- Recent trading saw Ethereum retest and rally from the Fair Value Gap, with a potential 57.87% increase anticipated.

- Increased large investor activity and the introduction of Ethereum ETFs suggest a shift toward more regulated investment options.

Ethereum is currently priced at $3,316.71 after a 3.60% decline over the past week, which contrasts with a slight 0.70% increase in the broader cryptocurrency market.

[mcrypto id=”12523″]Recently, Ethereum retested the weekly Fair Value Gap between $2,896.74 and $3,036.62, leading to a 20.42% rally.

However, it faced resistance at $3,545.90 and later dropped to $3,086.13. This area aligns with the 50% Fibonacci level, providing a strong support zone. If this level holds, there might be a 57.87% increase towards the all-time high.

The RSI on the weekly chart is above 50, suggesting positive momentum. Moreover, the AO is above zero, signaling a positive market sentiment. These indicators suggest that if Ethereum maintains its current levels, the positive trend might continue.

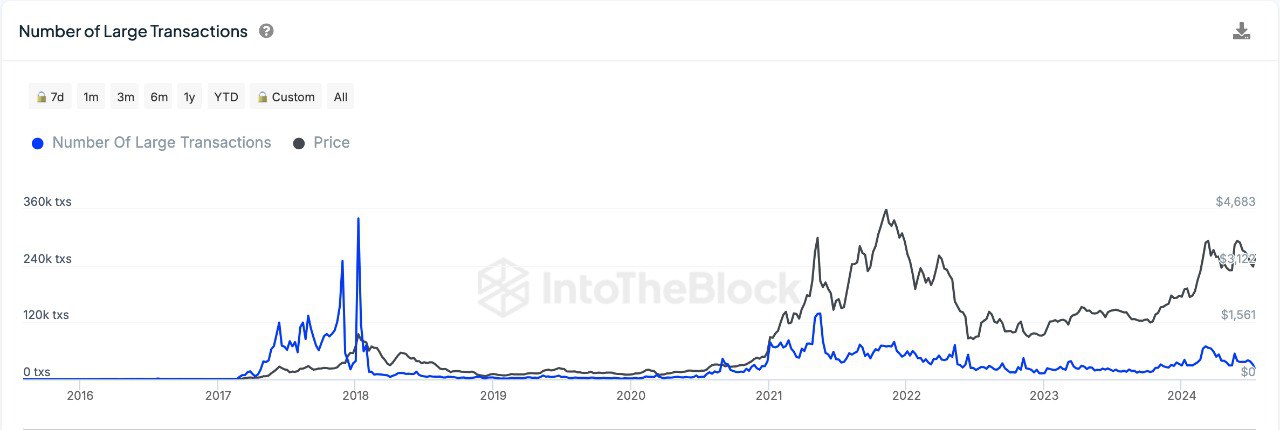

The increase in large transaction volumes indicates activity from large investors, likely linked to the introduction of Ethereum ETFs. These investors are moving from direct blockchain transactions to ETFs, suggesting a preference for regulated and potentially more accessible investment options.

According to DefiLlama, Ethereum has a total value locked of $59.414 billion. The market capitalization of stablecoins based on Ethereum is $78.742 billion. In the last 24 hours, Ethereum generated $3.61 million in fees and $2.29 million in revenue, with 368,579 active addresses showing significant user engagement.

ETH key support level at $1,721.40, aligning with the 0.618 Fibonacci retracement, is essential for maintaining its market structure. On the upside, resistance at $3,600.00 is the next hurdle.

Surpassing this could set Ethereum on a path toward its record high of $4,867.81, representing a substantial increase.

This review of Ethereum’s market position illustrates the importance of key support levels in determining its price movements in the near term. The interaction between investor activities, technical indicators, and new financial products continues to shape Ethereum’s path forward.