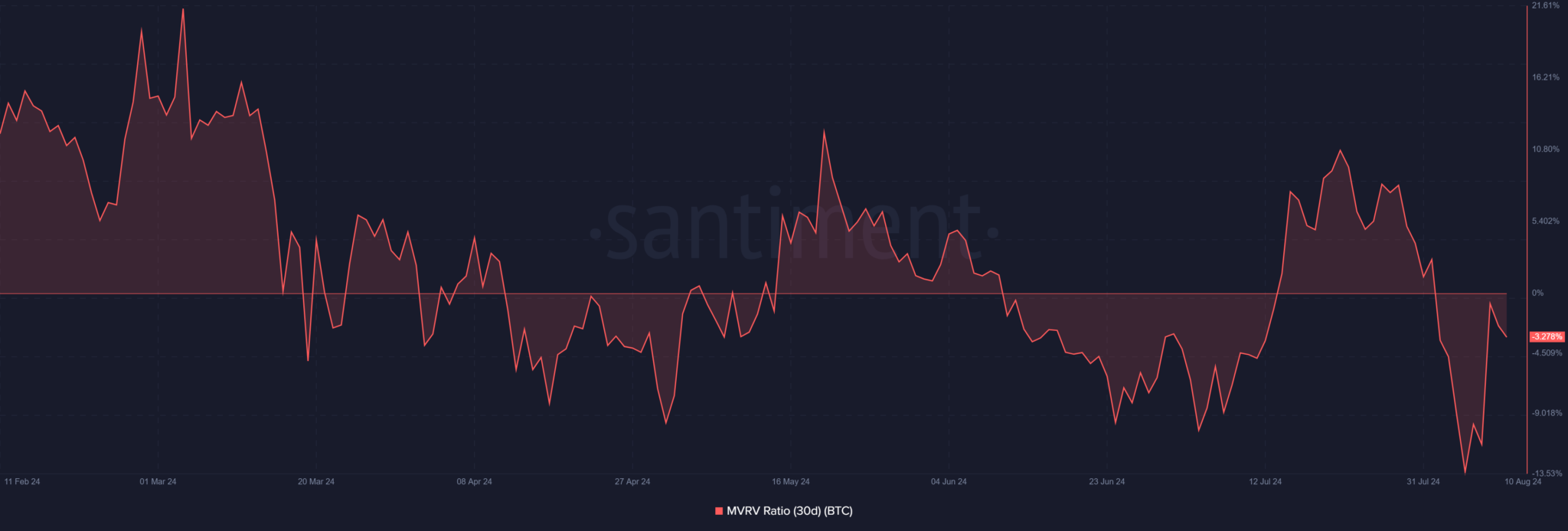

- MVRV ratio shows Bitcoin undervalued, suggesting current prices might offer strategic buying opportunities for savvy investors.

- Whale activity could stabilize or boost Bitcoin prices, countering recent market downturn pressures as accumulation continues.

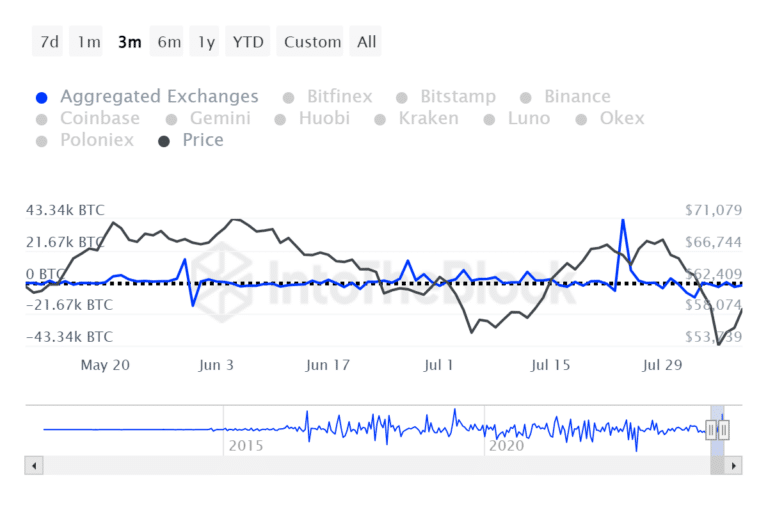

Recent Bitcoin market activity has revealed different responses among traders and large holders, known as “whales.” As Bitcoin’s price dropped below $60,000—a level previously seen as stable—many traders reacted by selling off their assets to limit losses. However, Bitcoin whales acted differently, accumulating over $1.7 billion worth of BTC, according to data from IntoTheBlock.

This pattern of accumulation indicates that large-scale investors are moving their Bitcoin from exchanges to private wallets. Such movements usually suggest long-term holding intentions rather than preparing for immediate sale. The recent net outflows from exchanges are the highest in over a year, reflecting a shift of BTC away from the trading platforms.

For the broader market, this whale activity might stabilize prices or lead to a potential rebound. The accumulation by these large investors shows that they see the current lower prices as a strategic buying opportunity. If this trend continues, it could counter the recent downward pressures in the market.

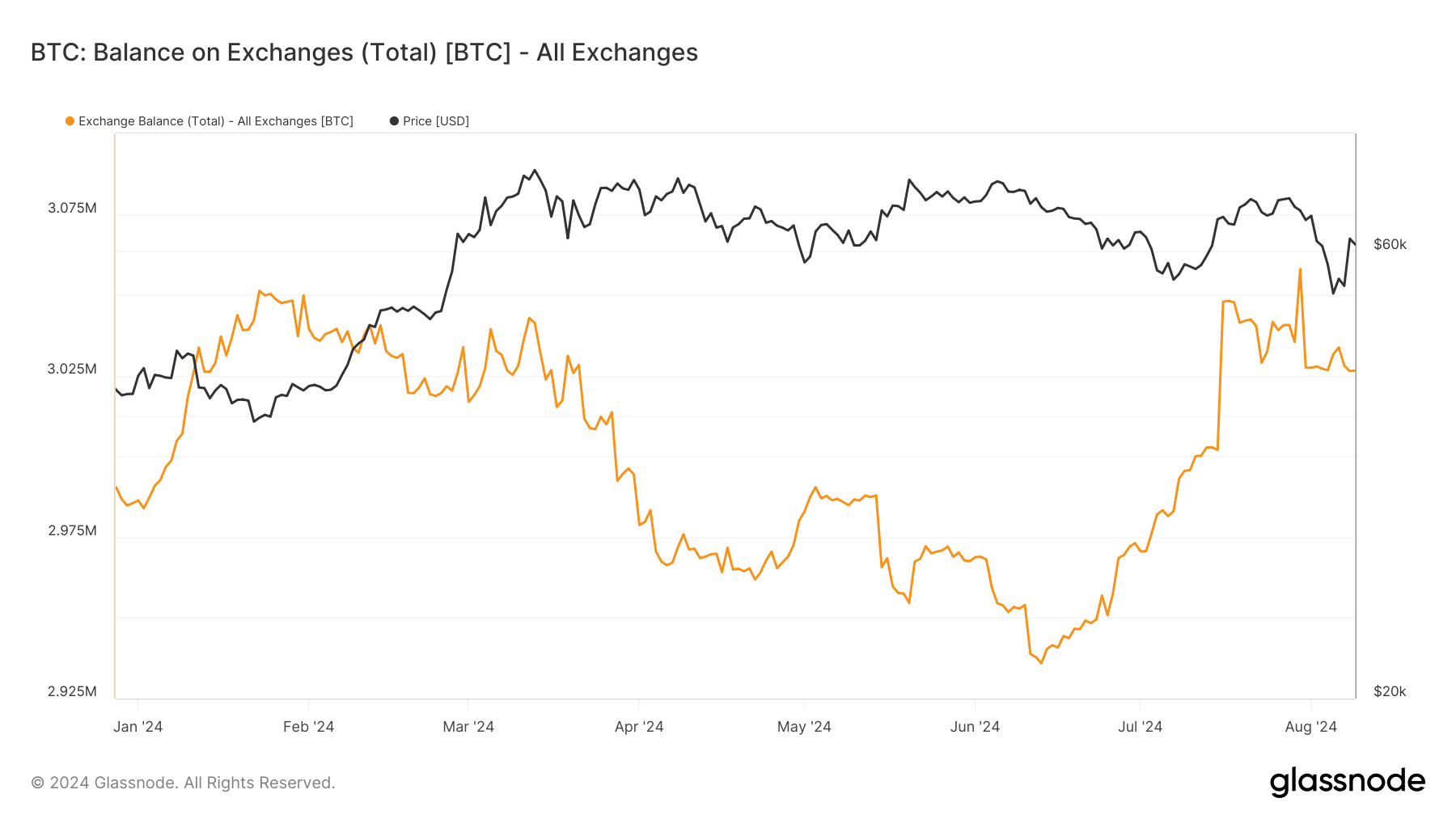

Data from Glassnode supports this trend, showing a decrease in the Bitcoin balance on exchanges. The balance dropped from around 3.057 million BTC on July 30 to approximately 3.026 million BTC, consistent with the ongoing trend of Bitcoin moving off exchanges.

Additionally, the MVRV ratio, which measures the average profit or loss of Bitcoin holders, is currently at -3.278%. This negative trend means recent holders are experiencing losses, suggesting that Bitcoin may be undervalued.