- Ethereum faces potential price decline, failing to break resistance at $2,933 after a bearish five-month pattern.

- Peter Brandt predicts Ethereum could fall to $1,652, based on technical analysis of recent bearish indicators.

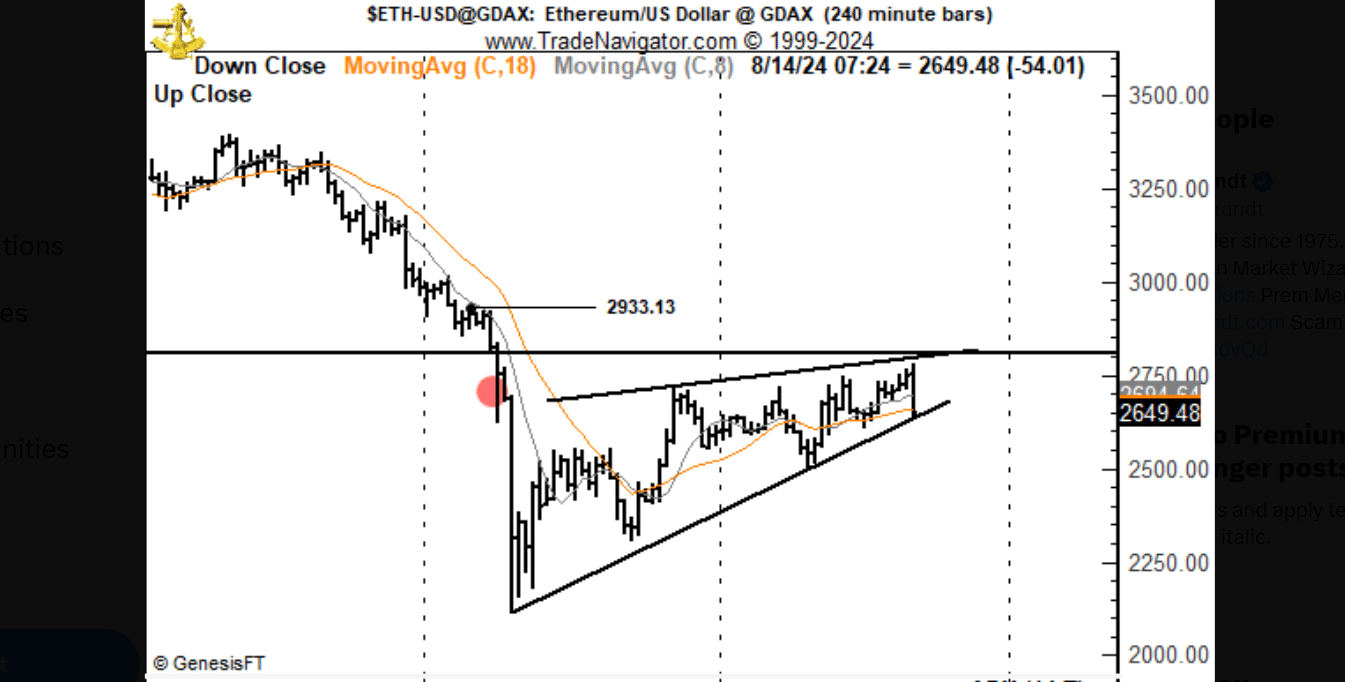

Ethereum is currently exhibiting signs that suggest a potential decline in its price. Recent analysis indicates a bearish breakout from a five-month rectangular trading pattern, with Ethereum struggling to surpass the resistance level at $2,933.

Following this pattern’s completion, the price attempted an unsuccessful rally on August 14, further confirming the bearish outlook.

Market reactions to the latest U.S. Consumer Price Index (CPI) data have also influenced Ethereum’s price trajectory. The data release led to a widespread sell-off in the cryptocurrency market, resulting in a 4% decrease in Ethereum’s price over 24 hours, bringing it down to $2,622.

Ether $ETH

I am posting this not as a slam on ETH, even though I'm not a fan, but to describe how I trade – so ETHernuts, dont take offense. I am as quick to go long on a good pattern as short on a good pattern

1. 5-mo rectangle (my fav pattern) completed Aug 4

2. Retest of BO… pic.twitter.com/h89EAzP7cb— Peter Brandt (@PeterLBrandt) August 14, 2024

Peter Brandt has observed that:

He notes a downward trend and predicts that the price could potentially fall to $1,652. Brandt has positioned himself for this outcome by entering a short trade based on these indicators.

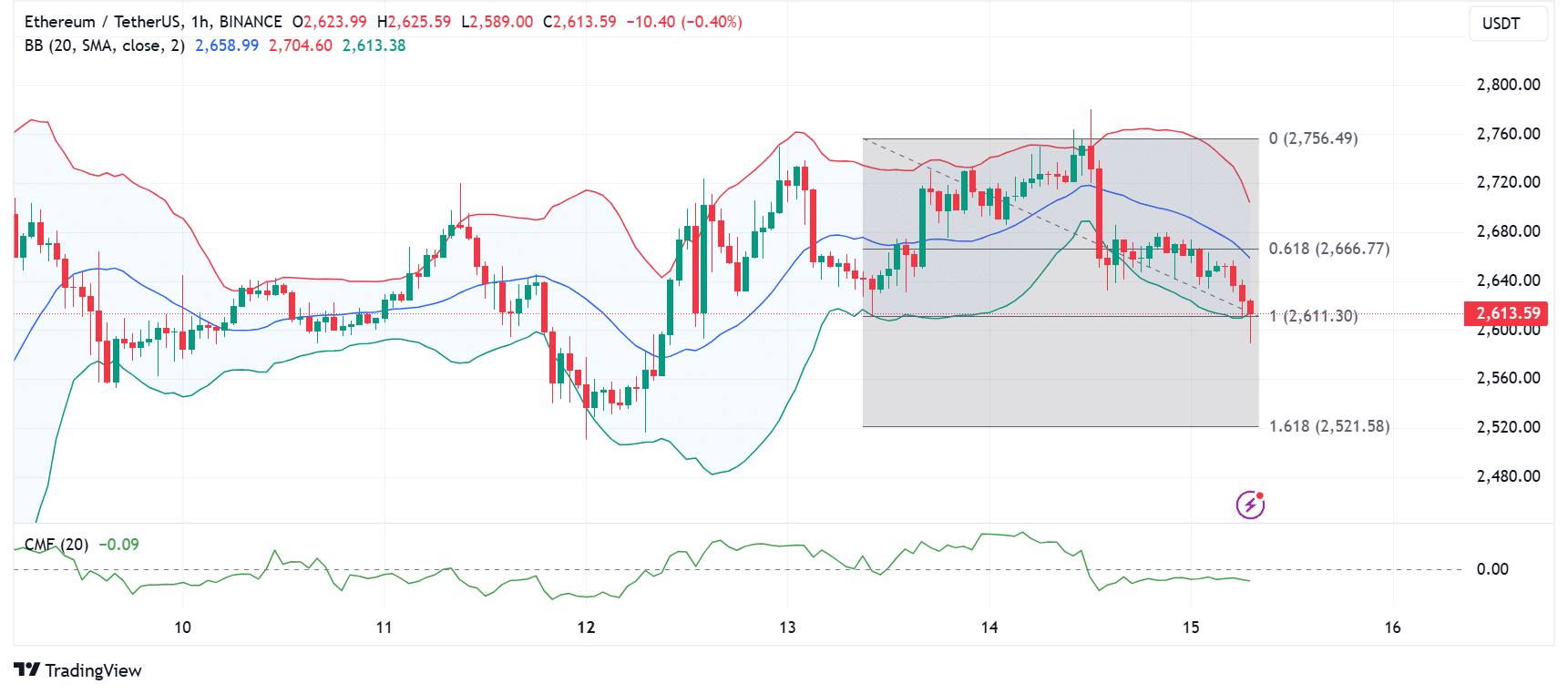

Technical indicators such as the Chaikin Money Flow (CMF), currently at -0.09, suggest that selling pressure is ongoing, with a lack of buying momentum. Furthermore, the Bollinger Bands have expanded, indicating rising market volatility and a likely continuation of the price decline.

If Ethereum fails to maintain support at $2,611, it could trigger further declines, possibly reaching a Fibonacci retracement level of $2,521. This potential fall could be exacerbated by traders liquidating their positions to minimize losses.

Technical Indicators Suggest Bearish Outlook

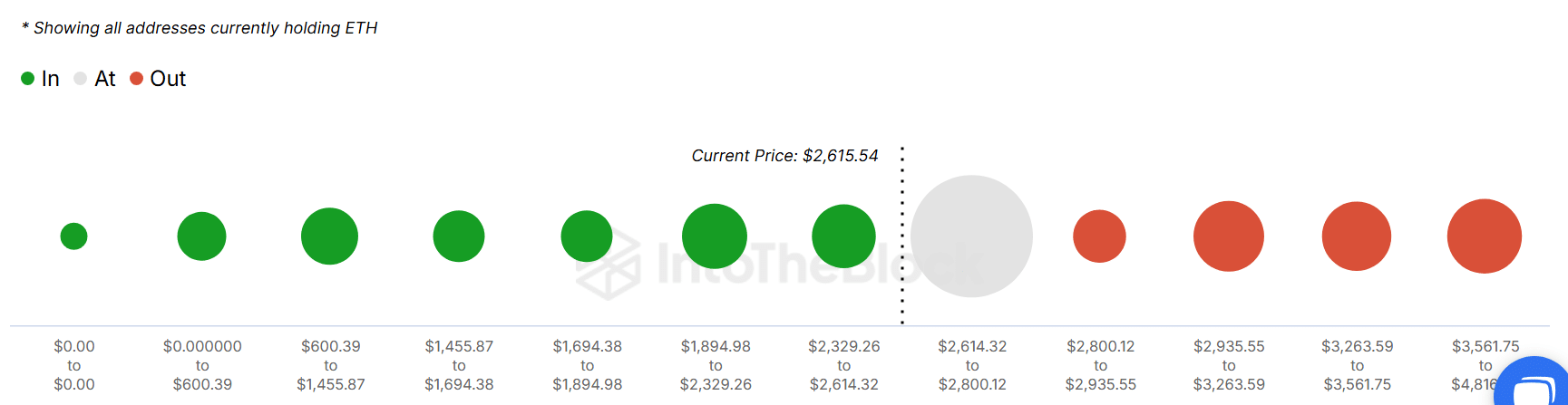

Ethereum is currently encountering resistance at the $2,843 level, which marks a 50% retracement from its recent peak to trough prices. If Ethereum does not exceed this resistance point, a decrease to the weekly support level of $2,118 might follow, reflecting a 20% drop.

The bearish indicators are corroborated by technical analysis tools such as the Relative Strength Index (RSI) and the Awesome Oscillator (AO), both of which are registering below their neutral thresholds. This suggests potential downward movement for the cryptocurrency.

Furthermore, there’s been a notable increase in Ethereum moving into exchanges, with the Exchange Flow Balance showing a shift from a significant outflow to an influx of 20,707 units, indicating intensified selling pressure.

Influential Transactions Impact Ethereum

Contributing to this pressure are actions by key figures in the Ethereum community. For instance, Vitalik Buterin, the founder of Ethereum, transferred substantial Ethereum holdings to an exchange, potentially to sell, which could lead to increased selling pressure.

Additionally, Jump Trading, a major trading firm, sold over 17,000 ETH, valued at approximately $46.44 million. This selling activity has been consistent and coincides with a noticeable decline in Ethereum’s price over recent weeks.

Moreover, there is a decrease in development activity around Ethereum, as measured by the number of project events on GitHub. This metric has decreased slightly, which may suggest a slowdown in innovation or engagement with the Ethereum platform, potentially affecting investor sentiment.

Decrease in Development Activity

Overall, these factors combined cast a cautious outlook for Ethereum in the immediate future. The convergence of increased selling pressure, influential market actions, and a slowdown in development activity are aligning at a time when Ethereum is facing key technical resistance levels, making the near-term trajectory for its price uncertain.

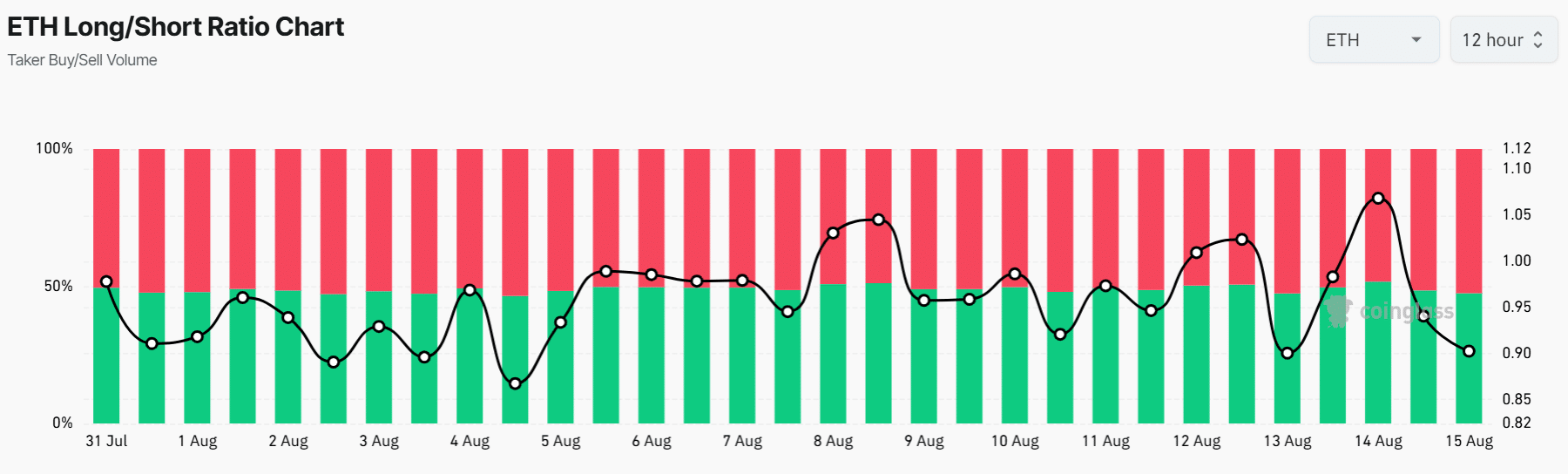

In the futures market, the prevailing sentiment is bearish, as evidenced by the dominance of short positions over long ones, with a long/short ratio of 0.90.

By the way, there has been a decrease in open interest, from $14 billion at the beginning of the month to $10 billion, which suggests a reduced commitment to Ethereum among traders.

This comprehensive analysis provides a clear picture of the current market conditions surrounding Ethereum, indicating a cautious outlook for its near-term price movement.