- Willy Woo attributes the recent Bitcoin price increase to a technical rebound, not to solid fundamentals.

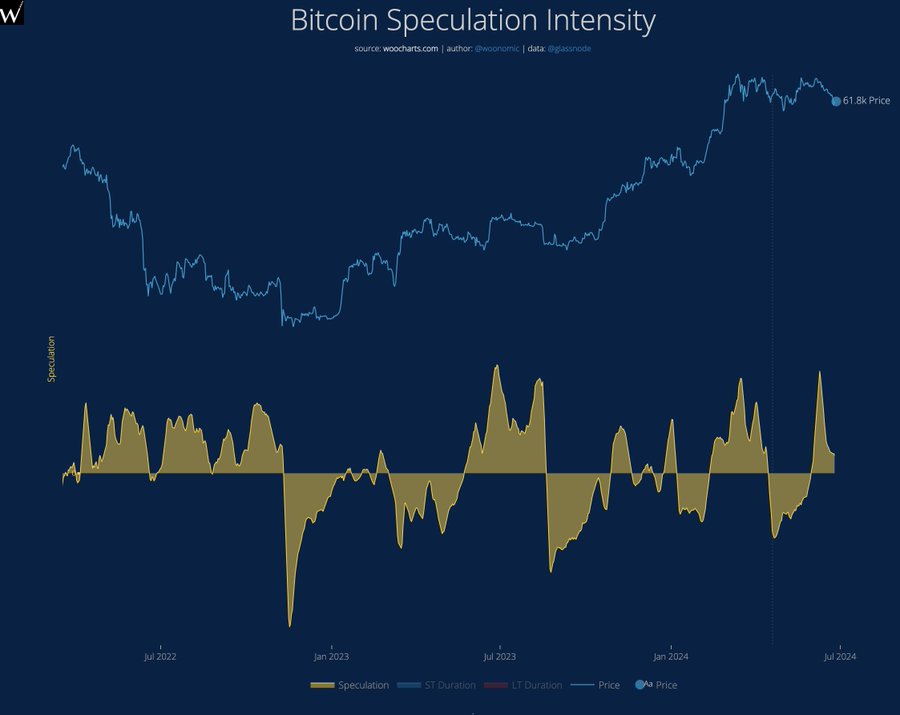

- Despite a temporary recovery in price, Bitcoin continues to face speculative pressures and underlying market weaknesses.

Bitcoin remains a focal point of discussion, recently experiencing a price rebound to $62,000. Crypto analyst Willy Woo suggests that this rise is largely technical and not a sign of underlying market strength. This surge is seen as a short-lived phenomenon rather than a sustainable recovery, signaling ongoing challenges in the market.

Bitcoin, despite reaching a high of over $73,000 in March, has subsequently faced a decline of nearly 20%, now trading below $61,000.

Recent market fluctuations have even seen dips to around $60,606. This decline mirrors broader market trends and suggests that earlier gains were not based on solid market fundamentals but were likely driven by short-term trading strategies.

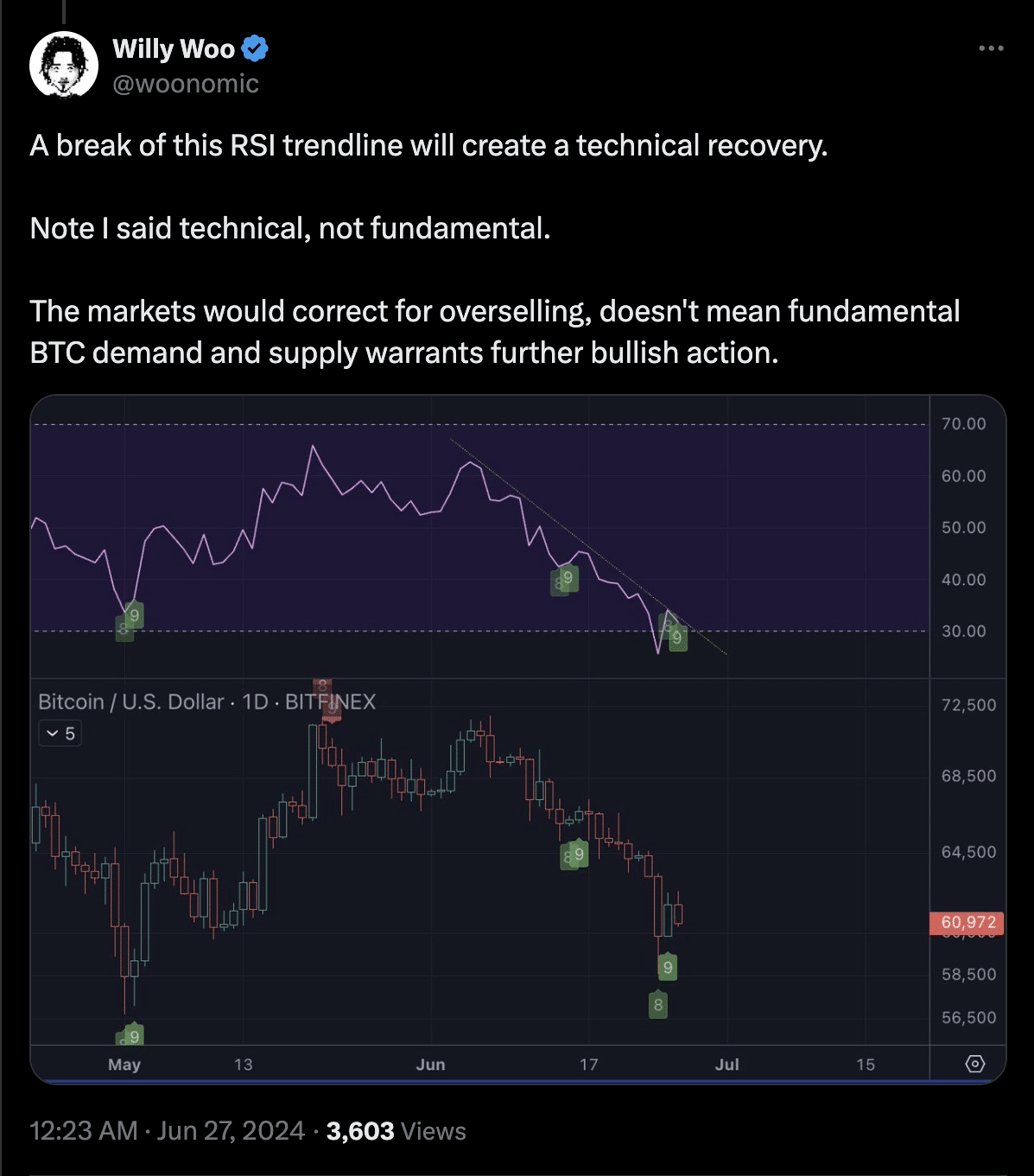

Willy Woo has offered insights into the volatility within the Bitcoin market, noting that although the recent price corrections helped alleviate some of the market’s over-leverage, a robust recovery seems distant.

He identified the recent uptick as a technical rebound, influenced more by trading algorithms than an actual increase in buyer demand. According to Woo, key trading patterns like the TD9 reversal and hidden bullish divergence indicate potential short-term recovery but do not necessarily reflect a long-term market health.

Moreover, Woo emphasized that the recent rebound does not signify a fundamental market strength. Instead, it appears to be a correction from an oversold condition, lacking changes in the real demand and supply of Bitcoin.

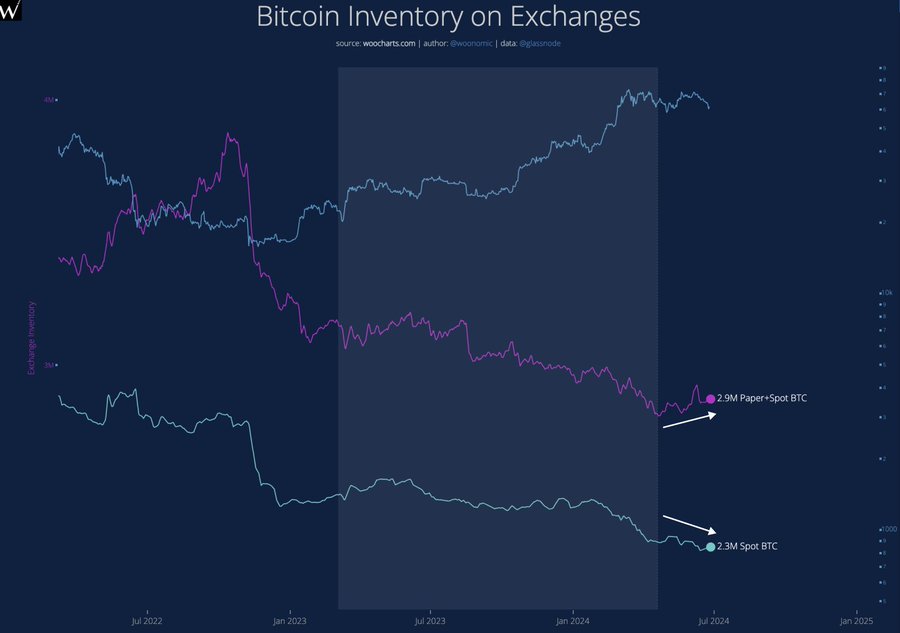

He stressed the need for an increase in spot buyers purchasing coins directly from exchanges for a genuine bullish reversal, which currently remains subdued.

Willy Woo also highlighted the importance of the Bitcoin hash rate as an indicator of market health, noting:

“We are still waiting for the hash rate to bounce, which is a leading sign that miners have stopped selling to fund hardware upgrades.”

He concluded with a caution to the market, predicting “very boring price action for many more weeks” and suggested that speculators might need to liquidate their positions or lose interest before the market can stabilize.

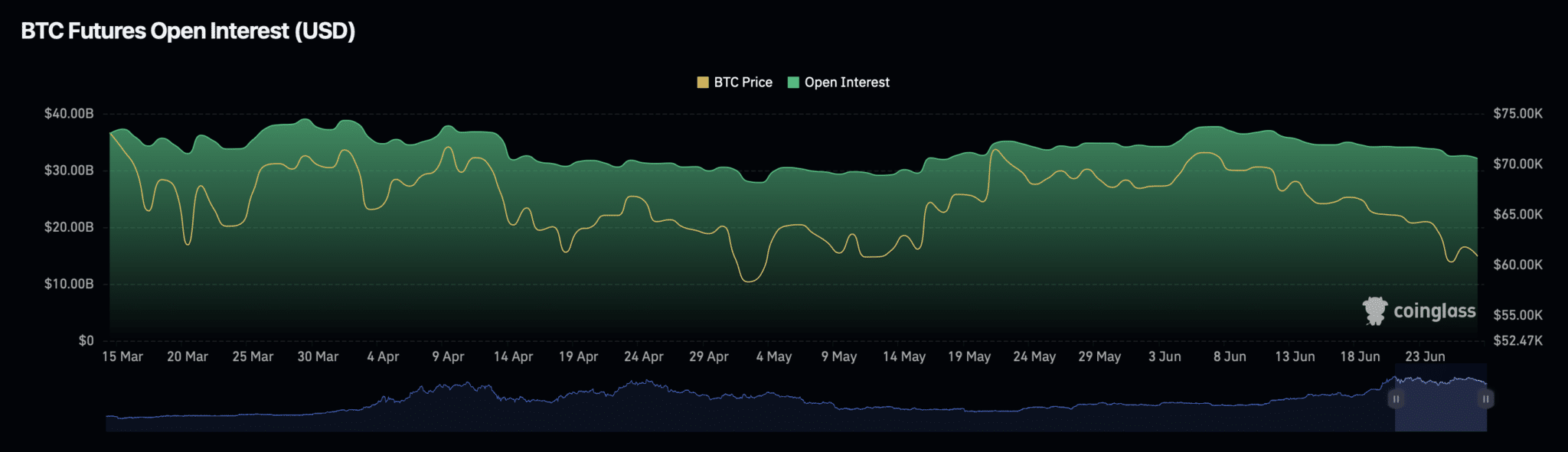

Adding to the cautious outlook, ETHNews analyzed data from Coinglass, noting a 2.16% decrease in Open Interest and a 25% drop in volume over the past day. Such declines indicate a reduction in trading activity and speculative interest, possibly foretelling further price drops.

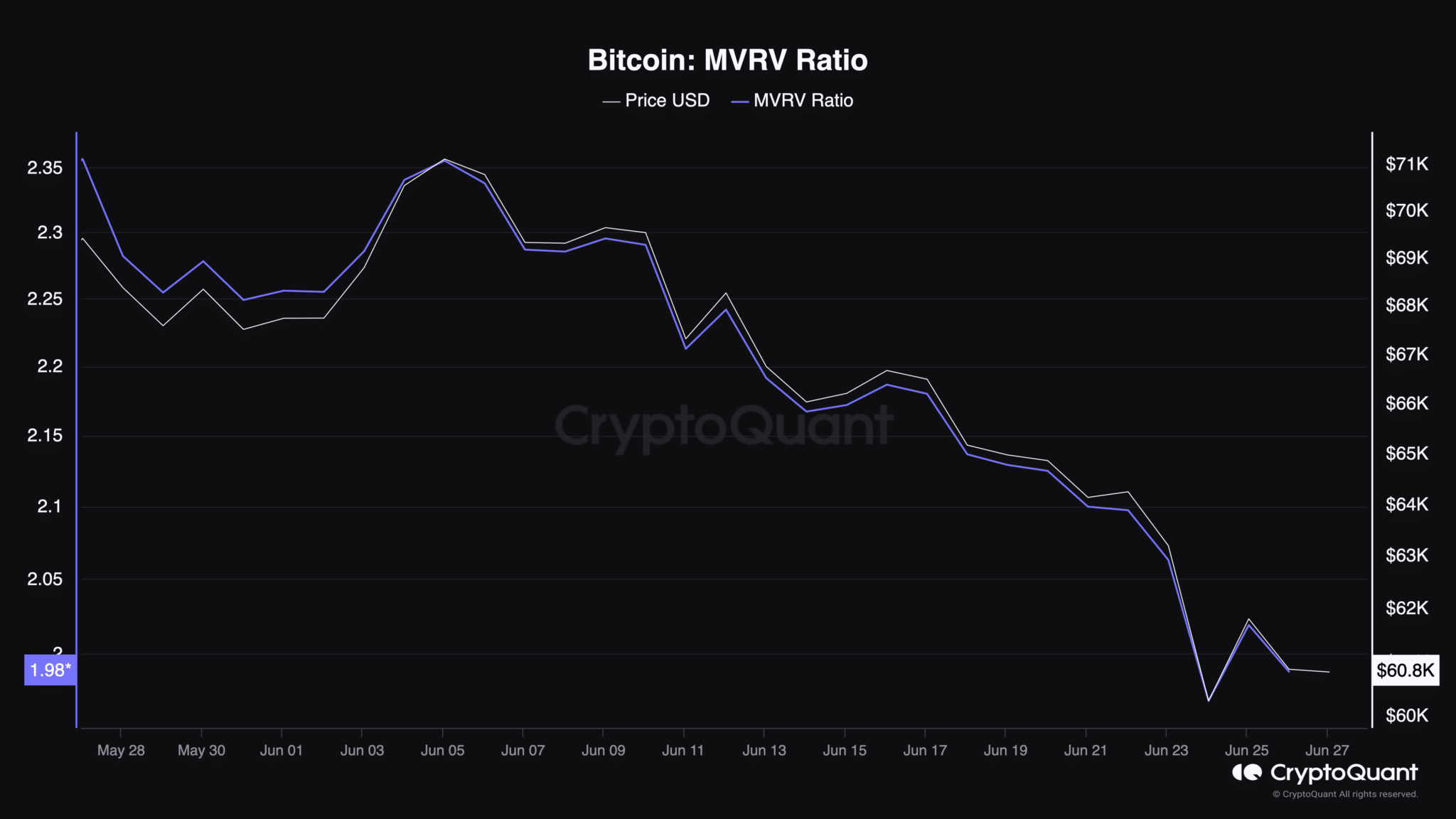

Furthermore, the MVRV ratio, which assesses whether Bitcoin is undervalued or overvalued relative to its historical norms, stood at 1.98, suggesting Bitcoin might currently be undervalued.

This could indicate potential for price growth if market sentiments shift. However, given the ongoing economic uncertainties and market conditions, any potential for growth should be approached with caution.

Bitcoin’s price has shown temporary increases, the underlying market conditions suggest continued volatility and uncertainty. Investors and traders are advised to monitor these developments closely, considering both technical patterns and fundamental market indicators in their decision-making processes.

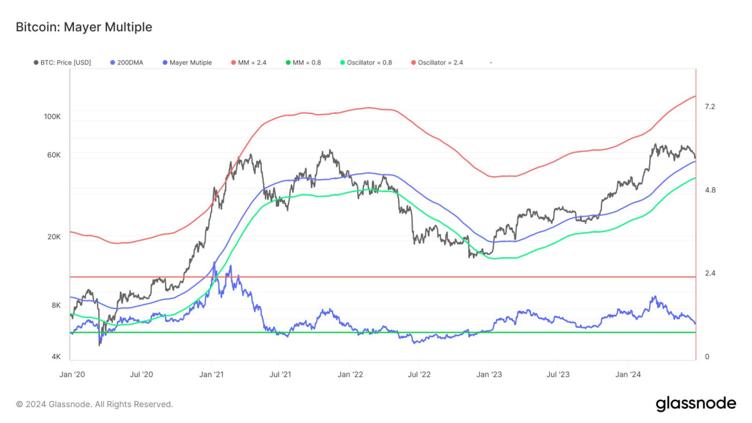

The Mayer Multiple for Bitcoin (BTC), a critical metric used to gauge relative price performance against its 200-day moving average, has recently fallen to 1.05, marking its lowest point since October 2023. This downturn suggests a “healthy reset” in market sentiment, potentially shifting from bearish to bullish conditions.

Traditionally, a Mayer Multiple above 2.4 is considered a strong buy signal, indicating that the current level is significantly undervalued according to historical standards, and might represent a strategic entry point for investors looking for long-term appreciation in BTC’s value.