- Despite recovery from an August crash, Bitcoin’s momentum falters, ending the month 8.74% lower, posing investor challenges.

- Historical data shows September as a tough month for Bitcoin, with significant drops noted in 2019 and 2014.

Peter Schiff, recently highlighted on social media platform X that Bitcoin registered all of its gains for the year within the first two months.

Since the end of February, Bitcoin has seen a decrease in value by 8%. During the same period, gold recorded a 23% increase.

We are now eight months into 2024, and all of Bitcoin's gains for the year occurred during the first two months. Since the end of Feb., despite the launch of 11 Bitcoin ETFs, #Bitcoin is down 8%. Over the same six months, the price of #gold is up 23%. The momentum has turned.

— Peter Schiff (@PeterSchiff) September 1, 2024

Schiff noted a shift in momentum for Bitcoin. Despite a recovery from a significant downturn in early August, Bitcoin closed the month down by 8.74%, presenting a challenge for investors who support the cryptocurrency’s growth potential.

Historically, September has often been a difficult month for Bitcoin, with the cryptocurrency seldom posting gains.

Specific past instances include a 13.91% drop in 2019 and a 19.31% fall in 2014. However, this September might differ as the U.S. Federal Reserve is expected to cut interest rates, which may influence the cryptocurrency’s performance positively.

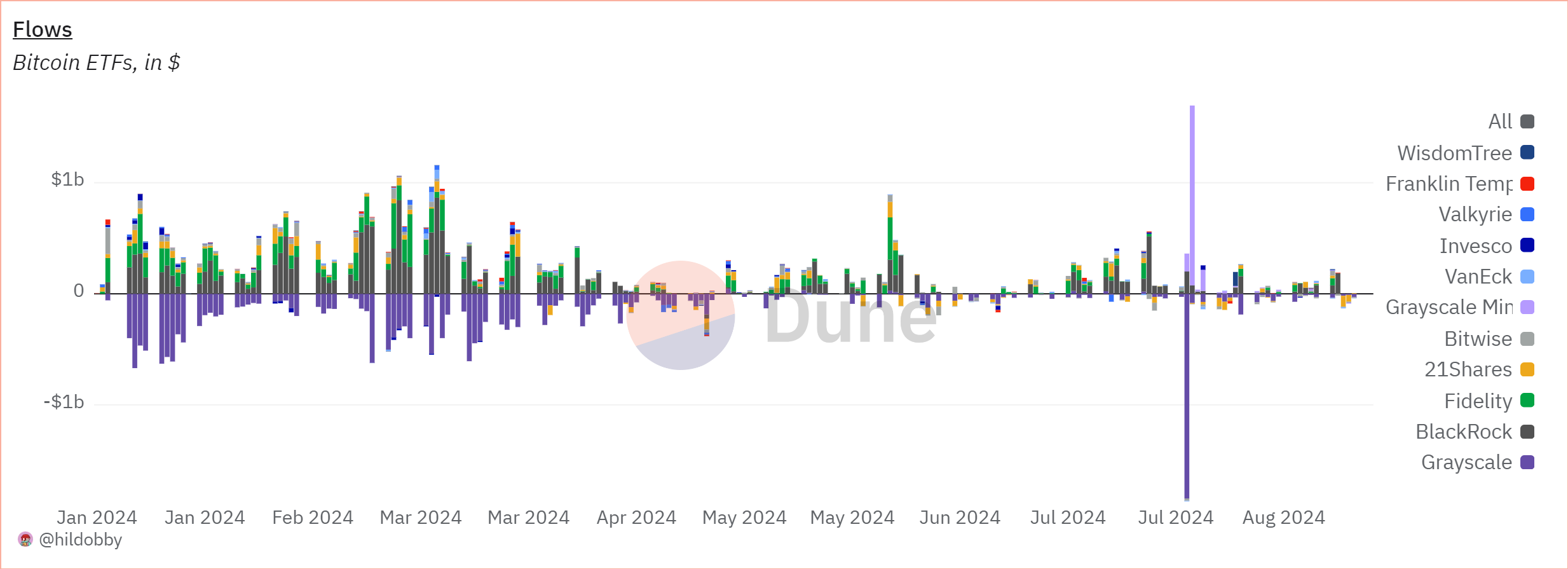

Further reflecting challenges for Bitcoin are the recent trends in Bitcoin exchange-traded funds (ETFs). These funds have been instrumental in raising interest in Bitcoin, helping drive its price to a peak in March.

Nevertheless, recent developments have seen a decline in interest. Last week, Bitcoin ETFs reported outflows totaling $277 million. Notably, BlackRock’s IBIT experienced its second day of outflows last week.

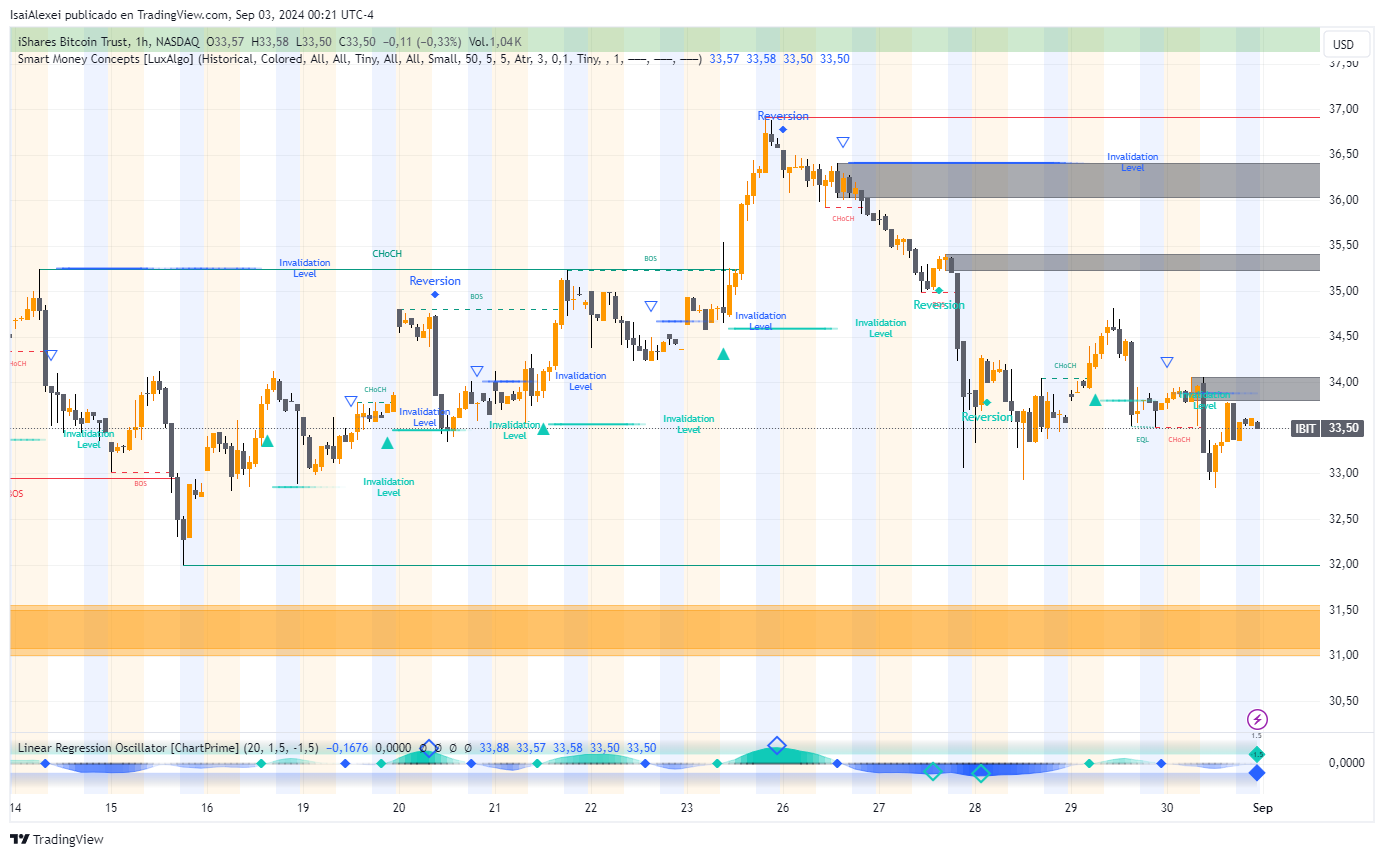

The current price of BlackRock’s iShares Bitcoin Trust (IBIT) is approximately $33.37 USD, showing a slight decrease of 0.95% at the market close. During after-hours trading, the price increased slightly to $33.55 USD, up 0.54%.

The day’s trading range was between $32.84 and $34.07 USD. Over the past 52 weeks, IBIT has traded between $22.02 and $41.99 USD. The fund currently holds net assets of $22.56 billion, and the average daily trading volume is around 26.46 million shares.

The comparative analysis of Bitcoin against traditional assets such as gold and the patterns observed in ETF flows provide a clear picture of the current market sentiment and the challenges Bitcoin faces.

As market watchers anticipate the Federal Reserve’s interest rate decision, the broader implications for Bitcoin’s market positioning through the end of the year become a focal point for both investors and analysts.

[mcrypto id=”12344″]

The current price of Bitcoin (BTC) is approximately $59,096.30 USD, showing an increase of 2.40% over the past 24 hours. Today’s trading range has been between $59,087.21 and $59,764.69 USD.

Over the past 52 weeks, Bitcoin has ranged from $24,930.30 to $73,750.07 USD. The market capitalization of Bitcoin stands at $1.167 trillion, with a 24-hour trading volume of about $25.62 billion.