- Ripple advances cross-border payment solutions targeting SWIFT; SEC’s XRP ETF review may boost institutional adoption.

- Standard Chartered forecasts XRP at $12.50 by 2028, contingent on banking adoption and regulatory clarity.

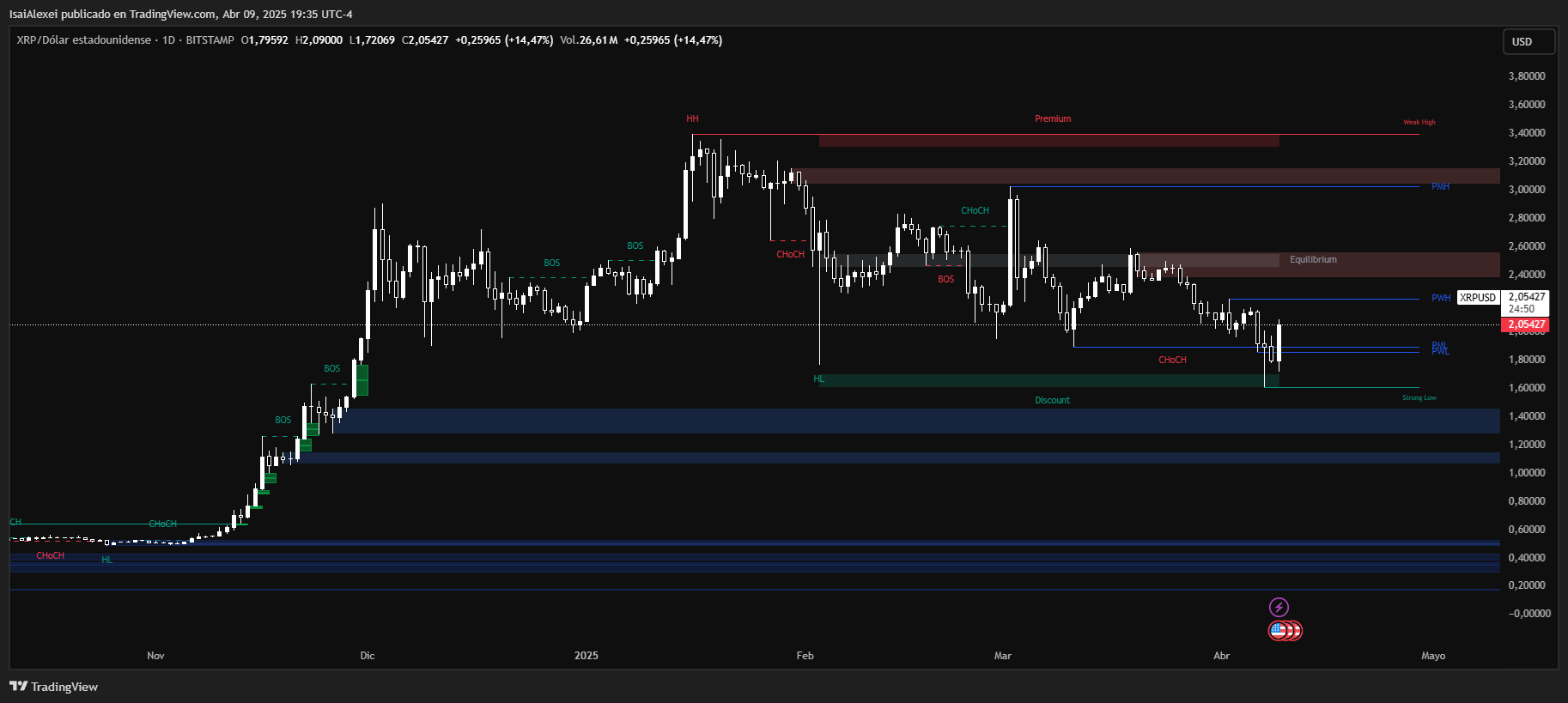

XRP traded at $1.82 this week, down nearly 50% from its 2024 peak, as broader market uncertainty weighs on crypto assets. The decline aligns with a $1.5 trillion loss across crypto markets since early April, driven by macroeconomic fears and risk aversion.

Ray Dalio’s Economic Warning

Billionaire investor Ray Dalio cautioned that rising global debt and U.S. fiscal deficits—now exceeding $36.7 trillion—could trigger economic instability. His outlook, shared via public channels, underscores risks for risk-sensitive assets like stocks and cryptocurrencies. Major indices, including the Dow Jones and Nasdaq 100, have declined sharply, erasing over $10 trillion in market value.

At the moment, a huge amount of attention is rightly being paid to the newly announced tariffs and their significant impacts on markets and economies. But very little attention is being paid to the circumstances that caused them—and to the even bigger disruptions likely still… https://t.co/wPIgzDscbk

— Ray Dalio (@RayDalio) April 7, 2025

Dalio’s analysis suggests prolonged economic strain could further pressure XRP, which often correlates with traditional markets during downturns. However, the token’s utility in cross-border payments provides a counterbalance to purely speculative assets.

Ripple Labs continues advancing its global payment network, targeting inefficiencies in traditional systems like SWIFT. Partnerships with financial institutions aim to streamline international transactions using XRP for liquidity, a use case that could stabilize demand despite short-term volatility.

The SEC is reviewing multiple XRP ETF applications, which, if approved, might attract institutional investment. Such funds would enable exposure without direct token ownership, broadening XRP’s investor base.

Standard Chartered projects XRP could reach $12.50 by 2028, potentially eclipsing Ethereum’s market cap. This forecast hinges on Ripple’s adoption in banking corridors and regulatory clarity, particularly in the U.S., where ongoing litigation with the SEC remains a hurdle.

XRP’s price faces immediate technical challenges. Sustaining above $1.80 is critical to avoid testing lower supports near $1.50. Conversely, reclaiming $2.00 could signal renewed confidence, though macroeconomic headwinds complicate recovery.

While Dalio’s warnings highlight systemic risks, XRP’s foundational role in Ripple’s payment solutions offers a tangible value proposition.