- Short-term XRP holders face elevated risk due to inflation, tariff shifts, and unpredictable regulatory developments from the SEC.

- Teucrium’s 2x Long Daily XRP ETF launched with $5M in volume, reflecting rising institutional interest in XRP derivatives.

The current position of XRP in the crypto market reflects a mix of technical challenges and broader economic pressure. As trades at $2.16, holders are balancing near-term market patterns with international developments that continue to shape risk.

Ongoing uncertainty around global trade, particularly between the United States and China, has weighed on speculative assets. Tariff policy changes, inflation trends, and central bank decisions are shaping investor behavior. On top of that, unresolved conflicts in areas like Ukraine keep markets cautious.

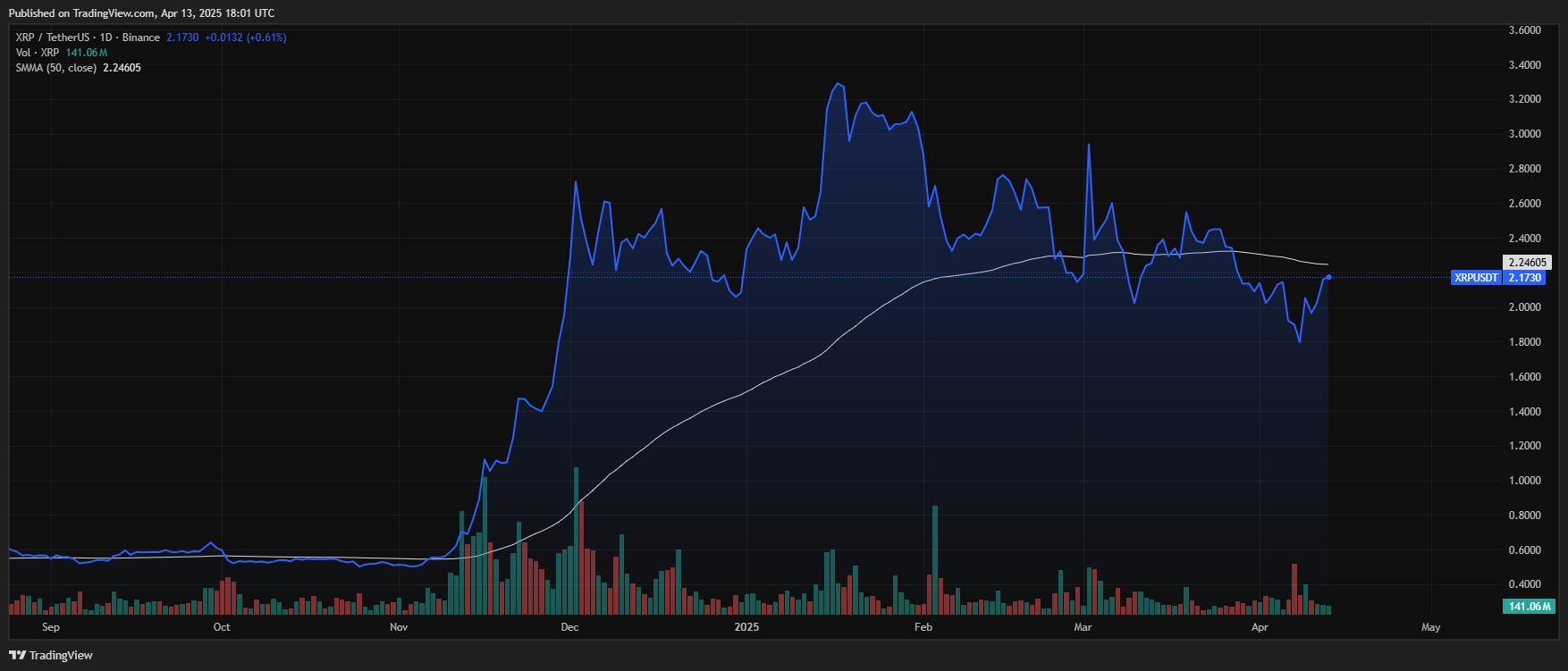

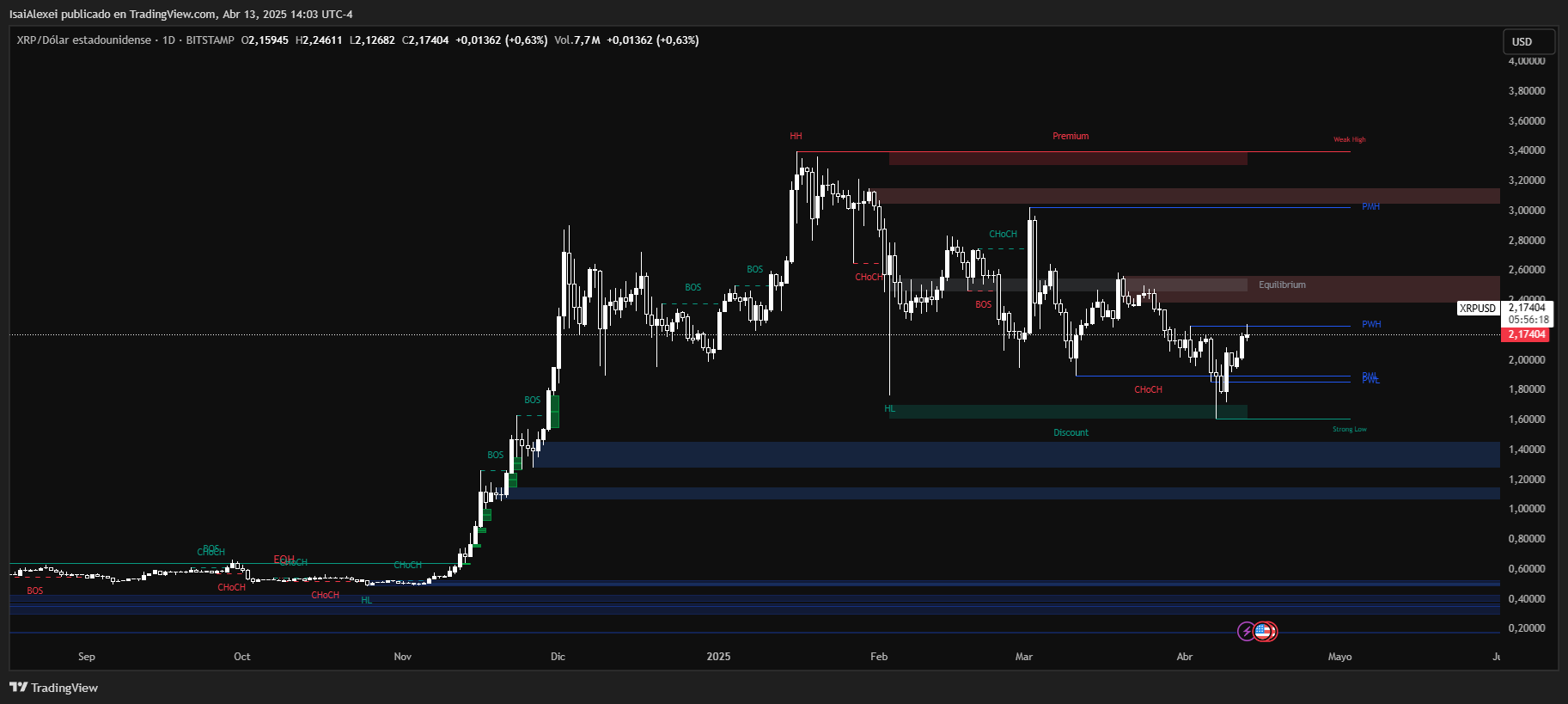

In the short term, traders are watching XRP’s interaction with its 50-day simple moving average (SMA), which sits near $2.25. That line, previously a level of support, has now shifted into a resistance zone.

If price closes above that barrier with volume, attention may shift to $2.60 and then to $3.00. Failing to break above could cause the price to fall back toward $2.00, or lower still, near the 200-day SMA at $1.88 or the recent low of $1.72.

ETHNews analysts say this range presents a test for market participants aiming for a breakout. Market caution is still present. Inflation, unclear regulatory signals from the SEC, and tighter liquidity policies from central banks continue to limit strong rallies. In such an environment, fast profit expectations may increase risk exposure, especially for those with shorter investment horizons.

For holders planning beyond the short term, a structured price objective — such as selling at $4 or $5 — offers a clearer benchmark. This approach, matched with understanding one’s XRP position size, can help build a plan that fits changing market conditions.

The recent launch of the Teucrium 2x Long Daily XRP ETF in the United States adds to XRP’s exposure. The fund posted $5 million in opening volume, placing it among the top 5% of ETF launches this year. It operates through swap contracts, offering double the daily performance of XRP using European exchange-traded data for tracking.

While this product does not change the fundamentals of XRP itself, it reflects institutional interest in structured exposure. However, retail holders must still contend with the same market variables, particularly resistance zones and policy uncertainty.

Ripple (XRP) is currently trading at $2.165, with a modest 0.23% gain in the last 24 hours. Despite the sideways action this week, XRP has posted a 295% gain over the past 6 months and is up 4.19% year-to-date, signaling a strong overall recovery.

After recently reclaiming the psychologically significant $2 level, XRP is consolidating above key technical supports, maintaining bullish sentiment amid expectations of legal resolution with the SEC.

From a technical standpoint, XRP is approaching resistance around $2.30, with a confirmed breakout potentially targeting $2.80–$3.00 in the short term. The trend remains bullish with upward momentum supported by positive volume flow and institutional engagement, including Ripple’s $1.25B acquisition of Hidden Road.

However, some caution is warranted as oscillators are nearing overbought zones, and profit-taking near major resistance could spark a retracement toward $1.90. Long-term holders are showing confidence, while short-term traders are watching for breakout confirmation.