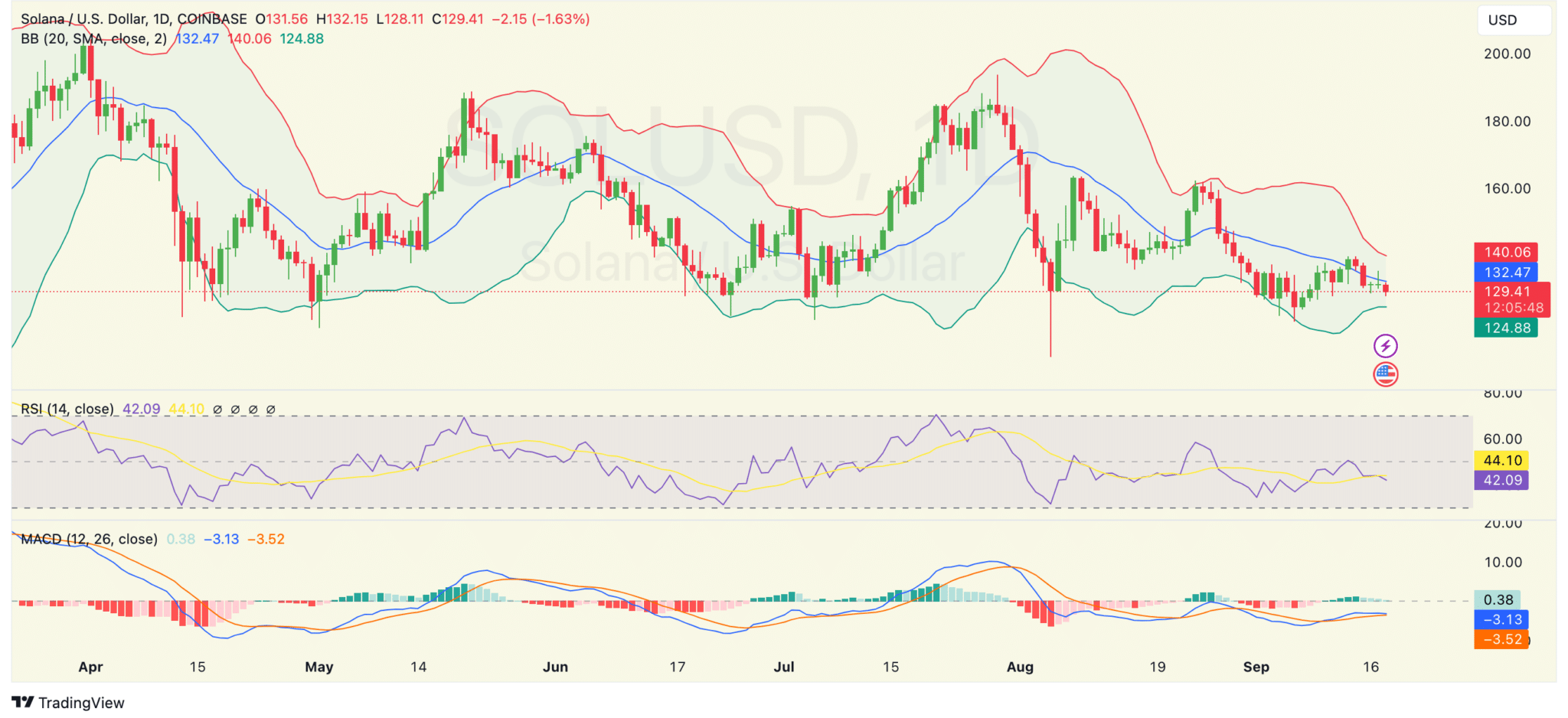

- SOL faces resistance at $132, with possible breakout imminent as Bollinger Bands narrow and RSI approaches oversold.

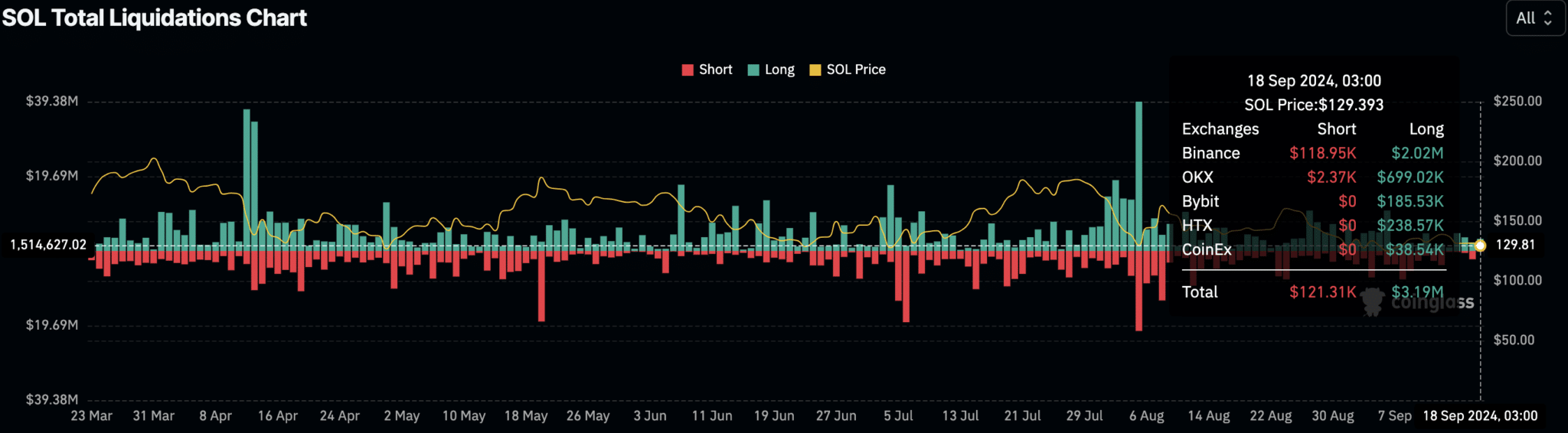

- Recent market data shows $3.19M in long liquidations on Binance, signaling high volatility and risk for traders.

Solana has recently reached a new benchmark with 75.2 million monthly active addresses, setting a record for the platform and underscoring a significant uptick in its adoption and user engagement. This milestone is indicative of the network’s increasing popularity and its expanding role in the blockchain.

Growth in Active Addresses The growth trajectory for Solana’s active addresses began escalating in mid-2023, with the numbers dramatically rising in recent months. This trend highlights a growing interest from developers, users, and entities involved in decentralized applications (dApps).

Solana’s framework has proven especially favorable in the decentralized finance (DeFi) and non-fungible token (NFT) sectors due to its scalability and efficient handling of large transaction volumes.

Network Expansion and Potential As Solana continues to evolve, it is poised for further growth. Planned updates and new features expected in the upcoming months could further enhance its attractiveness and functionality, potentially leading to an even larger user base and more widespread application.

Challenges in Price Valuation Despite these advancements, Solana’s crypto, SOL, encountered resistance around the $132 price level. Technical analysis shows that the Bollinger Bands around the price have tightened, which might suggest an impending price movement in either an upward or downward direction.

The Relative Strength Index (RSI) for Solana is currently at 42.07, indicating that the momentum is somewhat weak and nearing oversold conditions. This suggests that while downward pressure on the price is notable, there could be potential for a reversal if market conditions attract buying interest.

Market Volatility and Investor Caution Recent trading activity has been marked by volatility, as evidenced by the significant amount of liquidations on trading platforms like Binance.

The data from Binance shows that long positions have experienced notably higher liquidations compared to short positions, highlighting the impact of market sentiment and leveraged trading on price fluctuations.

Solana’s current market scenario underscores the cautious approach traders should maintain, given the ongoing volatility and the potential for sudden price changes.