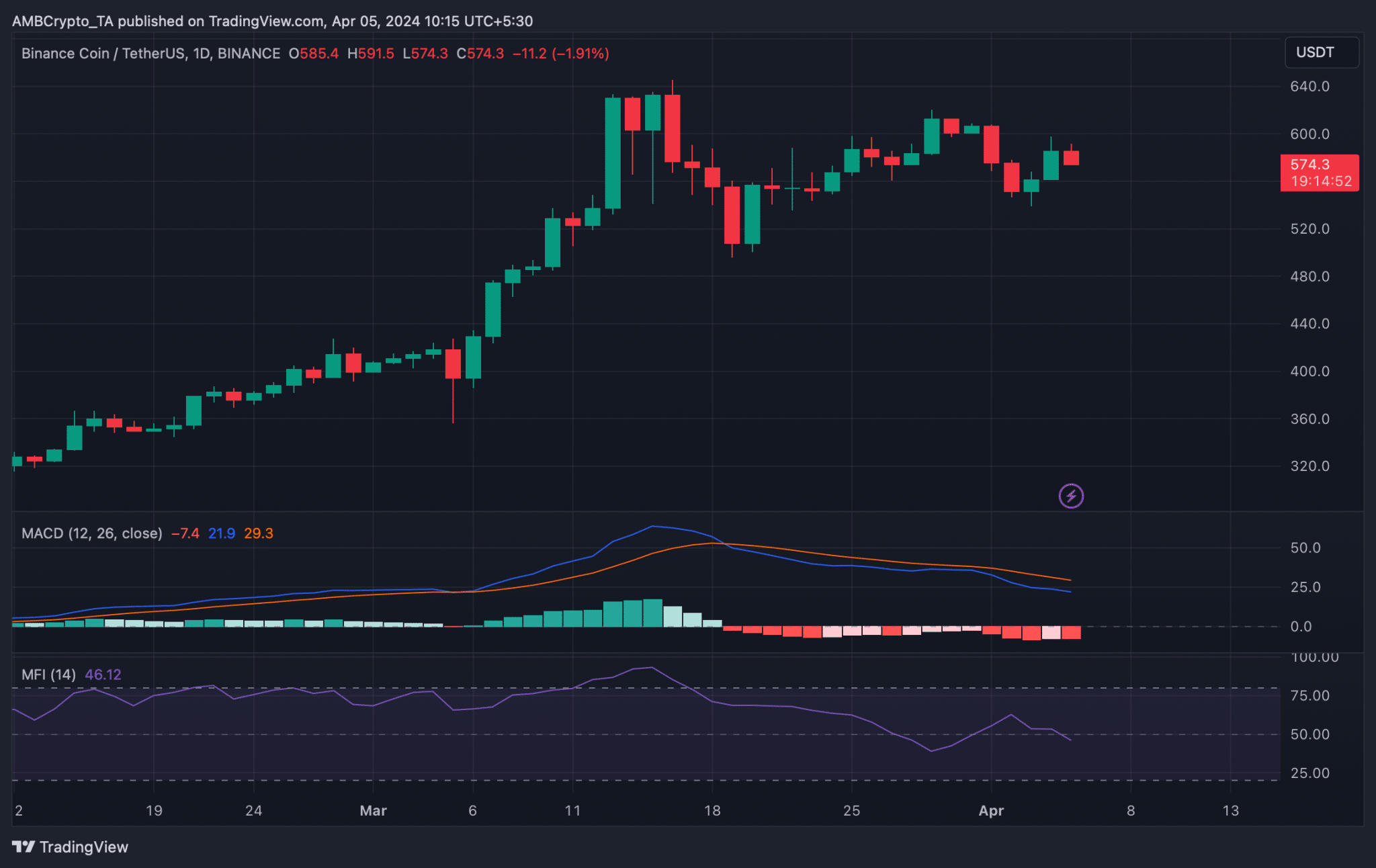

The difficulties facing the market as a whole were reflected in the price of BNB, which dropped by more than 3.70% in the last week to $581.98.

[mcrypto id=”51355″]Also, technical analysis of BNB’s Q2 results showed two alarming patterns: the Money Flow Index (MFI) declined and slid below the neutral barrier, and the MACD indicator showed a bearish crossover. All of these factors pointed to a higher probability of BNB’s price dropping further, which was consistent with the overall market uncertainty that was noted throughout the quarter.

It’s interesting to see that investor sentiment turned positive despite the adverse price action. On April 4th, BNB’s weighted sentiment reached the positive zone, showing that investors are becoming more confident despite the difficulties facing the market.