- Large investors bought 130,000 ETH near $1,781, mirroring 2023 accumulation patterns that preceded a 71% price rally.

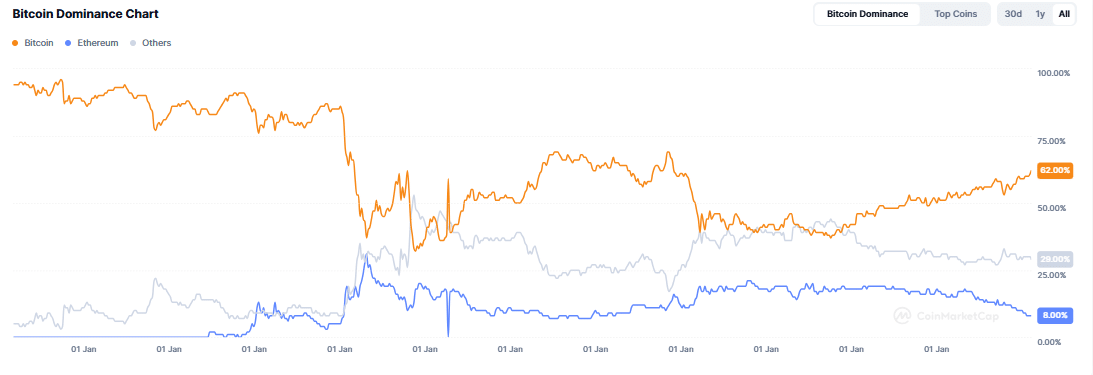

- ETH fell 15% in a month, broke $2,000 support; Bitcoin’s dominance hit 61%, a four-year high.

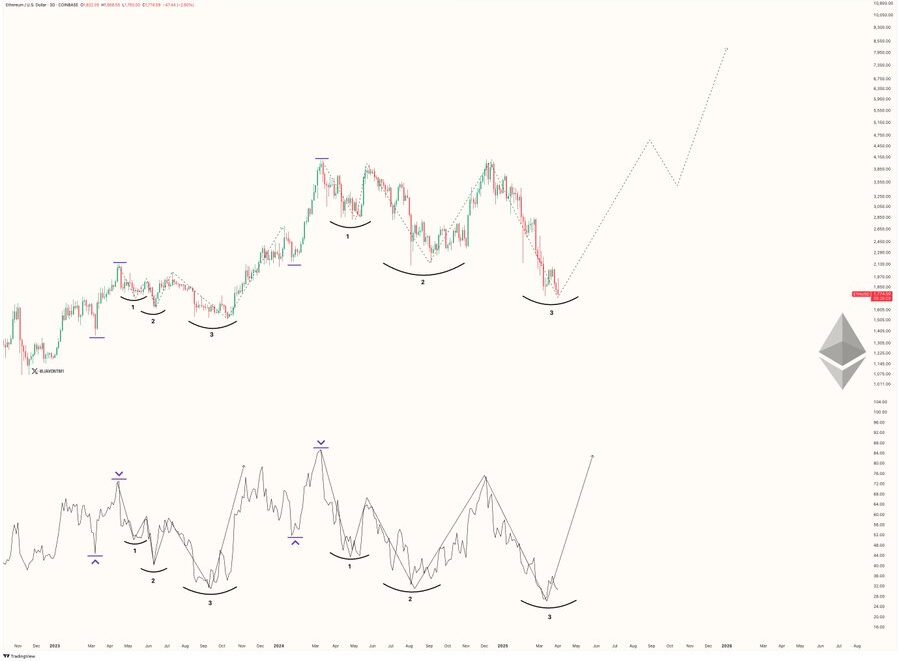

Ethereum’s price behavior in recent weeks has drawn comparisons to its 2023 cycle, when a prolonged consolidation phase preceded a sharp upward move. On-chain data reveals that large investors accumulated over 130,000 ETH as prices briefly touched $1,781, signaling buying activity near a historically important price level.

Ethereum whales are buying the dip, with the largest $ETH wallets adding over 130k ETH to their wallets yesterday pic.twitter.com/hLbDhO3Z6n

— IntoTheBlock (@intotheblock) April 3, 2025

This pattern mirrors accumulation trends from late 2023, when similar whale purchases preceded a 71% quarterly price surge. Despite this, Ethereum faces challenges: its value has dropped 15% in the past month, falling below $2,000 for the first time since 2022, while Bitcoin’s market dominance has climbed to a four-year high of 61%.

ETHNews analysts point to two factors that could influence Ethereum’s trajectory. First, macroeconomic uncertainty linked to U.S. election-related fiscal policies might divert investor attention from Bitcoin to alternative assets.

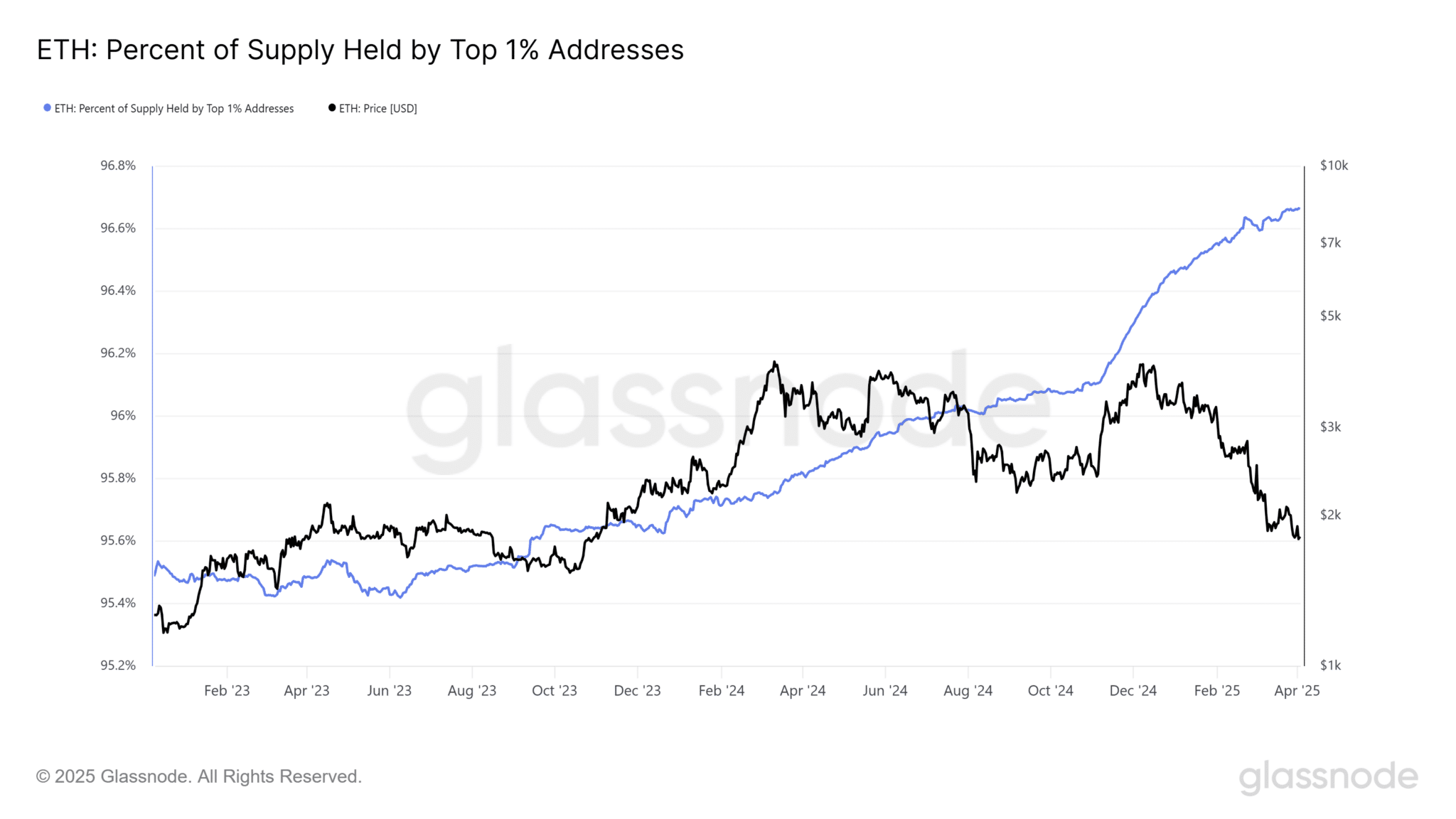

Second, the concentration of ETH holdings among major wallets has reached unprecedented levels, with the top 1% of addresses controlling 96.66% of the supply. This metric previously peaked in late 2023, coinciding with Ethereum’s rally to $4,012. Current accumulation at lower price points suggests some investors view $1,780-$1,830 as a strategic entry zone.

However, Ethereum’s performance relative to Bitcoin complicates the outlook. The ETH/BTC trading pair has slumped to a five-year low, reflecting Bitcoin’s stronger resilience during recent market turbulence.

Ethereum’s market share among cryptocurrencies has also declined sharply, dropping from double-digit percentages in 2023 to 8%—a record low. This shift indicates capital has flowed disproportionately toward Bitcoin, potentially limiting Ethereum’s near-term upside.

Historical data shows that whale activity played a decisive role in Ethereum’s 2023 breakout. Large investors began accumulating ETH during its six-month consolidation, with buying accelerating in Q4 as prices broke upward. Today, similar accumulation is occurring, but within a different macro context. Bitcoin’s dominance has created headwinds, while regulatory scrutiny of altcoins persists.

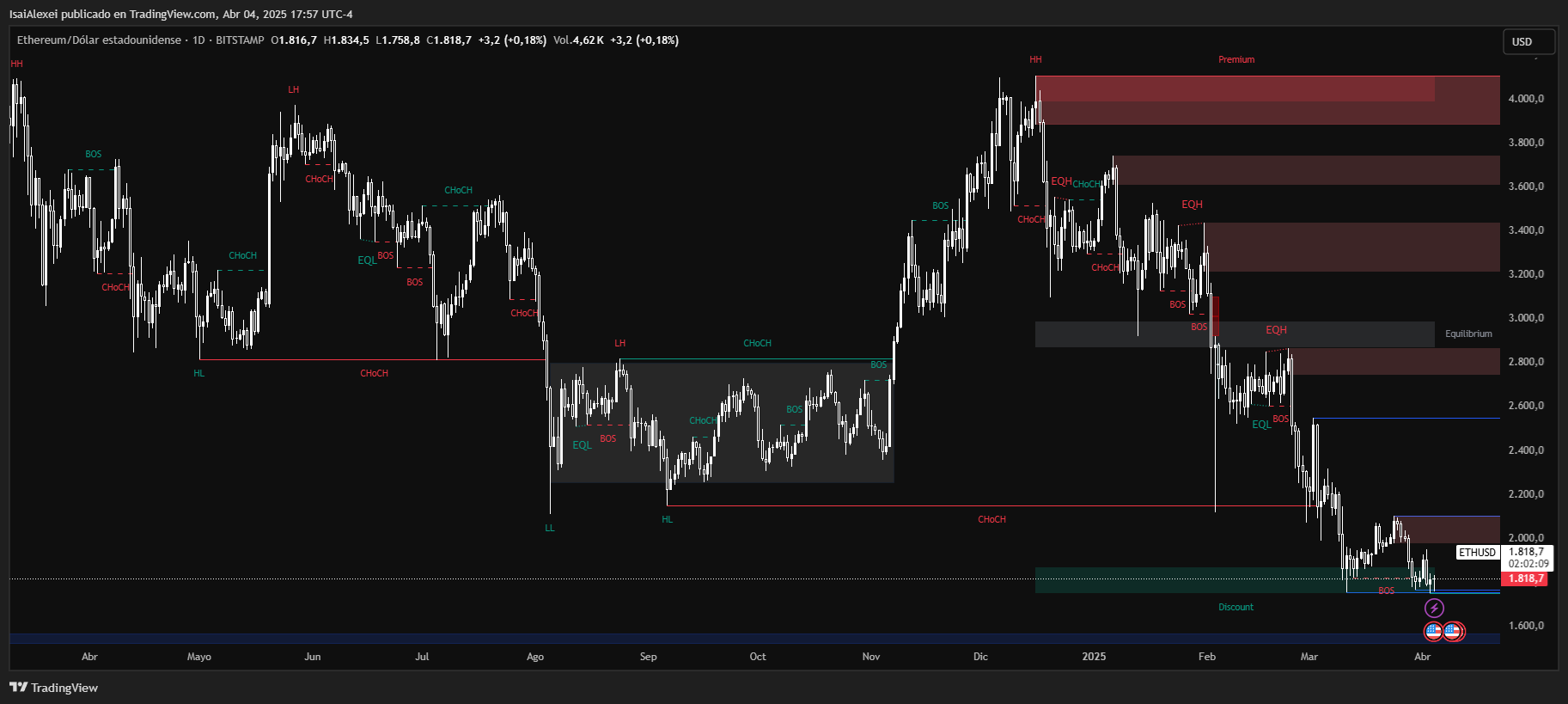

ETHNews analysts are divided on whether Ethereum’s current price action represents a durable bottom or a temporary pause before further declines. Proponents of a bullish case highlight the $1,780-$1,830 range as a demand zone where institutional buying has historically emerged. Skeptics note that Ethereum’s weakening position against Bitcoin and reduced market share could prolong its underperformance.

The coming weeks may test whether Ethereum can replicate its 2023 cycle. Key factors include sustained whale accumulation, shifts in Bitcoin’s dominance, and broader macroeconomic developments.

While parallels to past patterns exist, the current landscape differs in one respect: Ethereum must now compete not only with Bitcoin’s momentum but also with investor caution in an increasingly volatile market.

Ethereum (ETH) price is $1,821.01 USDT. Is showing a slight intraday recovery of +0.21%, after trading between a low of $1,758.72 and a high of $1,835.68 throughout the session.

This mild bounce comes after a sustained downtrend that has pushed ETH down −9.10% over the past week and −16.13% over the past month. The overall structure remains bearish, with ETH down −45.43% year-to-date, and −44.99% in the last 12 months, reinforcing that the broader trend is still negative despite short-term relief.